Thirty-one months of supply chain disruption. Currently, companies struggle with rolling electric outages in China. Water levels falling in the Rhine, the Loire, the Yangtze, and the Colorado River. Drought is a risk to TSMC manufacturing in Taiwan.

The winter offers no relief. COVID is far from over. Food instability, coupled with drought, is driving migration from Sudan to Europe. Political instability globally shifts supply chain demand and supply. The Russian invasion of Ukraine stretches into a much longer war resulting in serious disruptions to the food, automotive, and semi-conductor supply chains.

While many old-fashioned supply chain leaders speak of Risk Management and the need for Control Towers. Let’s face it, these approaches are passe. Organizations are more reactive today and less effective. A reactive supply chain introduces nervousness into the complex non-linear system called the supply chain.

Let’s face it. Historic practices are not equal to today’s new normal. Surviving disruption after disruption requires a different focus. Doing S&OP better is helpful but not sufficient.

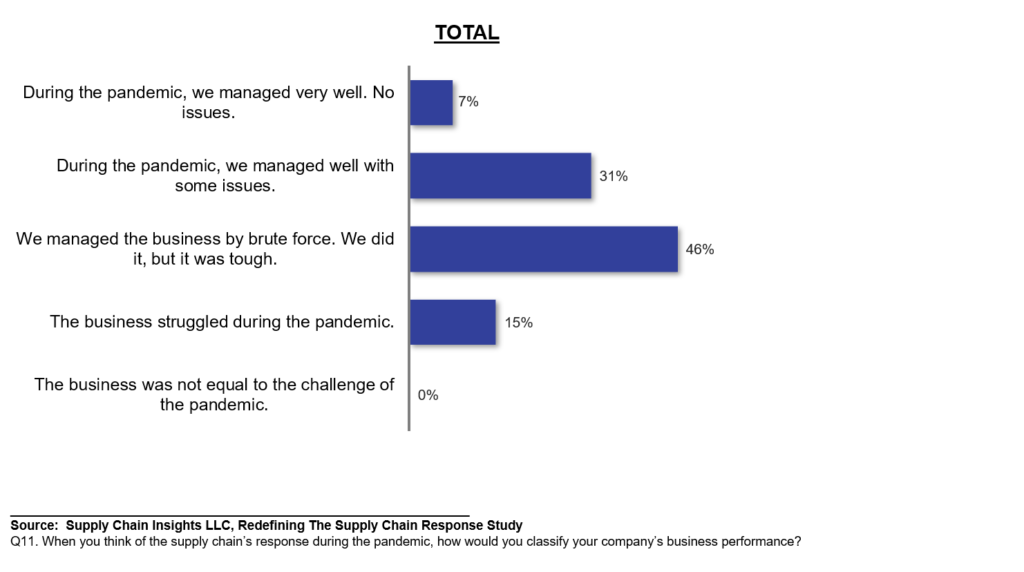

How are companies doing? As shown in Figure 1, on a five-point scale, 46% managed the business over the prior 28 months by brute force. Only 7% feel that their company managed disruption well.

What was different? The organizations that managed well during disruption were better aligned internally and focused on using external signals. These teams are also more advanced in the use of planning and more advanced analytics concepts.

Figure 1. Supply Chain Performance over the Period of March 2020 to July 2022

Inventory Is an Egregious Symptom of Supply Chains Gone Wrong

Today, inventory fire sales abound. Headline news included Wal-Mart, Target, Kohl’s, and Macy’s struggling with inventory bloat and offering deep discounts. Last week, I bought a shirt at Bloomingdales on Walnut Street in Philadelphia for 1$. The sad part of the story is no one was in the store.

In my 68 years on this planet, I have never seen such deep discounts. However, with declining customer sentiment, few were in the stores. Business continuity continues to be a risk for many retailers and manufacturers.

Across the world, warehouses are full. Containers serve as overflow warehouses adding to port snarls.

My takeaway? We are raping the planet to make inventory to sell at a deep discount for customers tightening their wallets. Is this a conscious and deliberate decision? No. Should we do better? Yes. Do traditional supply chain practices achieve this objective? My answer is no.

