My Favorite AI Use Cases

Traditional supply chain planning was defined by the theory of constraints and the Deming Wheel of Plan, Do, Check, and Act (PDCA) philosophies. The PDCA

Traditional supply chain planning was defined by the theory of constraints and the Deming Wheel of Plan, Do, Check, and Act (PDCA) philosophies. The PDCA

I laugh when business leaders tell me that they are going to replace their current supply chain planning technologies with “AI.” Sounds good, but most

A discussion on data latency and distortion and why it should come first before defining the supply chain architecture.

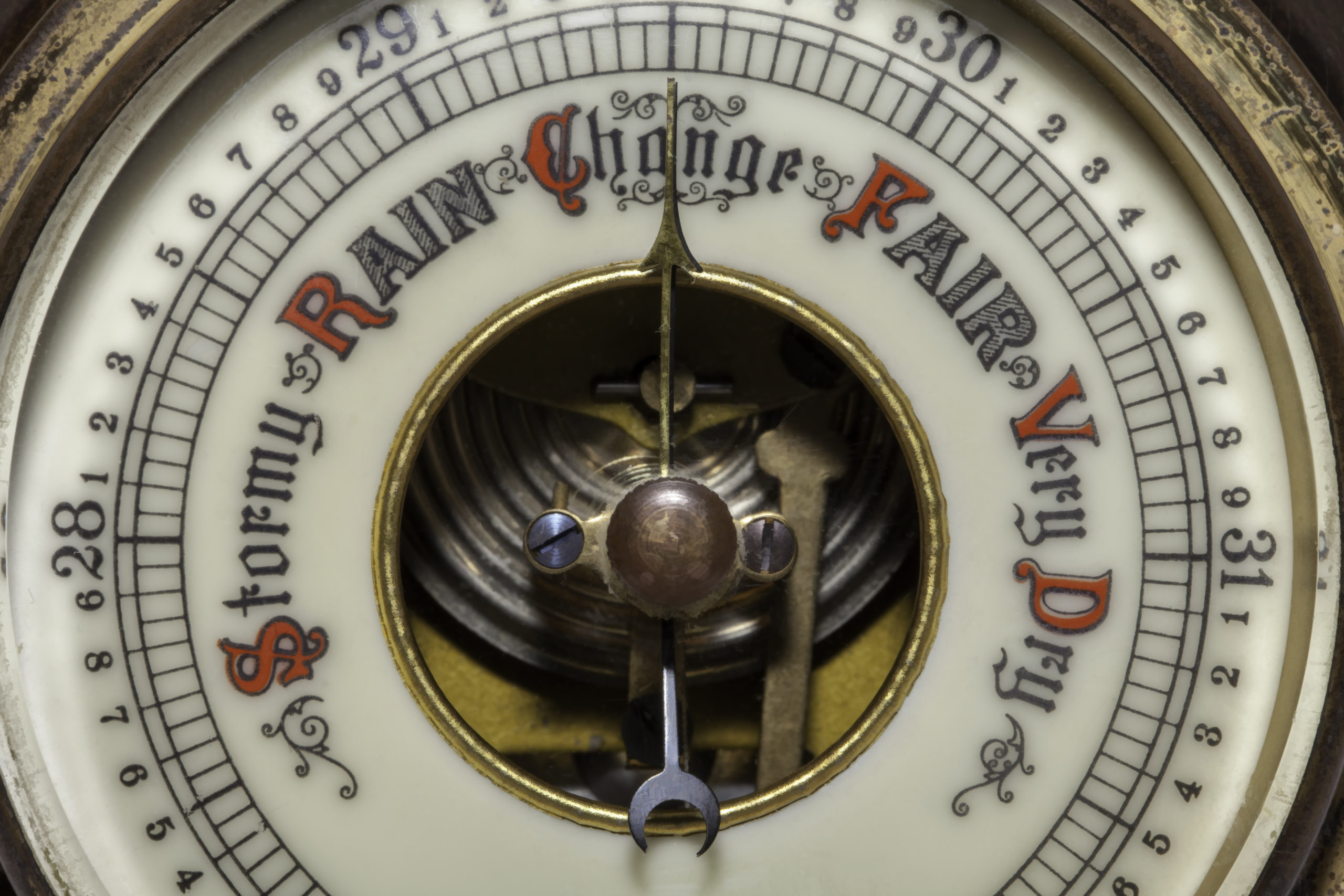

In this post, I explore the definition of supply chain excellence and the challenge of resilience.

When I was a teenager, I spent afternoons after school with my dad. As he lost his vision to macular degeneration, he taught me to

How do we use technology to make better decisions? Gain insights? Craft and execute strategies? Why does it matter? These questions are top of mind

The answer to a simple question of why do consumer products manufacturers not use retail data in the management of the supply chain?

For the past three weeks, I attempted to move my fingers on the keyboard, but to no avail. With the mounting devastation in Ukraine, my

Lora Cecere, the Supply Chain Shaman, shares insights on seven trends for the supply chain for 2019.

Nick Lynch is the Global Excellence Manager at Shell Lubricants, a division of Shell Global. Located in the United Kingdom (UK), he has more