Companies state that they want bold change; but within the company, I find swirling inaction. It baffles me. Why? Companies are at a tipping point. Traditional processes are not sufficient and there is a war being waged between traditionalists and reformers. Within IT organizations, there are many zealots of existing systems. I am speaking to companies that are being held hostage to SAP HANA upgrades with 70% cost overruns and 60% time-schedule expansion. Similarly, SAP Ariba frustration is mounting in the market. I have 15 clients trying to implement Ariba for direct materials, and struggling to make the flows work. Yet, the IT team is still mandating SAP standardization. Why? For many, mandating SAP is job security for the IT implementation team.

In this post, I am going to make an argument to augment ERP with new cloud-based solutions to improve decision making. I am going to start with the management of direct materials. The headline is parts are not parts. Yes, companies need the right materials at the right time to drive customer service. In today’s world, this is an issue. Here I make the argument for change, and close with insights on two best-of-breed technologies to consider in order to augment direct material processes.

The Driver for Change

Today, management of the supply chain is harder. Supply chain management is more complex. It requires the oversight of a nonlinear, and often very unpredictable, system. Systems thinking is tough for people with a transactional mindset. And we find many teams within a company are very transactional.

Sometimes the changes within a supply chain are subtle, but have a large impact. A slight change within a function—in sourcing or manufacturing, or along the chain—can greatly impact the outcomes of cost, customer service, or working capital. Today’s supply chain—with greater outsourcing, global manufacturing, and complex bill of materials—requires synchronization of the links. Historic processes focus on efficiency within the functions. As a result, the functions do not align to drive flows, and small changes throw the system out of balance. The topic of synchronization is far more complex than the concept of integration. As a result, the processes of yesteryear are not adequate.

Today’s reality is that we have optimized functions, not flows. Organizational alignment is an issue. Bonuses and incentives align with functions and are often counterproductive to driving supply chain excellence.

In parallel, there are also large alignment gaps in planning: the tension between planning and execution. Organizations reward the urgent. Firefighting is the result. Planning is about time to think about the important. When companies are good at planning there is less firefighting. However, when a job combines the urgent and the important, the urgent always wins, and planning gets short shrift. The gaps create waste. Insights and process synchronization help to close these gaps.

More Data Has Not Resulted in Improved Results

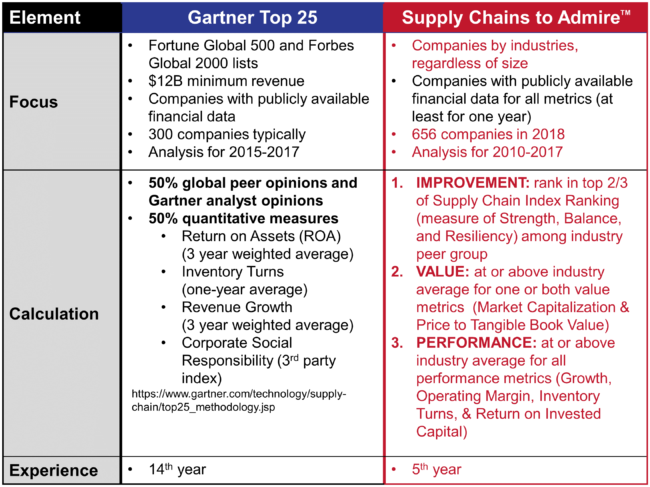

While many business leaders believe that Enterprise Resource Planning (ERP) and Advanced Planning Solutions (APS) will be equal to this task, it is not sufficient. In the words of planners, “Through ERP they can see the trees, but not the forest.” Today, over 90% of companies have deployed ERP and APS, but as shown in Table 1, inventory levels have grown, not decreased, in over 80% of industries studied. The largest increase is in Aerospace and Defense (A&D). And while inventories in automotive have decreased slightly, this progress is primarily due to shifting inventory back to suppliers versus overall value chain improvement.

Table 1. Days of Inventory by Industry Across Years

Why ERP Is Not Sufficient

Let’s take a closer look at sourcing. Materials Requirements Planning (MRP) functionality within Enterprise Resource Planning is a transactional view of assembly requirements. When a manufacturing operation is small, MRP data is easily viewed. As companies become larger, the dataset becomes increasingly complex, with dependencies that are difficult to manage by only looking at transactional-level data. The more planners, and the greater the sourcing complexity, the larger the issues requiring a new level of decision support for operations planning

MRP systems typically answer questions on requirements: what and how many items needed when. The MRP logic within ERP systems requires expensive, complex, and routine maintenance to keep their systems running efficiently. While central to day-to-day activities, the systems can become nightmares without a simple and structured process for routine data updates.

Plan for Every Part (PFEP) Is Aspirational

The inadequacies of MRP are the genesis of the Lean process of Plan for Every Part (PFEP). PFEP optimizes the policies which define how to procure each part. PFEP enables supply chain leaders to glean a 360-degree view of their inventory and procurement policies to maximize the value of each inventory dollar. Unfortunately, this PFEP “tune-up” often uses very time-consuming and manual Excel analysis that limits the frequency of optimization. Weeks become months become years. New technology based on Lean Supply Chain best practices is enabling the use of PFEP on a daily basis.