Why We Cannot Get Inventory Right

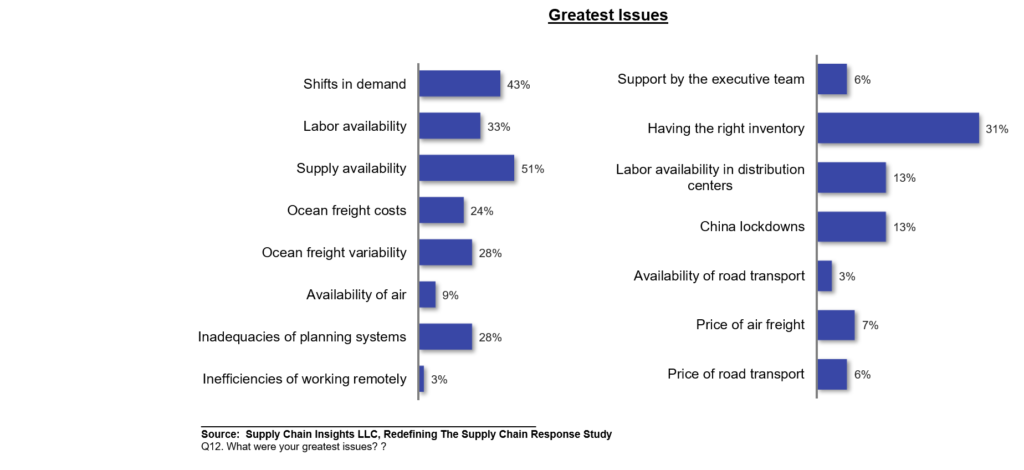

The news is full of headlines about supply chain issues. Still, as shown in Figure 2, when we ask supply chain leaders about the greatest issue in this period of disruption, we find that it centers on getting the right inventory level in the right place. You might say, what is the issue? Haven’t we been working on improving inventory for the past three decades? Why are having so much trouble with inventory now?

Figure 2. Greatest Issues of Supply Chain Leaders in the Period of March 2020 to July 2022

What went wrong? When it comes to inventory and driving improvement in the face of variability, there are five issues:

- Poorly Implemented Advanced Planning Solutions. In nine out of ten supply chain planning systems that I test, I find that companies have a negative Forecast Value Added (FVA) level. To put this in perspective, if they had no planning system and no planners and just assumed that they would ship based on prior shipments, the forecast would be better, and the inventory levels more accurate.

