As The Winds Blow: Improving Supply Chain Planning

The winds of change transform industries. Does a digital transformation add value? Who knows? The answer is blowing in the wind because there is no

The winds of change transform industries. Does a digital transformation add value? Who knows? The answer is blowing in the wind because there is no

Mine is bigger than yours. Who cares, I say? This week, SAP announced the intention to build business communities to drive improved outcomes. I say,

I remember the call like it was yesterday. Four years have passed. On this cold day, I would like to walk on the beach with my

Definitions: Provocateur. A person who or thing which provokes; a challenger, instigator, inciter, irritator; (in later use) specifically = “provocateur.” Incrementalism. Movement by degrees. Known

It is Saturday. This was a tough travel week on the East Coast by any measure. I’m rearranging my schedule as stranded friends cancel personal

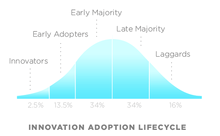

The supply chain technology market is in transition. Over the last three decades, the market weathered consolidations, mergers and technology shifts. Many of the clients

Today I attended the SAPinsider Conference. The theme? Digital transformation. The storyline of the event goes like this: Do you have the business problem of

Holiday travel. Packed airports and the children screaming in unison. Today as I sit scrunched into a coach seat in 26C, working on this blog post and

Market-Driven Value Networks: An adaptive network focused on a value-based outcomes. The network senses, translates, and orchestrates market changes (buy- and sell-side markets) bidirectionally with

Today Thoma Bravo, a private equity investment firm, announced a definitive agreement to purchase Elemica, a provider of Supply Chain Operating Networks for the chemical