Encore. This month, I gave a repeat performance. I gave it again the month before. And, the month before….

The S&OP IE Group asked me to present the same presentation that I gave on January 20th in Las Vegas at their new Integrated Business Planning (IBP) conference in Atlanta. I was also asked to present the presentation at the Extended Supply Chain Conference in London. Seems that my article–ENOUGH!—got some attention and caused some industry tongues to wag (reference blog article http://www.supplychainshaman.com/supply-chain-planning/enough/). The presentation link (from Slideshare) from the last conference is (http://slidesha.re/fyPua1). So, an encore it is!

So, what did I present in Vegas?

Clearly, what happens in Vegas should not stay in Vegas. As a contrarian, I am pushing back on the concept of Integrated Business Planning (IBP). It seems to now be all the rage. For more insight into my presentations, reference the video links:

http://ie.arcticfoxtv.com/11/tackling-the-change-management-of-issues-of-delivering-a-better-forecast – High tech 2010

http://ie.arcticfoxtv.com/216/letter-perfect-practice-imperfect – Boston 2010

http://ie.arcticfoxtv.com/298/letter-perfect,-practice-imperfect – Vegas 2011

http://ie.arcticfoxtv.com/301/letter-perfect-practice-imperfect – Atlanta IBP

A Contrarian View

This is a contrarian view. I am swimming upstream against the populist analyst opinion. Why, I am doing this? When I was a Gartner analyst in 2002, I gave the market what I feel was bad advice. I wrote an article recommending that companies tightly integrate the S&OP plan to financials. Through subsequent research, I found that I was wrong, and I feel bad about it. My goal is to prevent others from incurring the same pain.

So, again, why I am I pushing a contrarian view? Simply said, it is because it is the right thing to do. I care about my clients and want them to be successful. I have worked now with over 400 clients on S&OP. Here I share my argument. Please let me know what you think.

Getting past the Nuance

To get started, let’s get beyond the nuance of the debate. This debate is not about the TERM. I REALLY don’t care what term is used or what process is called. I agree with Shakespeare, “A rose by any other name would smell the same….” But, I don’t agree with the conventional views on Integrated Business Planning (IBP) in three areas: focus, emphasis and readiness.

Before we get started with the argument, let me get the obvious out of the way. Yes, of course I believe that we should include financial information into the tactical planning process! And, similarly, I believe that we should include finance input in the S&OP process. To do this, does not necessitate a name change. However, to me, it also does not mean tight integration with financials. I find this as a common mistake with customers.

The number one change management issue with S&OP is and continues to be the role of the budget. If the company wants to maximize opportunity, the budget should be an input into the process, but not constrain the process. Likewise, the S&OP plan should be an input into the financial forecasting process. Why? The financial budget is usually anything but, market-driven, is outdated the moment that it is published and is not a good basis to begin modeling the issues of the supply chain of mix, constraints and variability.

