I was on my way to Peru. I scooted into an aisle seat and sat beside a stranger. He begrudgingly let me slide my bag under the center seat. I put in my earphones and zoned out letting the plane take off.

It was a hot day, and I was not in the mood to talk. He introduced himself as Steve. Over the course of trip to Atlanta to connect to Peru, we began a discussion. Steve used to work for Ariba. During the conversation, he thanked me as an ex-Gartner analyst for putting Ariba on problem-watch in May 2001. I peered over my glasses in disbelief. Speechless, I stared at him. I had never had a vendor thank me for giving a company a negative review. (I am seldom without words.) Hesitantly, I asked, “Why?” Steve’s response was fascinating and enlightening. He said, “Ariba was in trouble. The market shift was dramatic, and if we had made a series of small cuts in staff or direction, we would have had the same fate as i2 Technologies or Manugistics. We could not afford death by a thousand cuts. Instead, we needed quick and deliberate action. Your note forced our management team to act.”

I smiled. The decision to write that note was fraught with internal debate. Two of my co-authors fought me on the wording believing it was too strict. My mind flashed back…

A death by a thousand cuts rolled around in my mind. For many years (1992-2001), I worked at Manugistics, a supply chain planning technology provider. The company is now owned by JDA. During the period of 1996-2001, the company struggled. I experienced many layoffs. Often it was three times a year. It was hard to get work done. Watching people walk out the door with a cardboard box in their hands and leave the parking lot for the last time was mind numbing. I related to Steve’s story of death by a thousand cuts. It was refreshing for me today to talk to Adexa and see their fresh approach to supply chain planning. They remained independent despite the death spiral of Manugistics and i2 Technology.

Another Story of Death by a Thousand Cuts?

Today I am deep into writing reports for the Supply Chain Insights newsletter. Each year we look at supply chain financial ratios and write a report on the Supply Chains to Admire. It is our fourth year. The time-consuming analysis is fascinating. I love the patterns. At the end of a long day I often have more questions than answers. However, in the writing of the recent report on the Household Products and Beauty industries, my observation is that companies are stuck in neutral and going backwards.

ratios and write a report on the Supply Chains to Admire. It is our fourth year. The time-consuming analysis is fascinating. I love the patterns. At the end of a long day I often have more questions than answers. However, in the writing of the recent report on the Household Products and Beauty industries, my observation is that companies are stuck in neutral and going backwards.

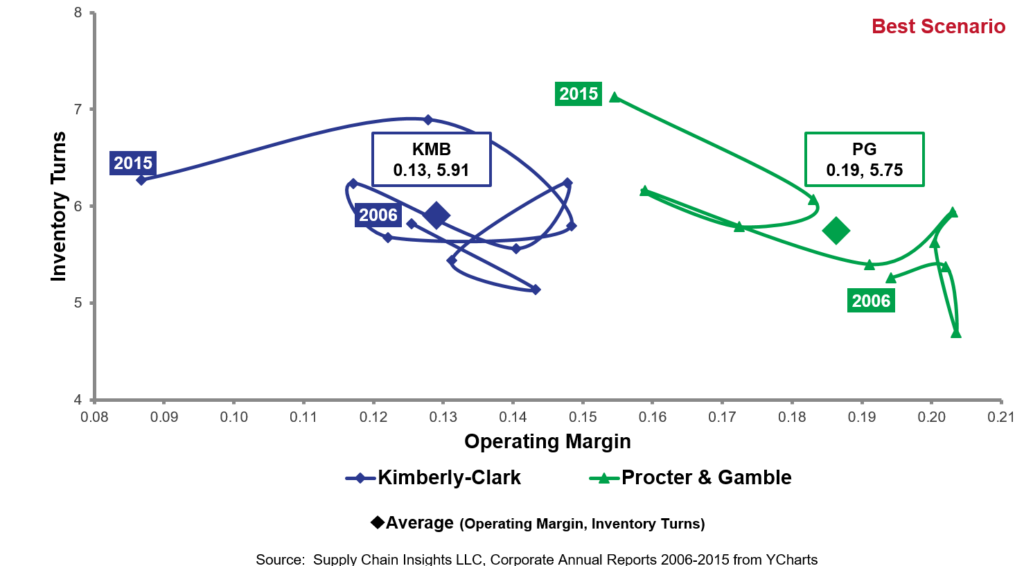

When I speak, people ask, “Who has the best supply chain?” I used to say that companies in the household products sector–Colgate, P&G, and Unilever–built the best supply chains. However, based on my current research, I can no longer say this. I believe that the regression of the household products supply chain is a story of death by a thousand cuts. Even though the supply chain today is not dead, it is definitely stuck in neutral and going backwards. Take a look at Figure 1. Both Kimberly-Clark and P&G are going backwards on operating margin while making progress on inventory turns. Item complexity is taking a toll.

