E2open Acquires Zyme: A Bridge Too Far?

This week, E2open announced a definitive agreement to acquire Zyme. For readers of this blog that do not know Zyme, the company focuses on the

This week, E2open announced a definitive agreement to acquire Zyme. For readers of this blog that do not know Zyme, the company focuses on the

Within a supply chain organization there is turmoil. The enlightened leader knows that the efficient silos do not create the most effective supply chains; however,

It was November. I was speaking at a client site. The topic was customer-centric supply chains. We started the morning by asking attendees to share

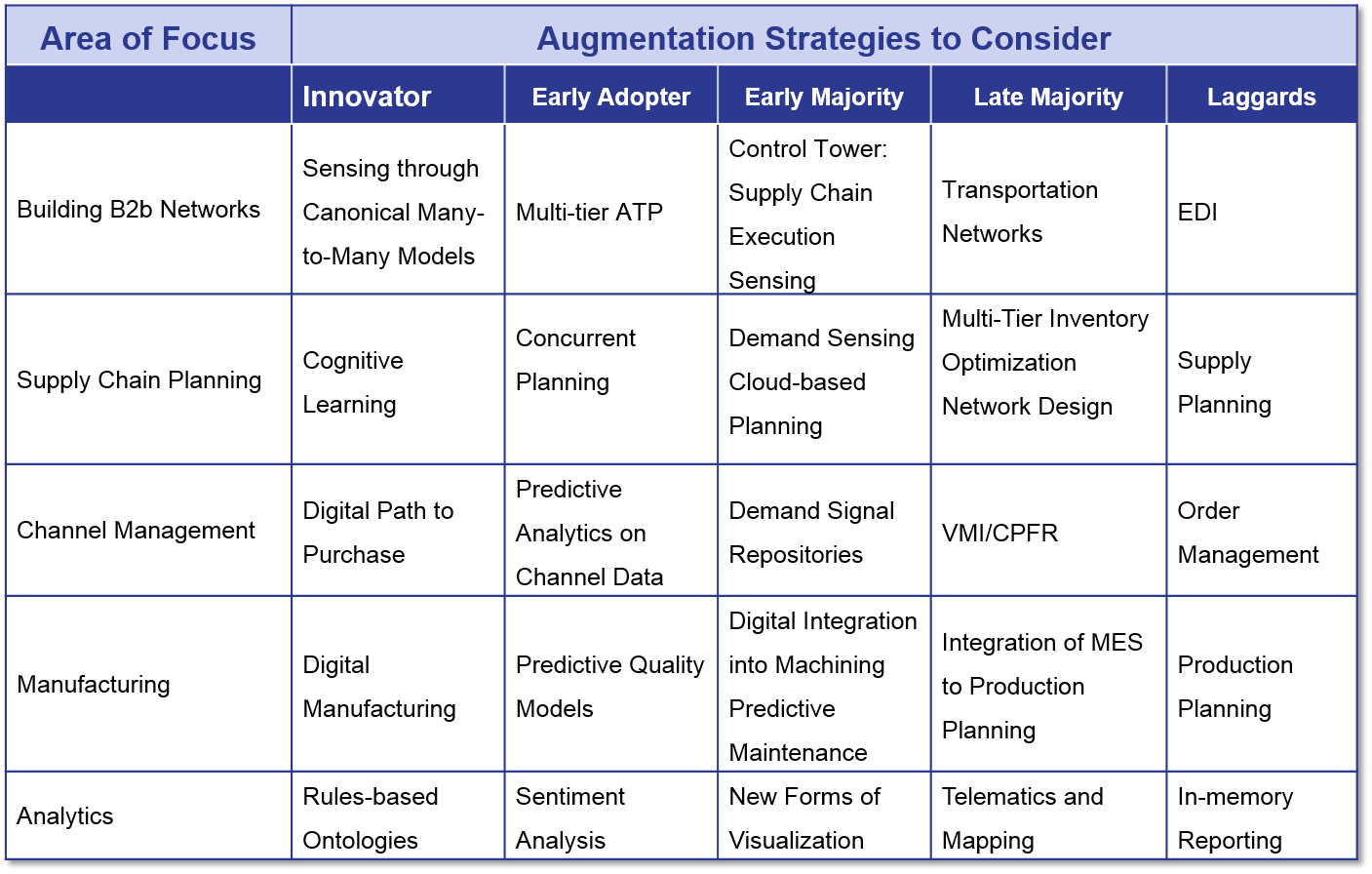

Supply Chain Operating Networks: The building of supply chain applications using many-to-many architectures to connect multiple parties to multiple trading partners to improve multi-tier supply chain

The sun is shining brightly through the conference room windows as I listen to the consultants talk. It’s buzzword bingo at its finest. The air

Wang Laboratories. Eastman Kodak. Nokia. Blockbuster. Polaroid. Xerox. What do these names have in common? They were once strong brands that could not adjust fast enough to

It was a stuffy, hot day, and I found myself sitting by Bridget. The supply chain team was attempting to explain their demand-driven project. They

“What did you learn?” asked the client. I smiled and reflected. It was a thought-provoking question. The ROI study on supply chain planning was completed. We

It is morning in Chicago. I crave coffee. The sun shines brightly out the window, but the noisy city is quiet. My mind is moving

An antagonist (from Greek ἀνταγωνιστής – antagonistēs , “opponent, competitor, enemy, rival”, from anti- “against” + agonizesthai “to contend for a prize,”) is a character, group of