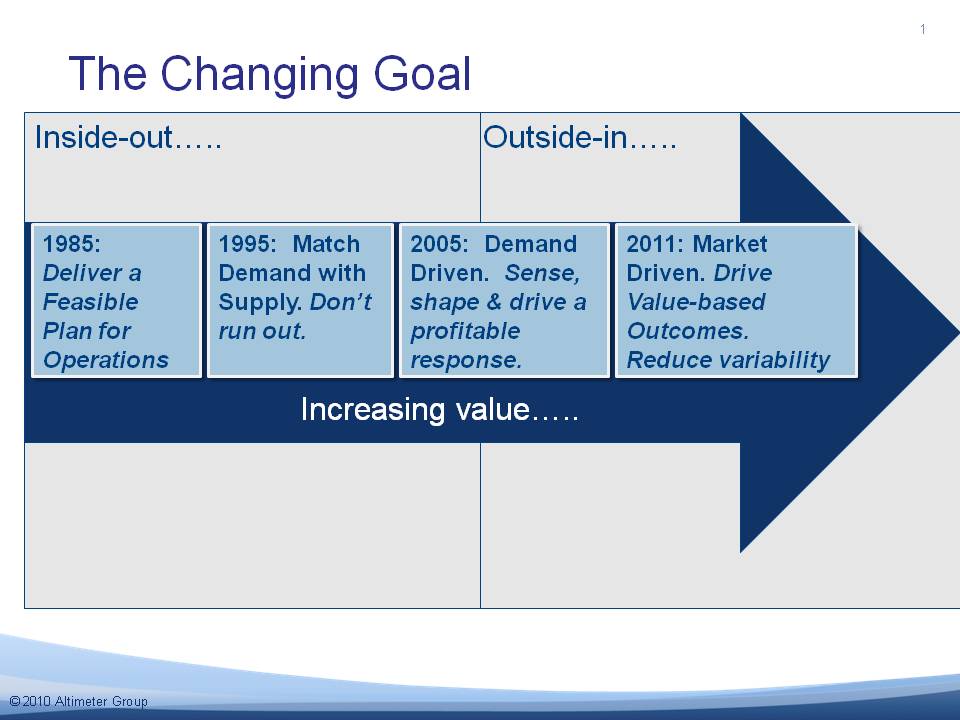

What I think we are talking about is maturation of the process (see figure 1). As the process matures, both supply chain and financial modeling inputs change to support the goal. Likewise, the modeling technologies for what-if analysis mature.

Figure 1: Maturation of S&OP Planning Processes

Yes, this is different than the S&OP definition of 25 years ago. And, it is different than most definitions that I see of IBP. However, this is where I see business leaders focused.

Focus: From Demand Driven to Market Driven

Supply chain disruption is everywhere: cataclysmic events in Japan, the Great Recession, scarce commodities, and the meteoric price rise of gasoline. The unpredictable, but rising demand in China coupled with the tightening of supply and turmoil in the Middle East. It goes on and on. Supply chains are reeling. Where is the recovery from the worst recession of our lifetime? When will supply chains start to settle down? It is clear that that it will not be anytime soon. Successfully managing the supply chain through change, will define today’s leader.

When I mention “commodity costs” to supply chain managers, they will often twitch. Their jobs are on the line. Supply is tight, expensive, and unpredictable. The pressure on price is intense. When supply chain management technologies evolved, Advanced Planning Systems (APS) improved visibility for manufacturing constraints and enabled better management and allocation of resources. However, as the constraints move from manufacturing to sourcing, there is little –often no –integration between supply chain management and sourcing technologies to better manage commodities.

While the commodity may vary by industry –whether the pressure is coming from aluminum, cotton, corn, gold, oil, or other agricultural products—companies all agree is that in 2011 sourcing strategies matter. Today, it is more about sourcing than transactional procurement. To combat rising pressures, supply chains need to connect horizontally market-to-market to plan to orchestrate the demand signal from the buy-side market to sell side decisions and to infuse supply chain commodity risk into decisions on go-to-market strategies.

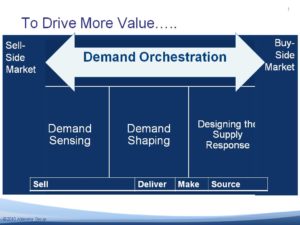

Figure 2: Market to Market Tactical Planning to Sense, Shape and Respond to Demand

My issue with most definitions of both S&OP and IBP are that they are inside out not outside-in. To combat market drivers, there is a need for a horizontal set of processes that can sense demand—variation, market drivers, risk and competitive activity—and translate this demand across the vertical silos of the supply chain (sell, deliver, make and source). Likewise the process needs to sense supply-side risks, commodity price volatility and availability to determine hedging strategies, raw material sourcing strategies and contract manufacturing network design and translate this risk horizontally and bi-directionally across the supply chain. As companies become demand-driven, they realize that traditional process definitions are not sufficient. They learn that processes need to move from inside-out to be outside-in connecting market to market. The process needs to be bi-directional to answer questions like:

- Marketing/sales: How should a company best shape demand based on market conditions (buy and sell side markets)? This is not trivial. Over 50% of promotions are based on history, and 52% of promotions are never evaluated. With commodity uncertainty, a bad decision in this area can be costly. Now is a bad time to promote a product with a high priced commodity or material constraints. Del Monte, a leader in this type of activity, runs a Monte Carlo simulation each week to determine the risk profile for each product to determine their promotion strategy.