Figure 1. Orbit Chart for Kimberly-Clark and P&G for the Period of 2006-2015

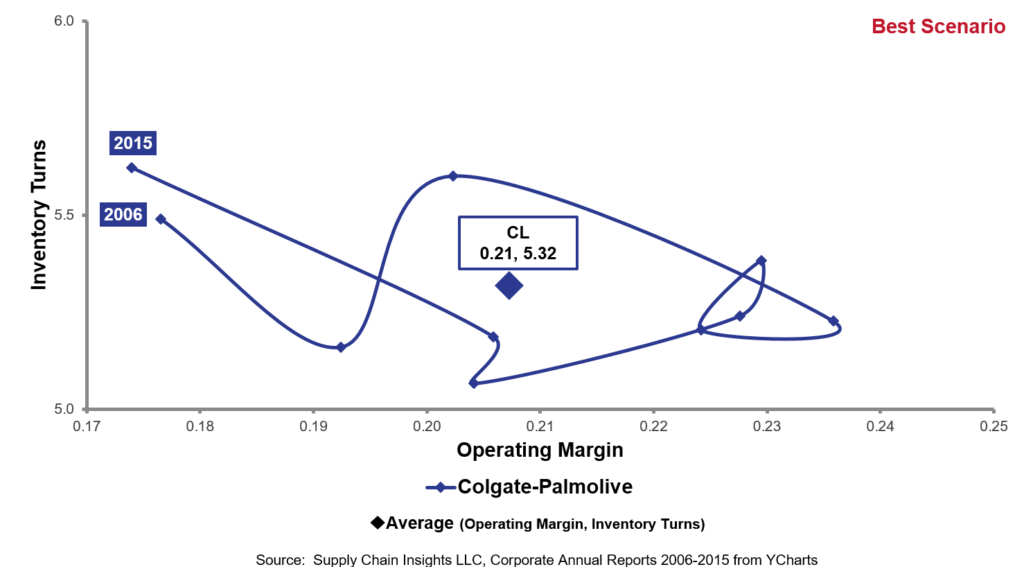

A similar pattern exists for Colgate. While Colgate posted better margin (.21 versus P&G’s .19 average) and 3 times better ROIC for the period (33% versus P&G’s 11%), note that none of these three household products companies made progress on supply chain excellence in the period of 2013-2015.

