It is a new world. We have always assumed that supply chains can keep on trucking, but has all this changed? Supply chain applications matured based on the assumption that manufacturing was a constraint and transportation was abundant. Transportation is now anything BUT abundant.

It is the number one top of mind issue. I am encountering it everywhere I travel. At a Logility executive session last month in Orlando, transportation was cited by attendees as the number one issue for their supply chain surpassing demand volatility and rising commodity prices. This theme was also pervasive in the roundtable discussions that I facilitated at the Extended Supply Chain Conference in London. I am currently prepping with two groups for panel debates on the topic for conferences in May and June.

Why now?

What has changed? Why is it so important now? The answer is three fold: equipment, labor and regulation. Equipment shortages abound, and driver shortages are now acute. With the rise of gasoline, these shortages are coupled with escalating pricing. It is unprecedented. Historically, transportation availability was a given; and as a result, the focus was on getting the best price. Traditional supply chain processes focused on manufacturing constraints and minimization of these impacts. As a result, this new wave of transportation issues are catching some supply chain leaders by surprise, and our historic supply chain policies are not aligning the functional teams to solve the problem. Instead, they are often putting supply chain functions at odds.

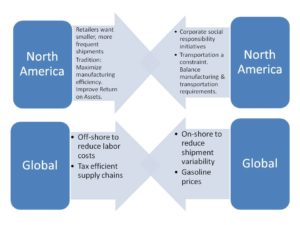

Now is the time to act. Scarce materials and tightening transportation constraints are going to get more intense. The drivers are numerous and varied. They are often contradictory forming a conundrum. For example, retailers want smaller shipments more frequently; yet, corporate sustainability requirements are driving efficient larger order supply chains (see figure 1). Available trucks for over-the-road shipments in the United States have never been tighter; however, companies still want to negotiate price using strong-arm tactics. The price of oil is at a record high, road congestion has never been higher, but customer dock requirements have never been stricter.

Figure 1: The Logistics Conundrum

For me, one of the valuable market indicators for me to navigate these uncertain times and give client’s counsel is the Morgan Stanley Index. I have never seen the index look less favorable for a shipper (see Figure 2).

Figure 2: Morgan Stanley Index for Shipping.

It will get worse before it gets better. Based on the Council of Supply Chain Management Professionals (CSCMP), there is an expected shortage of drivers of 400,000 by the end of 2011. This will be acerbated by retirement. In the United States, 1 in 6 drivers are nearing retirement age of 55 in 2011. Yet, there are few young drivers. The number of drivers under the age of 35 is less than 25%. There is also a shortage of equipment. Over 2000 trucking companies went out of business in the Great Recession of 2009, and available over the road truck capacity is expected to fall another 40% between 2009 and the end of 2011. Increasing regulation and government intervention will make this a stewpot that will boil over in the upcoming back to school and winter holiday seasons.

So what do I do about it?

It is clear. The power in the supply chain is shifting to the logistics providers. Shippers still act as if they have the power. They don’t it is shifting. So, what should companies do? Here we provide five tactics, based on the facilitation of three customer roundtables that should help:

#1. It is going to get worse not better. Act now. Be easy to do business with.

The old saying, “when the going gets tough, the tough get going”, has never been truer. Companies that understand the true nature of the transportation issues are investing in building long-term relationships with carriers. This includes the use of transportation planning systems to speed tendering, building continuous loops and managing empty miles, driving improvements in supply chain execution at the dock, in drop yards and in continuous shipping operations. They are making it easier for the carriers to get the loads, move trucks more easily in and out of the warehouse facilities and making their operations easier to do business with. Seven-day shipping operations are becoming the norm. When it comes to leadership in this area, I continue to be impressed with the work of Kraft. Is anyone else seeing another company pushing leadership in this area?

#2. Improve planning. The early bird gets the worm. Companies are speeding time to tender by 30% through the use of advanced planning tools and business-to-business connectivity. This includes the use of transportation forecasting applications, direct integration of transportation planning systems to inbound and outbound manufacturing planning systems, and quicker processing of orders. In January 2011, the Supply Chain Leaders Association polled 45 supply chain leaders, 46% responded that improving supply chain optimization was the most important factor to improve to drive growth. Last month, I attended the Terra Technology conference in Key Biscayne. Their first day session on transportation planning was packed. The use of transportation forecasting improves carrier visibility of an order by a day. The need to forecast transportation is obvious. I was sitting at this conference wondering why it has taken us 20 years to define this application.

#3. Educate, forecast and build a guiding coalition. Educate your management team quickly on the new reality because the paradigm has changed. To do this, look outside in. I recommend the use outside benchmarking to help your team quickly see that freight costs, availability, and increasing variability are the new reality. For transportation benchmarking, I find the best answers and advice to be at Chainalytics. Does anyone else have sources that they would like to share?

#4. Improve decision velocity. Freight is no longer the tail that wags the dog. Times are tough for the carriers. Remove the barriers. Improve time to decision for freight payments, fuel charge adjustments, and accessorial charge. Invest in analytics to get at the data in Enterprise Resource Planning and Supply Chain Planning Systems that is largely untapped. Make decisions quicker. Make decisions better. Improve the working capital in the transportation supply chain.

#5. Take responsibility for your ENTIRE network. Today, 33% of companies have central teams that plan and execute freight contracts. This consolidation of freight requirements enables a company to take control of THEIR entire network and gain economies of scale. Even though you have outsourced manufacturing, leaders still take responsibility for their network and the movement of the freight.

Additionally, manufacturing strategies dependent on long supply chain contract manufacturing relationships need to be rethought. Many of them were built assuming that freight would be available. DUH!? Won’t you look bad this holiday season, if this is not the case? For many, I expect there to be egg on their face as they share the reasons why they failed to get products to market in the upcoming seasons.

It is going to get worse not better. It is clear. Transportation is no longer something that you can take for granted.