- Logistics: Based on what is happening in the market, how should I manage inventory builds? Manage carrier relationships? (for additional insights on transportation reference the blog “Keep on Truckin”). With rising prices, inventory builds may be necessary to hedge against inflation or to ensure supply. Inventory policy changes abound.

- Supply: Based on market conditions, what are the best formulations to use? Where should I source? How should I hedge? Should I pre-buy materials to hedge against stagflation?

Emphasis: Tactical Planning

The hype over which name has added to the confusion on how to plan. When I was in London facilitating roundtables on S&OP, the greatest issue for the executives that I was working with was how to pick the right planning horizon. The second largest issue was the defining a supply chain strategy given a business strategy. There is a level of granularity required for tactical planning of the value chain that is often missing in organizations. Companies are not clear on what is supply chain excellence and have not clearly defined the planning horizons to enable a successful planning process.

The need is effective tactical planning across functions to drive alignment to maximize the value-based outcomes. The process is tactical (12-18 months based on the decisions that can be affected). It will vary by industry. However, it is not strategic planning (long range planning of 3-5 years), and it is not operational planning (less than 6 months). However, there is a need to have a parallel S&OP execution process to take the monthly S&OP decisions and enable them throughout the month.

I find that when many of my clients speak about tight integration with financials, they are talking about operational planning or budget management in the short-term horizon. While there is a need to tie tactical planning to execution, there is no substitute – no matter what the given name of the process– for great tactical planning processes.

Readiness: Technologies Evolving.

The data models for financial data modeling are in their infancy. While there are data models that enable financial modeling –Acorn Systems, Jonova, Riverlogic, and Portfolio Decisions—they are not widely used and poorly understood. Most of these financial modeling tools are also complimentary, not competitive to each other. This adds to the confusion. I also find through discussions with clients that there are currently no strong financial modeling tools in the war chests of the major Enterprise Resource Planning (ERP) vendors like Oracle or SAP.

As a result, the ability to drive what-if analysis on financial decisions requires multiple technologies and iterative analysis. The modeling has to be iterative between constraint-based supply planning technologies, revenue management planning technologies, inventory optimization analysis and financial data modeling tools requiring the work/collaboration of both finance and supply chain resources.

Getting to this end state requires clarity on supply chain excellence, and availability of data for modeling. There is no one tool or vendor that offers all of these options. Typically, there is a different model and technology to determine the answer to these five financial trade-offs:

1) The probability of a new item’s success (margin and profitability)

2) Ideal product portfolio mix

3) Fixed versus variable accounting options with changing networks

4) Tax efficient supply chain planning

5) How to improve cost to serve to improve channel management

6) Value-add analysis on multi-tier cost of capital

So, Encore it is! Whatever name you chose to use, get on with tactical planning. Focus on it. Get good at. Prosper in these times of uncertainty.

I look forward to your comments. What is your experience on the inclusion of financial imformation into tactical planning?

For additional information on S&OP check out recent blog posts in this area:

- S&OP Letter Perfect. Practice Imperfect. http://www.supplychainshaman.com/supply-chain-excellence/sop-letter-perfect/

- What if: Focus on the & with the End in Mind. http://www.supplychainshaman.com/supply-chain-economic-recovery/what-if-focus-on-with-the-end-in-mind/

- Make Money turn your Supply Chain on its Ear. http://www.supplychainshaman.com/uncategorized/make-money-turn-your-supply-chain-on-its-ear-go-horizontal/

- Mirror ,Mirror on the Wall, Who has the Best Supply Chain of All? http://www.supplychainshaman.com/uncategorized/mirror-mirror-on-the-wall/