Once again, it is Friday and time to pen a post.

As the weeks move swiftly by, I feel each week that the industry is treading water. I see a lot of pretty PowerPoint presentations, but little innovation.

Technologists and business leaders are good at locking horns, but not dancing together to a new sheet of music.

Let’s Have Some Fun

This post is packed with a bit of musings, some sarcasm, and fun. Bear with me.

As technology advances, supply chain leaders are still fixated on automating planning processes designed in the early 1980s, when I still carried a slide rule in my briefcase. (Mine was round and quite cool, I might add.) Most business leaders approach supply chain planning as a math problem. It is so much more complicated.

In post after post, I see thought leaders writing about making today’s planning processes faster and more autonomous. My question is, “Should we really try to make these processes faster and more autonomous if these traditional processes are not effective in a more variable world?” I don’t think so.

My view? In this world of increasing variability, traditional supply chain planning processes are largely a cost sinkhole that adds little value beyond providing a company with a clear system of record (marching orders for the company’s future plan). In other words, the plan may not be good, but the organization has a common plan.

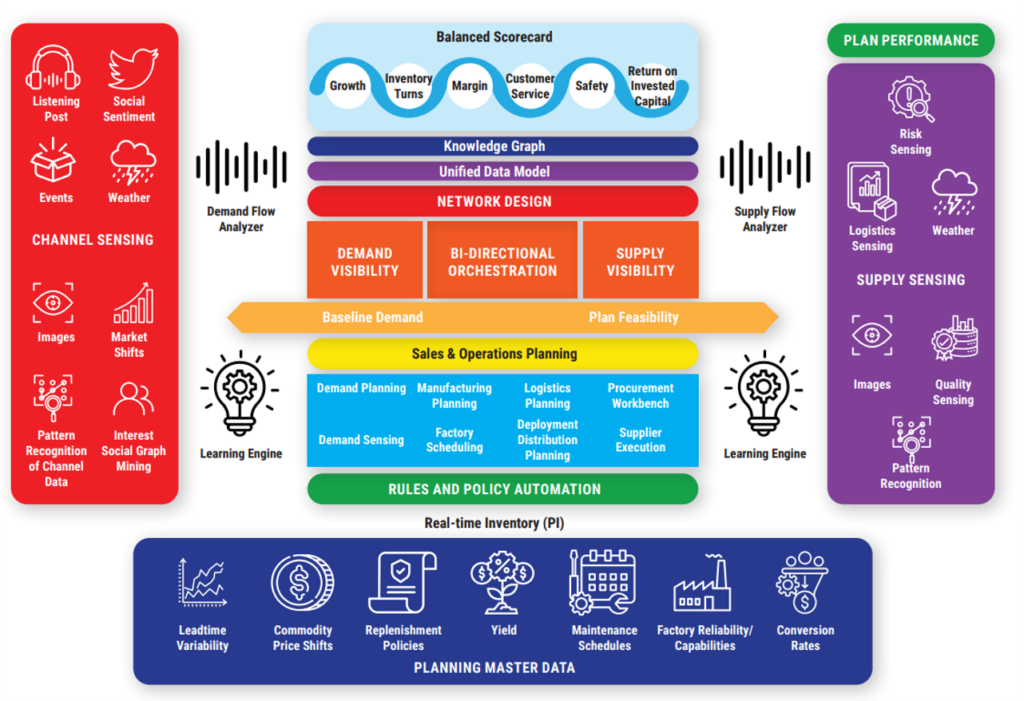

Why do I say this? As I test forecastability, inventory plans, plant schedule compliance, the use of market data for lead times, and the impact on the bullwhip effect, I am convinced that we are spending a lot of money to create waste. Today’s planning processes were a good fit for the small, regional teams, but, like the round sliderule, they are outdated for the global multinational. This is why we have focused on helping companies understand how to build outside-in processes.

You may not like this model or have your own, but it is clear to me that traditional Advanced Planning is only a fit for a regional, process-based company.

So, how do we move forward? I think that we innovate.

If we could adopt an innovation mindset rather than an improvement mindset, we could drive so much more progress. But to do this, we have to face the fact that performance is regressing across industries. With the widening of product portfolios and unchecked product complexity, items became less forecastable, making most traditional planning models archaic and increasing the bullwhip by 7-10X (based on homework from my outside-in classes). Few companies can measure and define a good plan.

Why Progress is Tough

The wheels on the bus go round and round. It is a world of lift-and-shift. The BlueYonder ex-employees’ bus went to Kinaxis; the Kinaxis employees’ train moved on to Relex; the Coupa teams moved to Optilogic and Lyric Software; and the o9 sales team moved to SAP. Supply chain planning is a story of re-treads. The world of supply chain planning is small, and many — especially in sales —hop from company to company.