Figure 2. Orbit Chart of Colgate for the Period of 2006-2015

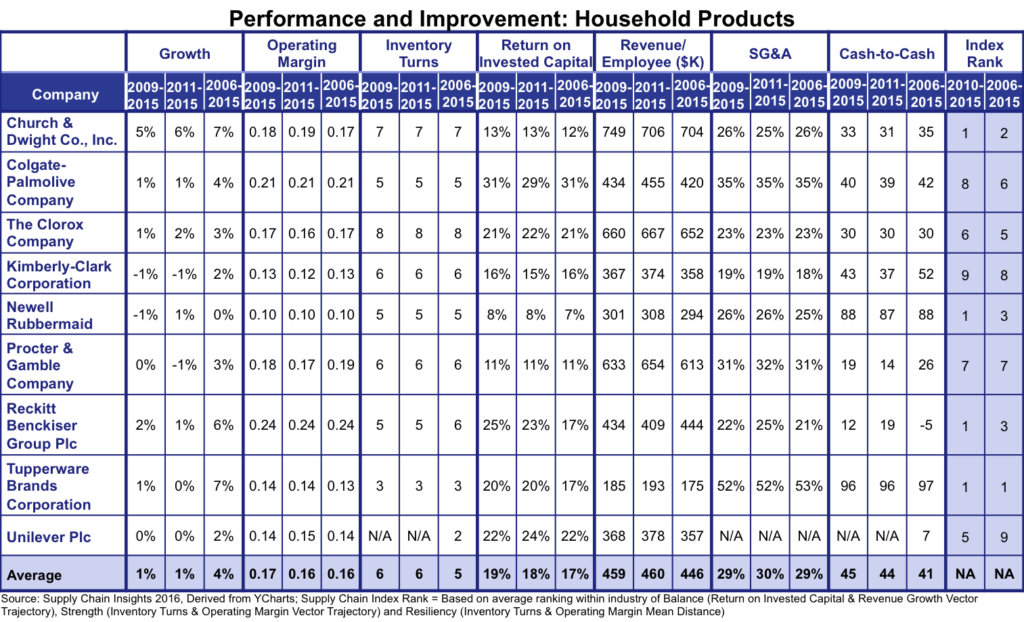

Who is performing the best in this industry? It depends on the criteria.

The industry as a whole struggled. Growth slowed with a decrease from 4% to 1 %. Margin declined 1%, and Cash-t0-Cash grew four days. Return on Invested Capital (ROIC) increased 1%. For example, P&G kept pace with the industry average on operating margin and inventory turns, and posted some of the best results in Cash-to-Cash (30 days below the peer group), but underperformed on growth and Return on Invested Capital. P&G’s rate of improvement on the Metrics That Matter was lower than the peer group. So, can I say that Colgate, P&G or Unilever are top performing supply chains? Today the answer is no.

Table 1. Performance of the Household Products Peer Group

Reflections

As an analyst, I get to watch and observe industry progress. Here is my observation. At the beginning of the last decade B2B high-tech companies (think Cisco and Seagate) and household products companies operated similar supply chain processes. This is no longer the case. In the last decade the high-tech firms outpaced the household product firms.

Let’s take the case of Cisco Systems. Cisco had a kick in the gut in 2001. The dot.com era was a speculative market bubble in the period of 1995 to 2000 (with a height on March 10, 2000). During the mid to late 1990s, due to their relative market capitalizations, Cisco Systems, Dell, Intel, and Microsoft were known as “the Four Horsemen of the NASDAQ.” In this period, a combination of rapidly increasing stock prices, market confidence on future profits, and speculation in individual stocks, made investors overlook traditional metrics in favor of confidence in future technological advancements. Caught in this e-commerce hype, Cisco Systems did not foresee the bubble getting ready to burst in 2001. As the company spiraled in the updraft of the market, it built inventory. When the company did not see the market downturn, the company wrote-off $2.3 billion in inventory charges in April 2001. The company stumbled, and its stock value fell 6 percent.

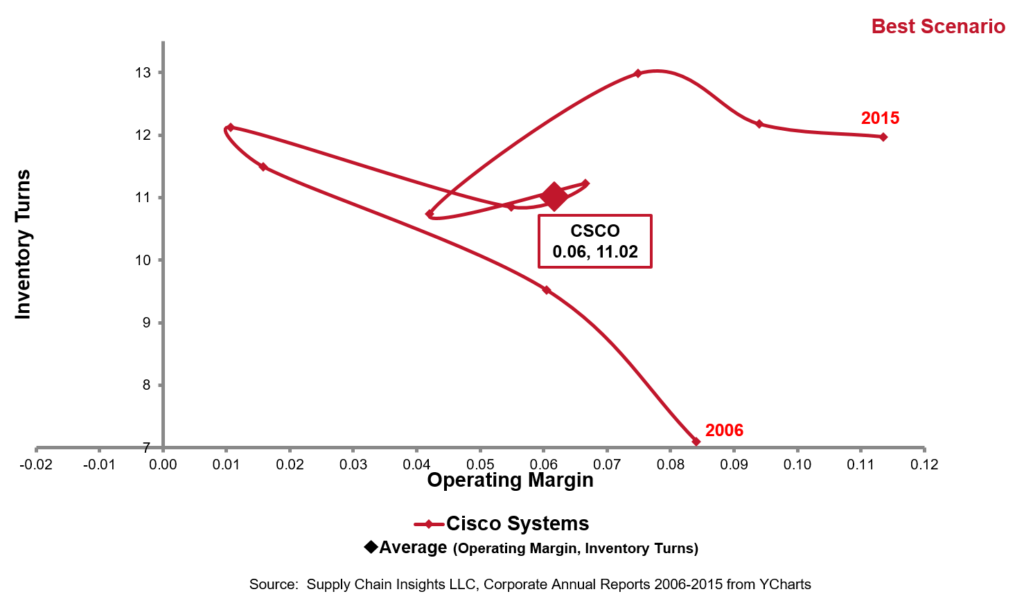

What was the answer for Cisco? The company built strong horizontal processes. They got good at Sales and Operations Planning (S&OP) and tied the output to decisions on what to make in contract manufacturing. Based on this process evolution, Cisco was one of the first companies to sense the economic downturn of December 2007. The company weathered the storm of the recession with no write-offs. While they lost operating margin in the recessionary period, as shown in Figure 3, they improved turns and regained margin post recession.

