Transforming Consumer Value Chains: Navigating the Power Shift to the Shopper

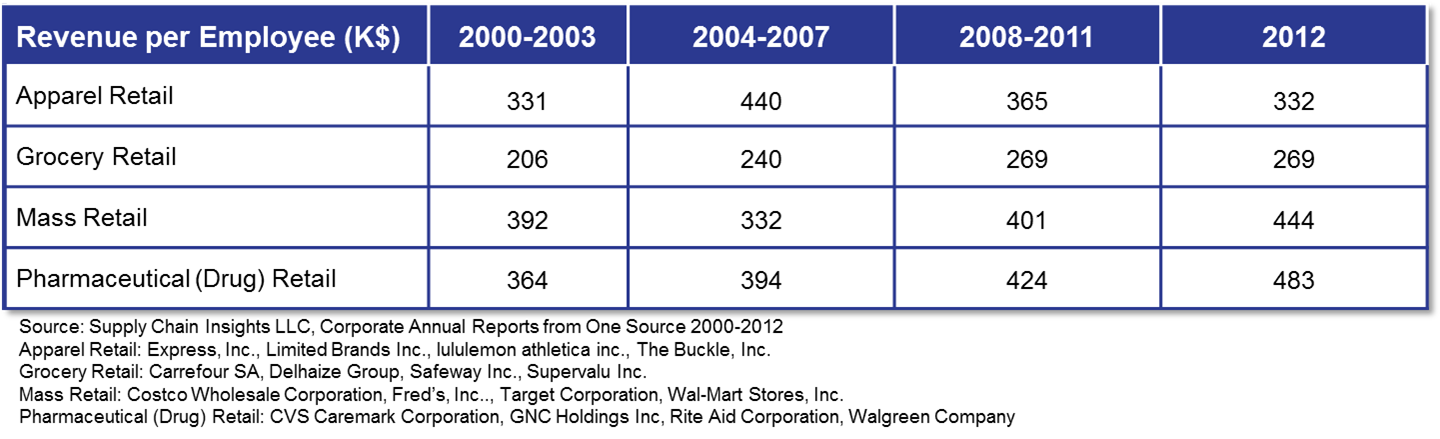

Last week Walmart announced the closing of 269 stores and the layoffs of 10,000 employees. In addition, Macy’s announced the closure of 36 stores and

Last week Walmart announced the closing of 269 stores and the layoffs of 10,000 employees. In addition, Macy’s announced the closure of 36 stores and

Definition: Brass tacks are a type of pin or nail. The phrase to come (or get) down to brass tacks is sometimes used idiomatically to consider the basic facts of

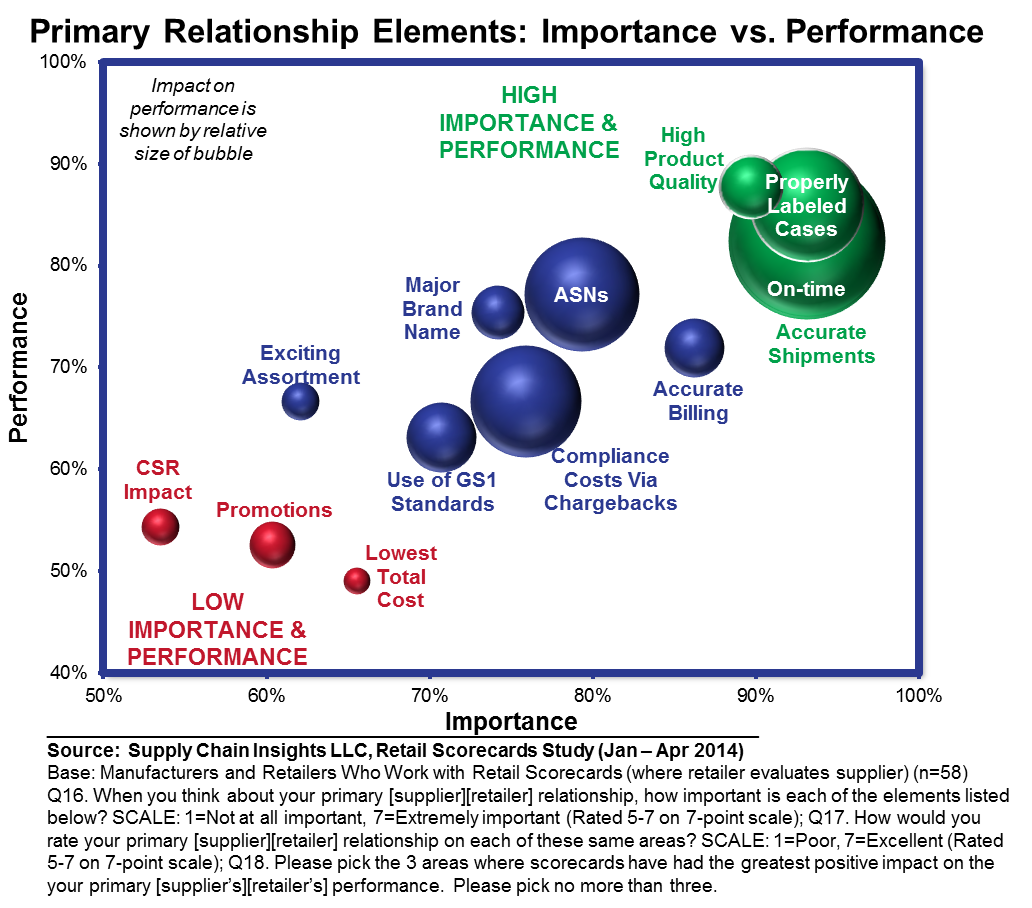

It is about the right balance of the carrot and the stick. Progress happens when you measure. Relationships happen faster when there is more carrot

I love retail research. While some gals would call it retail therapy, I actively converge my days of shopping with supply chain research. Let me

“A Wolf in Sheep’s Clothing” is an idiom of Biblical origin. It is used to describe those playing a role contrary to their real character, with

This week, I am attending the annual NRF event in New York. For those that have never been, it lives up to its claim of

I take supply chain seriously. My friends might tell you TOO seriously. I think that the entire world should. I believe that better supply chain practices

This morning I am sitting at my kitchen table, sipping coffee, writing a report. The coffee is good, the sunflowers are blooming on the deck

It is cold in New York. My feet are tired, but I have enjoyed the first day of the National Retail Federation (NRF) Big Show. (Twitter

This week, I spoke at the Vendor Compliance Federation (VCF). While 2009 was a bad year for VCF conference attendance (and for conferences in general),