In the process, the sales teams’ messaging and understanding change little. No technology or consulting company in the industry is good at measuring and delivering value. In the process, fresh thinking is extinguished.

(The moves from company to company are across the board. I just picked a few companies here. The names of the sales team personnel remain the same, but only the logo on their business cards changes.)

So, amid all the rah-rah speeches at technology kick-offs, we have companies full of nomads who are convinced that historical practices are best practices. Risk-averse and chasing deals, innovation at scale is largely non-existent. This is despite the confluence of promising new technologies. The promise has never been so compelling, and the deployments so disappointing in this old gal’s life.

Dancing With True Innovators

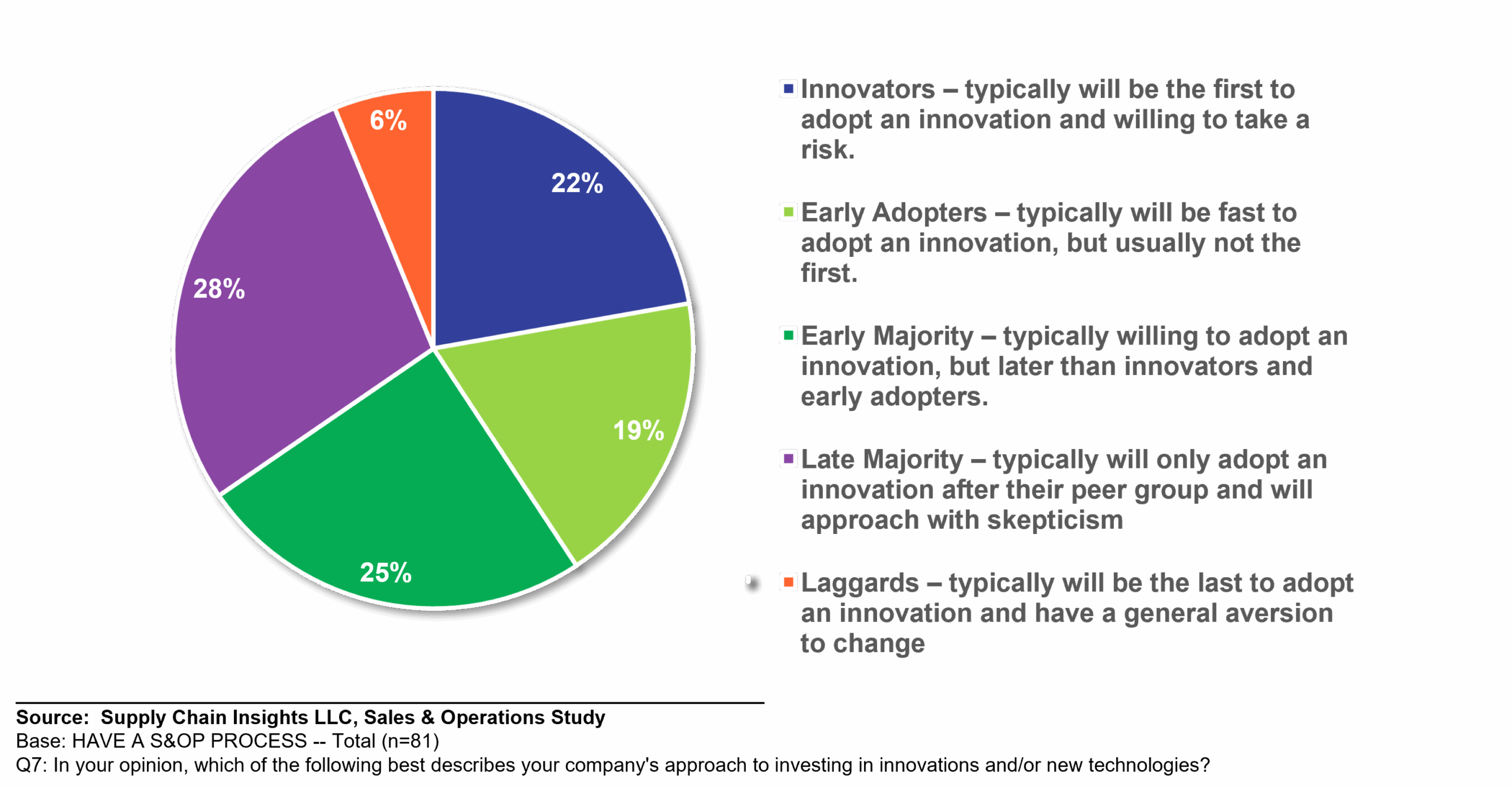

It is hard for a re-tread to dance with innovators, and the true innovators are far-and-few between, often willing to roll their own. To better understand the story, let’s examine some data.