While Excel can perform some of the function, there an emerging need for tactical inventory analytics that can perform this more quickly and handle larger datasets across assembly sites. This need is acute for discrete manufacturers. This includes:

- Prioritized Inventory Actions

- Order Policy Optimization

- Cross-Site Analytics

- Shortage Management

- Performance tracking to drive accountability

The Missing Insights That Can Drive Results

In planning, there are distinct planning horizons matching decision cycles. These planning cycles translate to cross-functional workflows. MRP logic is a transactional planning tool for procurement. It translates a buying requirement into a purchase order for requisition. In contrast, operational decision making in the short-term horizon of five to twelve days enables buying decisions based on supplier capabilities, aggregate inventory views, substitution logic, risk factors and quality performance.

Valuable insights missing from a typical MRP planning cycle are:

- Which suppliers are consistently over- or underdelivering on schedule performance? Do patterns for quality exist for each supplier requiring attention? How does this tie to cost?

- Quality issues with parts and assemblies? What are the patterns to avoid? How does this tie to supplier development?

- Opportunities for the operation in parts performance by analyzing materials in aggregate against demand to understand excess inventory? Obsolescence?

- How are suppliers performing in aggregate against expectations?

- What are the alternate bills-of-materials and substitution logic at a part level, an assembly level, or a supplier level? And, what are the implications of substitution on contract performance?

- How do purchases from multiple material planners affect sourcing schedules from a supplier?

- How well are different supplier locations performing? How is this impacting reliability?

Spending Time Where It Counts: Making Decisions

Let’s use our heads. Benchmarking data of supply chain organizations has shown that most buyers and supply chain analysts spend over 50% of their daily activity searching for data in ERP systems, manipulating data and performing analysis in Excel, sending emails to track parts status, and attending meetings to prioritize and reprioritize critical actions. It is nuts to think that the current path of traditional MRP/ERP is the answer.

By using best-of-breed technologies in the cloud and linking to ERP data, business teams improve their ability to get to data by 15–20% while also improving the effectiveness of decisions. While there is much hype on the use of DDMRP, I find that most of today’s solutions lack depth and rigor. (DDMRP is a useful tactic, but it is not sufficient to drive demand-driven value networks. I think that the Demand Driven Institute has co-opted the term demand driven and confused the market on demand driven. I am frequently beat up for these beliefs on social media, but readers know that I cannot sidestep the truth as I see it. With this said I like the depth of the Orchestr8 solution. It embraces DDMRP thinking while offering options for planning not found in other DDMRP technologies. (Nick Lynch of Shell has spent the last year implementing Orchestr8 and will be speaking at the Supply Chain Insights Global Summit.)There is also a technology startup, LeanDNA, focused on closing this gap for discrete manufacturers. (Check out the recent webinar that we finished with LeanDNA to understand their solution.) With strong references, business users of LeanDNA average 15% raw material savings and improve customer service. Companies using the solution also gained value from starting cross-functional alignment meetings using Lean Process Thinking across manufacturing sites to better manage materials.

Later this week, I will continue this series focusing on other work processes. I strongly believe in cloud-based augmentation of current decision-support technologies to improve business results. We are stuck, and need to move past incrementally.

Upcoming Webinars. Don’t Forget to Register for the Supply Chain Insights Global Summit!

This is our fifth year to analyze publicly-held companies to understand which companies are outperforming their peer groups while driving improvement faster than their industry. On June 20, 2018 at 1:00 p.m. EDT, we will announce the winners on a webcast.

This year, we analyzed 655 companies (319 discrete, 250 process, and 86 in retail). There are 31 winners (companies that meet the criteria of the Supply Chains to Admire), outperforming their peer group in the areas of growth, operating margin, inventory turns and Return on Invested Capital (ROIC).) In general, retail is gaining on their downstream manufacturing partners. Once companies make the cut, it is hard for them to stay on the list. Eleven companies receive the award for two consecutive years.

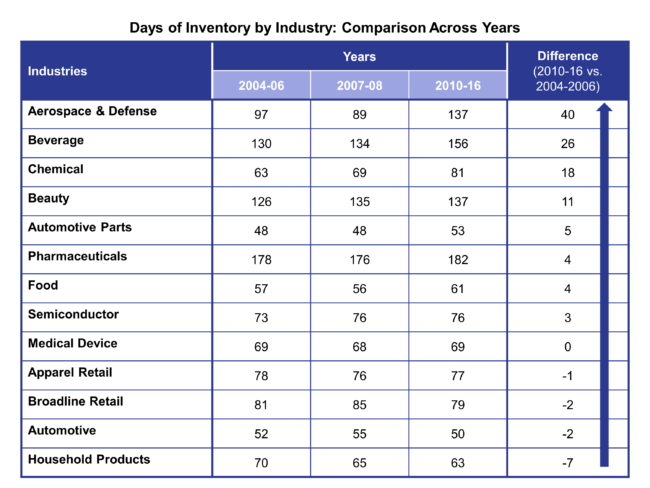

There are two rankings of supply chain leaders in the industry. The one that we do each year, and the Gartner Top 25. The difference is simple. In our analysis, financial balance sheet analysis for the period of 2010-2017 decides the winner. Peer group analysis is used in the analysis and we do not use popular opinion. In the Gartner analysis, the comparison is across industries. (A cross-industry analysis biases the analysis for companies that hold few assets and penalizes companies in heavy manufacturing process industries like chemical where the processes are closely tied to asset ownership.) In Table 2, we show the differences.

Table 2. Comparison of the Gartner Top 25 Analysis and the Supply Chains to Admire Calculations