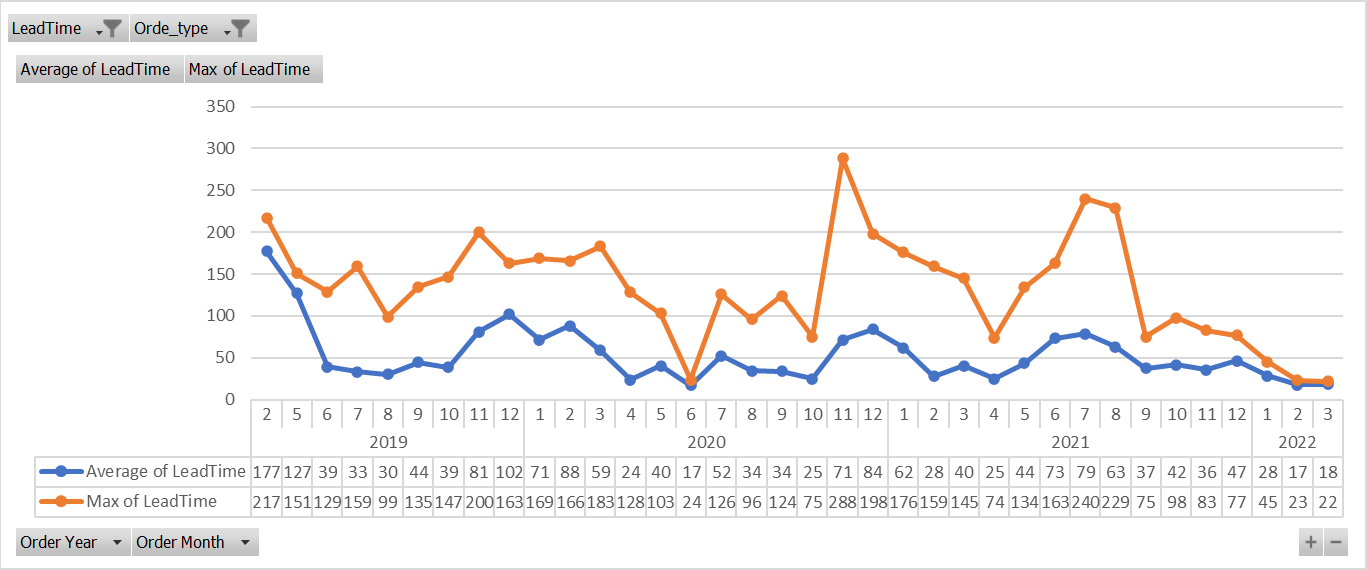

- Lack of Accounting for Supply Variability. Most planning systems are implemented with a fixed value for lead time. Safety stock levels need to account for demand and supply variability but most built inventory policies only on demand data. To understand how variable lead times were in this period, In Figure 3, I share data from an automotive spare parts supplier. Planning inventory well requires understanding not only the changes in the lead times but also the variation.

- Insufficient Understanding by the Executive Team. Mature organizations focus on the form and function of inventory and tie the inventory strategy to corporate policy. In contrast, finance flexes inventory up and down in less mature organizations to manipulate cash flow for either investor reporting or bonus incentives.

- Reactive Behavior Based on Transactional Data. Using enterprise data—order and shipment data—in planning with tight integration increases the bullwhip impact increasing inventory requirements. Knowing demand latency (reducing the time to read the market signal from consumption to the order) increased in importance and few companies had this capability.

- Port Snarls. Due to issues with unloading, in-transit inventory increased often not hitting planned selling plans. As a result, obsolescence increased.

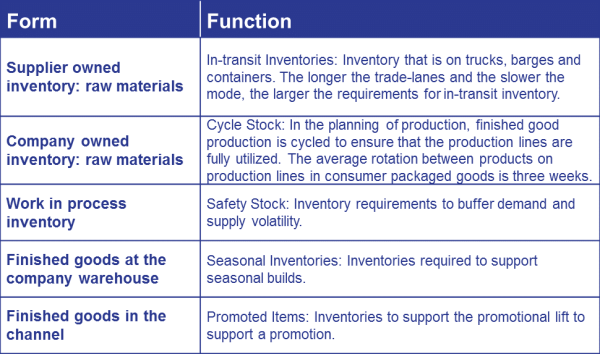

In Table 1, to help the reader, we share the definition of the form and function of inventory.

The Discussions We Should Be Having

The first step is to clarify the definition and test our processes. Most companies implement planning technologies without analyzing if the data is forecastable, if the lead times are variable, or if the output is better than the Naïve forecast.

We perpetuate a belief that we have best practices. The story is perpetuated through data manipulation. The extension of days of payables hides the lack of progress in cash-to-cash. ( The Formula for cash-to-cash is C2C= Days of Receivables + Days of Inventory-Days of Payables. As a result, if Days of Payables is extended, companies falsely sense that they are making progress on inventory.)

Likewise, if companies increase carbon emissions (Scope 2 and 3), two-thirds of public companies invest in Carbon offsets to reduce the potential impact. There are many problems with this approach. First, there is not enough land to plant enough trees for the required carbon offset. The second is there is no clear reporting on the cause and effect. Shouldn’t our focus be more on reducing inventory, waste, and Scope 2 and 3 emissions and less on carbon offsets?