Figure 3. Orbit Chart of Cisco Systems

So, what can we learn? Before I begin, let me state that no company is perfect, but here are some general trends. Let’s start with three:

- Acceptance of the Status Quo. Household Products focused on continuous improvement of existing processes while Cisco Systems matured some of the best network design processes in the industry. Cisco continually redesigns the supply chain and builds inventory strategies (form and function of inventory) to improve the supply chain response.

- Supplier Relationships. Cisco actively owns and builds the supply chain value network. Supplier relationships in household products are more buy/sell.

- Supply Chain Planning. While the high-tech industry built a senior supply chain planning track to drive excellence in planning, the household products companies built global hub strategies with more junior people. The effectiveness of supply chain planning within the household products companies steadily declined over the last decade as new people rotated through planning positions. The high-tech companies are better at planning. Their planning systems are more finely tuned and refined.

So what do you think? Did the Household Products companies become complacent, letting many market factors–complexity, generic products, increase in trade promotions, shifts in power to the retailer–slowly erode the competitiveness of traditional processes? Yes, I believe so.

Is it a story of death by many cuts? It is too early to tell.

Will the industry realize the issue and snap back? Yes, I think that it is possible. As Steve said, “The first step is recognizing the trend and taking action.” Cisco had a wake-up call while the trends in household products have slowly reshaped the industry.

Let me know your thoughts.

We will present all of our results on July 20th on our webinar to announce the 2016 Supply Chains to Admire winners. Join us for the webinar scheduled for 1:00 PM. (Click the link to sign-up for the webinar.) Join us to gain insights on the Supply Chains to Admire winners. We hope to see you there!

We will present all of our results on July 20th on our webinar to announce the 2016 Supply Chains to Admire winners. Join us for the webinar scheduled for 1:00 PM. (Click the link to sign-up for the webinar.) Join us to gain insights on the Supply Chains to Admire winners. We hope to see you there!

Take Us With You for Your Summer Holiday

Last month we published our new Shaman’s Journal. The Shaman blog is now read by 15,000 readers globally. The Shaman’s Journal book is a collection of best read posts organized in more readable format. Order your copy today to learn more about our research on building the global supply chain. Tuck it into your bag as you leave on your summer vacation.

Last month we published our new Shaman’s Journal. The Shaman blog is now read by 15,000 readers globally. The Shaman’s Journal book is a collection of best read posts organized in more readable format. Order your copy today to learn more about our research on building the global supply chain. Tuck it into your bag as you leave on your summer vacation.

Also, listen to our podcasts. Download the Straight Talk with Supply Chain Insights app on your iPhone to listen to the testimonials of this year’s Supply Chain to Admire winners on your phone as you travel.

Continue the Discussion at the Supply Chain Insights Global Summit

We will continue this discussion at the Supply Chain Insights Global Summit. (Registration is open for the first 125 participants. We limit the number of technology providers to 25% of the audience.) The conference will be live-streamed. We will be discussing five themes:

- Supply Chains to Admire. Financial Results. A critical look at supply chain processes impacting financial results through the Supply Chains to Admire research.

- Economic Vision of Supply Chain 2030. It is hard to know where we are going if we are not clear on the end state. Join us for a critical view of supply chain 2030 through the insights of leading economists.

- New Business Models. Making the Digital Pivot. Sit back and listen as companies share insights on the adoption of robotics, the Internet of Things, 3D printing, manless vehicles, new forms of analytics, and the emergence of new business models.

- Supply Chain 2030. Building Outside-In Processes. Experience the difference between traditional inside-out and new outside-in processes through the use of new forms of analytics and the network of networks.

- Building Supply Chain Talent and Leadership. Insights on leadership, continuous improvement and talent development for emerging markets.

We hope to see you there!

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn.

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn.