The Supply Chain Merry-Go-Around

This week, I feel like a bobble-head. My head is wobbling with announcements, late-night Friday press releases, company name changes, and executive turnover in the

This week, I feel like a bobble-head. My head is wobbling with announcements, late-night Friday press releases, company name changes, and executive turnover in the

The winds of change transform industries. Does a digital transformation add value? Who knows? The answer is blowing in the wind because there is no

This week, I was introduced by phone to a marketing leader new to supply chain planning. I listened in amazement when she said, “My marketing

Build political capital to drive a supply chain planning culture.

Do these dogs hunt is a blog challenging the validity of the concepts of autonomous planning, probabilistic planning and the use of artificial planning in planning systems.

The use of pattern recognition and orbit charts to study supply chain excellence.

Concerned about the impact of the Gartner Top 25 on the market, Lora Cecere, Founder of Supply Chain Insights, shares insights on the performance of the companies selected to be on the list.

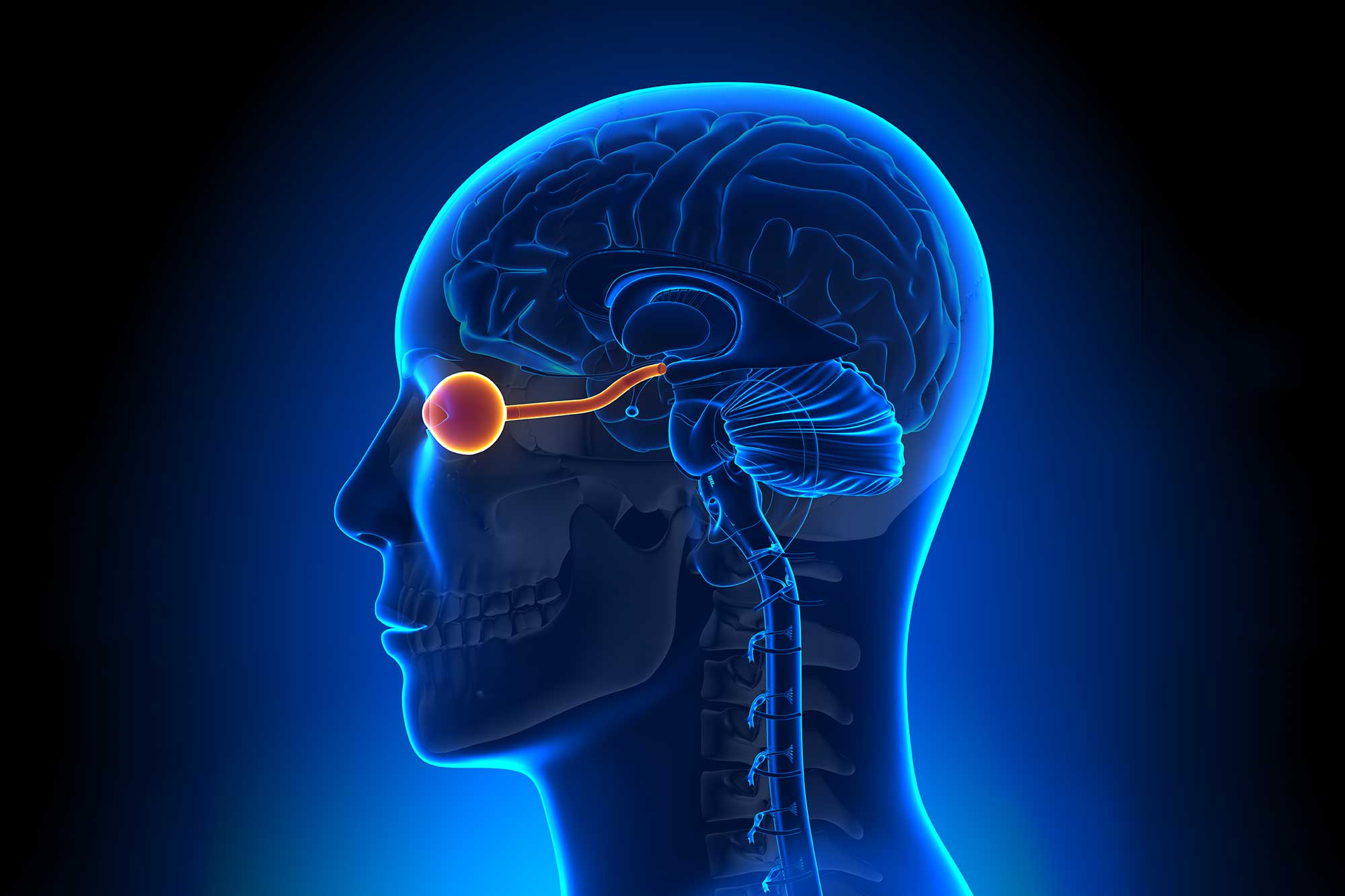

Traditional supply chain planning approaches push all products through a common engine to produce time-phased output. The demand stream is analyzed for error and bias, but in traditional processes, companies do not see the patterns. Pattern identification is key to drive successful supply strategies. This is a missed opportunity in traditional approaches.

Let me start with why I selected a baby with ears for this post. I find that most companies’ understanding of supply chain planning is

I take supply chain management seriously. My focus is writing research for the business leader that is an early adopter attempting to drive first-mover advantage.