Thirteen years ago, 22% of respondents in a study on S&OP technology stated they would be innovators, compared with 7% in a recent survey on digital transformation/artificial intelligence. Now, an astute reader will respond, “Yes, but are the samples comparable?” The answer is no. I don’t have an absolute number for innovators, but I do know that the percentage of manufacturers/retailers that see themselves as innovators ranges from 5-28% in my studies, with recent studies showing lower levels of companies identifying as innovators. I also know from the research that smaller companies are more likely to rate themselves as innovators. The global multinational is more conservative. They are also more confused.

Figure 1. Supply Chain Planning Innovators

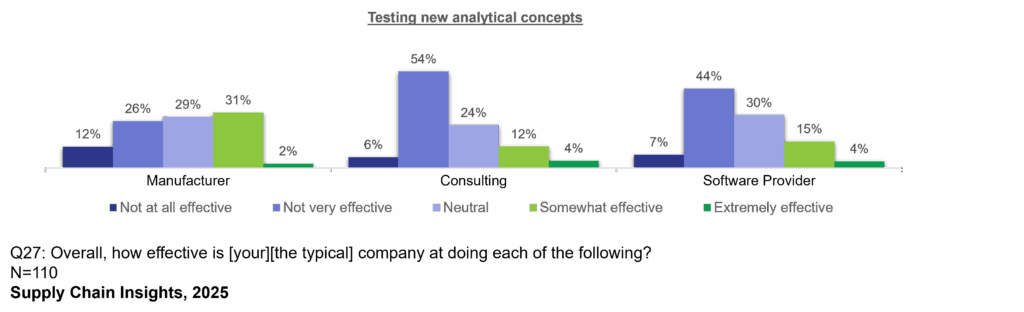

More troubling is the ability of business/IT/technologists to work together to drive innovation. Look at the gaps in Figure 2. Manufacturers see themselves as significantly more effective than consulting partners, and software providers view them with 80% confidence when testing new approaches.

Sadly, industry acumen and understanding regressed over the last two decades. As a result, re-tread sales teams are forced to dance a nonsensical dance with late adopters. They both talk about innovation, but true innovation remains elusive.

Let’s face it, we don’t have good ways to test and learn on the potential of new approaches, which is why I am pushing technologists to push market education and Foundry models. (A business model where business leaders could come and test potential solutions to hairy problems before buying software.)

Figure 2. Ability to Test New Concepts

ChatGPT defines a foundry sales model as:

“Foundry sales models in testing software typically refer to frameworks or methodologies used to evaluate and deploy AI models effectively within software applications. These models help organizations assess performance, scalability, and integration capabilities of AI solutions in their testing environments.” ChatGPT

The test-and-learn model would allow business leaders and technologists to learn together, but it will require us to rewire the brains and bonus incentives of the sales teams that circle the market, shifting from company to company every year. It will also require us to do a Mea Culpa and admit that what was conceived in the period when I carted around a round slide rule is not a good fit for most organizations. Tough change management.

The technologists should take the lead, but few are capable of doing so. Business leaders should improve their capabilities to drive innovation and partner, but most are chasing shiny objects — talking innovation but unable to understand how to close the gaps. So, the retreads try to lead the dance, but make little progress.

How To Break the Cycle

My recommendation is simple. As a business leader, break the cycle.

Dos:

- Clarify business opportunities and align the organization on the definition of what makes a good plan. Remember that a good plan is actionable, feasible, and available at the speed of business.

- Approach the project with clarity, grounded in a systems approach and tied to strategy. Supply chain excellence is more than a math problem. Focus on improving balance sheet outcomes and aligning the organization from functional metrics to a balanced scorecard.

- Explore the use of market data and define process flows from the customer’s customer to the supplier’s supplier. Start by tackling the hairy problems that matter most.

- Redesign work based on discovery. Be open to the outcome.

- Build systems thinking in your teams. Look at the supply chain holistically.

Don’ts:

- Issue RFIs or RFPs.

- Hamper progress by building a project plan with a definitive ROI before the business case is clear.

- Tie the project to a fixed project plan before the objectives are clear.

- Staff the project with a bus-load of consultants. Remember, only one woman can have a baby. (The strongest talent is at boutique consultancies. Unfortunately, the consultants with household names are relatively weak in planning.

These are my thoughts. I welcome yours.