A River Runs Through It is one of my favorite films. The scenes directed by Robert Redford are beautiful. As the story unfolds, a family with many dramatic ups and downs always return to the Blackfoot River to fish. The river becomes the thread that connects their lives. The last scene shows an old man sitting on the Montana river where he used to fish with his family many years ago. He mentions that nearly everyone from his youth is dead and he is haunted by the waters.

shows an old man sitting on the Montana river where he used to fish with his family many years ago. He mentions that nearly everyone from his youth is dead and he is haunted by the waters.

In my work with supply chain clients, teams change, business strategies shift and dramas unfold. All are haunted by the river that runs through the supply chain. What is it? It is the river of “demand.”

The River and The Quest for Growth

On an ongoing basis I view supply chain strategy documents. Growth is a common theme. Companies attempt to grow through mergers, global expansion, new products and services, and line extensions. While most companies attempt to shape demand–through promotions, new product launch, pricing, sales incentives and marketing–they confuse demand shaping with demand shifting.

Shifting demand increases cost and complexity while shaping demand increases market share or baseline forecast demand for the product. Demand for products/services is not unlimited. It is finite. We grow the pull for the product through brand awareness and competitive positioning.

A successful leadership team learns to dance with demand. They soon learn that they cannot force it, and they cannot fight the forces. In times of revenue shortfalls, sales-driven initiatives are short-term. Push-based strategies initially increase revenue, but quickly fade based on market potential.

Within each company and market there are distinct rhythms and flows for demand. Each supply chain is unique. It starts with the needs of the customer’s customer and flows through the extended supply network. To meet the needs, and navigate the volatility of global markets, leadership teams must navigate the river flows. The better the horizontal alignment, the better the results.

Sometimes the river is dry, and demand falls. Sometimes the river overflows the banks and supply must ramp. (When there is a flood, many on the supply chain team would like a lifeboat.) When demand is high, in the supply chain world, it is hard to keep in perspective that high demand is a good thing. In the words of a person that I once heard speak at the conference,”It is much easier for a supply chain team to run downhill than uphill.” To apply the analogy of the river of demand, it is easier for the supply chain to keep pace with falling demand than to build and respond to a demand spike.

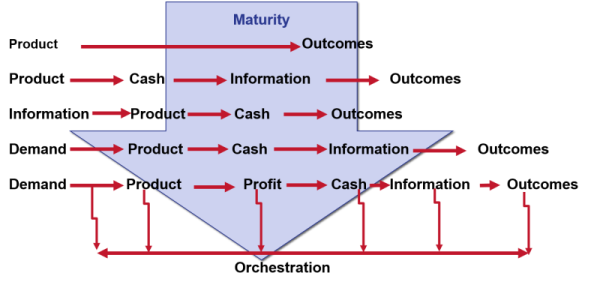

Why is this? Traditional supply chain processes are supply centric. Demand is seen as a fixed set of numbers, and as a result, the team’s focus is on numbers without understanding the drivers of the markets. In organizations, there is a better understanding of supply than demand flows. As companies and teams mature, the definition of the word “flow” changes. The maturity cycle in Figure 1 outlines the steps organizations move through. At first the flows are very linear and supply centric.

Figure 1. The Maturity Model of Flow Definitions within Supply Chain Management

Over time, companies start to understand the linkages between revenue management, and sales and operations (S&OP) planning begin to orchestrate demand. They learn that demand elasticity is closely coupled with price and revenue management, and that the river of demand connects the horizontal processes. This understanding evolves in steps. The first part of this journey is recognizing demand as a flow to be managed horizontally. The traditional approach is to manage demand as numbers within functional silos.