Definition of groupthink

A pattern of thought characterized by self-deception, forced manufacture of consent, and conformity to group values and ethics

Wikipedia

When I look at the market, I see major contributions of GroupThink:

- Failure of IT Standardization. SAP and IBM failed the market. The recent gains in market share of Kinaxis, o9, and OMP are largely due to the failure of SAP to drive thought leadership in planning. The sunsetting of SAP APO and the deficiencies of SAP IBP is an issue in the face of disruption. In Figure 1, companies with SAP IT standardization rated themselves as lower performing during the pandemic. Many companies with strong SAP investments are uncertain about the best next steps. IBM, in contrast, purchased over fifteen supply chain acquisitions but drove little innovation. Remember Emptoris, Demandtec, or Ilog? Probably not. When IBM acquired the assets, technology leaders left, and innovation stalled. I tell technology leaders, that IBM is the company where innovations go to die.

- Private Equity M&A. Software mergers & acquisitions also slowed innovation. The technology roll-ups of INFOR, JDA (now BlueYonder), and E2open improved investors’ balance sheets, but did not drive value for their clients.

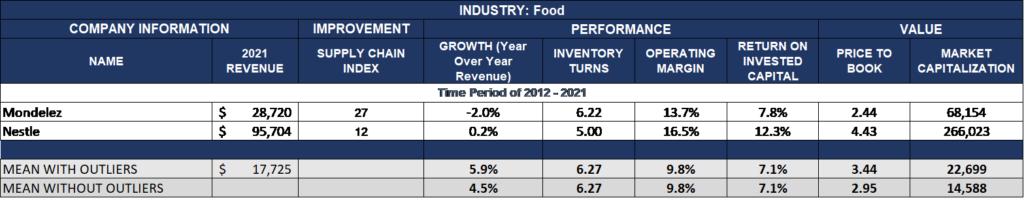

- Event Companies Are the Nemesis of the Industry. Event companies take large sums of money from technology companies and host events based on the Rolodex of a prior supply chain leader. For example, the North American Council of Supply Chain Executives (NASCES22) in Chicago next week builds off of the Rolodex of Daniel Myers. Daniel moved through several leadership positions in Mondelez supply chain leaders ship for 8 years and 1 month, retiring in September 2019. His prior experience for more than seven years was at P&G leading the merger of Gillette into P&G. (Most people I interview about the Gilette merger into P&G say it was rocky. The reason? P&G pushed standards from other businesses like Laundry onto a very different business decreasing the value of the Gilette assets.) I writhed in my seat when Daniel spoke at the University of Tennessee forum on improving cash-to-cash by increasing payables to 160 days. He proudly showed a picture of his sportscar purchased with the bonus payouts from improving cash-to-cash by extending payables. As shown in Table 2, for the period of 2012-2021, Mondelez is 27th out of 35 companies in the food sector in driving improvement. Mondelez also underperformed the industry average in growth, inventory turns, and Price-to-Book valuations. Yet, Daniel is the keynote speaker at the NASCES 22 event next week.

Table 2. Mondelez Comparison to Nestle and Industry Average for the Period of 2012-2021

The attendees of the NASCES 22 event include many North American Supply Chain Leaders. The net result? The event company gets rich from the sponsorship money from the technologists. Business leaders attend free to network and contribute to groupthink. Will the NASCES 22 event move the industry forward or will there be a groupthink dialogue? The answer is unsure, but the agenda has no guardrails to keep the audience from moving into groupthink mode.

Summary

Today, only one in three companies feel they are managing well with few issues during this unprecedented time of supply chain disruption. Industry groupthink is a large barrier to driving improvement.

I fear that the conditions in the industry are going to get worse, not better. In this period of unprecedented disruption, fighting groupthink is paramount to improving business continuity and saving the planet. I pray that leaders realize that the mounds of inventory sold at firesale prices are a symbol to rethink to drive new outcomes.

We need to make supply chain leaders and technologists more accountable to drive value.

Join the Guiding Coalition to Improve Planning

This week, we kick off the Supply Chain Insights Global Summit. Two hundred attendees will join virtually from all regions of the world. The presentations, videos, and pictures post a month after the summit. Post-conference we will host several share groups to discuss improving systems to better sense and drive insights.