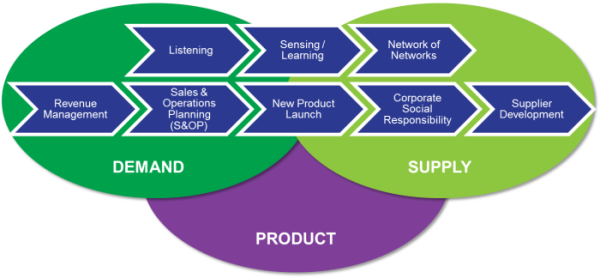

Figure 2. A Focus on Horizontal Processes to Support Demand Flows

A Focus on Demand Flows

The river of demand has many tributaries. This includes: new product launch forecasting, seasonal inventory targets, demand affinities, push-based inventory strategies, demand shaping activities (price, promotion, run-out strategies, sales incentives, trade incentives), and turn-based volume. Each demand segment is a tributary forming the river. Understanding the market starts with sensing and measuring each individual demand flow. Listening–mining of unstructured text to understand customer sentiment–enables early sensing of tributary shifts.

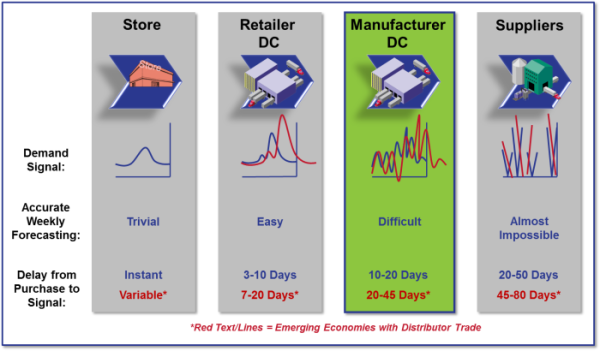

In the process today, because of a lack of focus on flows, we ask the wrong questions and are often unclear on outcomes. These gyrations put artificial dams and diversions into the demand flows creating the Bullwhip Effect. The translation of demand across reorder points and order policies distorts the demand signal across the parties. As a result, by the time the demand signal is translated across the extended supply chain to two or three parties the distortion is so great it is not usable.

Figure 3. The Bullwhip Effect

So What Does This Mean to You?

Learn to navigate the river of demand. Realize that, within the organization, the concept of demand as a flow is not well understood. There are many misconceptions that must be challenged:

1) Demand Management Is Forecasting. The process of forecasting–the use of statistics to mine the patterns of orders/shipments to forecast the future (applying statistics using historic patterns)–is only a part of the picture. There needs to be demand pattern recognition for the strategic, tactical, operational, and transactional planning horizons.

The modeling of demand today is supply focused. Traditional Advanced Planning Solutions (APS) approaches are too limited. Why? The forecast is developed on the tactical horizon and then consumed through rules that are out of date when they are written. It is like taking a picture of a river and saying that you understand the flows. Instead, in the short-term horizon, market demand needs to be sensed and translated into replenishment.

Today supply chains respond. They do not sense. Forecasting is executed in the tactical planning horizon (monthly or weekly forecasting without the connection to strategic forecasting and demand sensing). Leaders are building demand solutions to cross the time horizons that are market-driven based on channel demand. Navigating the river requires a constant sensing of the current.

Figure 4. Client Example of Demand Management Across Time Horizons.

2) One-Number Forecasting. At almost every client that I speak to, they ask how to have “one-number forecasting.” This is a myth perpetuated by large consultants who do not understand demand. When I am asked this question, I go to the whiteboard and draw two hierarchies: one that is market-driven based on channel locations, and one that is supply-centric based on shipping locations. I then ask the client how many demand units they forecast, and we draw the numbers on the hierarchies at each level. When we are done, and the hierarchies are populated, I ask, “Which number do you want to use?” Most will laugh. The average company has hundreds and thousands of values in the hierarchies. The goal should be an agreed upon and common plan, not one number. Companies need to agree on the assumptions.

3) The Order Represents Demand. Traditional supply chain processes assume that the order represents demand. However, companies mature in the concepts of demand know that each order has latency–the time to translate market take-away into re-order points through the channel to the manufacturer.

Why does the order not represent true demand? Out-of-stocks are not recognized, and shipments do not always reflect what customers really want. Consider the story of the green Volvo. Imagine a car lot full of lime green Volvos. It was an ugly color. The automotive manufacturer had a surplus of green vehicles that no one wanted. To move the product, the company discounted the cars to stimulate purchase. They were successful. The green Volvo cars finally sold, but guess what happened? Yes, the manufacturer made more green Volvo cars. In the traditional supply chain, there was no visibility that the green Volvos were being discontinued and that the incentives were part of a run-out strategy.

The lesson? An order is not an order. An item is not an item. As we swim the river of demand, the goal is to match customer attributes with product attributes, and read markets quickly with little latency. Understanding the assumptions in the demand plan and run-out strategies is important to manage product obsolescence.

4) Accuracy versus Demand Probability. Too often I find that companies focus on being precise. As a result, I find teams are often precisely wrong. Instead, the focus needs to be understanding the probability of demand. The translation of demand by range and distribution drives better results. The supply chain needs to be designed to embrace the probability of demand.

Demand flows have to sync with supply flows. The methods vary by industry. Attributes and profiles work well for apparel, attach rate forecasting is a must in high-tech industries and platform modeling works well in automotive. The translation of demand across the hierachies must include information about mix and variants to automate supply. When the focus is only on SKU-based forecasting the context is lost.

5) Details Matter. Focus on Attributes. In the building of tightly integrated supply chain planning systems, the drivers of demand are often lost and not visible. A focus on attributed-based modeling and the building of demand profiles enables better insights. Focus on modeling and communicating what drives the river of demand. Spend less time talking SKU geek talk.

6) If You Want to Know What You Are Going to Sell, Ask Sales. A naive team thinks that if they want to know what to sell, they will ask sales. Unfortunately sales teams have the greatest bias and error. They tend to be coin-operated, based on sales incentives and internal politics. Demand processes need to be designed outside-in with a focus on the tributaries (learning what drives demand).

7) Marketing-Driven Is Not the Same as Market-Driven. Likewise, marketing-driven is not the same as market-driven demand management. While marketing is focused on advertising and campaigns, marketing processes are often working with demand data which is weeks and months old. The most effective supply chains sense demand, and translate demand cross-functionally with a focus on role-based views. When done well, the river of demand flows across the entire chain.

I hope that this helps. As you build your understanding, I hope you can avoid the drama of the movie, and that you will not be sitting at the end of your career lamenting about the river and haunted by the ups and downs of the waters.

Got tips and tricks to share? Comments? I look forward to hearing from you.

Take Us With You for Your Summer Holiday

In June we published our new Shaman’s Journal. The Shaman blog is now read by 15,000 readers globally. The Shaman’s Journal book is a collection of best read posts organized in more readable format. Order your copy today through Amazon to learn more about our research on building the global supply chain. Tuck it into your bag as you leave on your summer vacation.

In June we published our new Shaman’s Journal. The Shaman blog is now read by 15,000 readers globally. The Shaman’s Journal book is a collection of best read posts organized in more readable format. Order your copy today through Amazon to learn more about our research on building the global supply chain. Tuck it into your bag as you leave on your summer vacation.

Also, listen to our podcasts. Download the Straight Talk with Supply Chain Insights app on your iPhone to listen to the testimonials of this year’s Supply Chain to Admire winners on your phone as you travel.

Continue the Discussion at the Supply Chain Insights Global Summit

We will continue this discussion at the Supply Chain Insights Global Summit. (Registration is open for the first 125 participants. We limit the number of technology providers to 25% of the audience.) Move quickly! The hotel room block is almost sold out.

At the conference, we will be challenging supply chain leaders to focus on Supply Chain 2030 through a programmatic focus on five themes:

- Supply Chains to Admire. Financial Results. A critical look at supply chain processes impacting financial results through the Supply Chains to Admire research.

- Economic Vision of Supply Chain 2030. It is hard to know where we are going if we are not clear on the end state. Join us for a critical view of supply chain 2030 through the insights of leading economists.

- New Business Models. Making the Digital Pivot. Sit back and listen as companies share insights on the adoption of robotics, the Internet of Things, 3D printing, manless vehicles, new forms of analytics, and the emergence of new business models.

- Supply Chain 2030. Building Outside-In Processes. Experience the difference between traditional inside-out and new outside-in processes through the use of new forms of analytics and the network of networks.

- Building Supply Chain Talent and Leadership. Insights on leadership, continuous improvement, and talent development for emerging markets.

We hope to see you there!

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn.

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn.