In the 1990s, it was all about transactions. In the early 2000s, it was about catalogs and shopping carts. Later as teams tried to integrate the end-to-end supply chain, the focus was document management. Today, with the introduction of F8 by Facebook it is about effective story telling and harnessing the Open Graph. What is the “it”? It is the ability to reach the customer: the heart of the supply chain. The story is the same, but reversed in supplier interaction. I firmly believe that the evolution of different data types can unlock new insights for supply chain leaders.

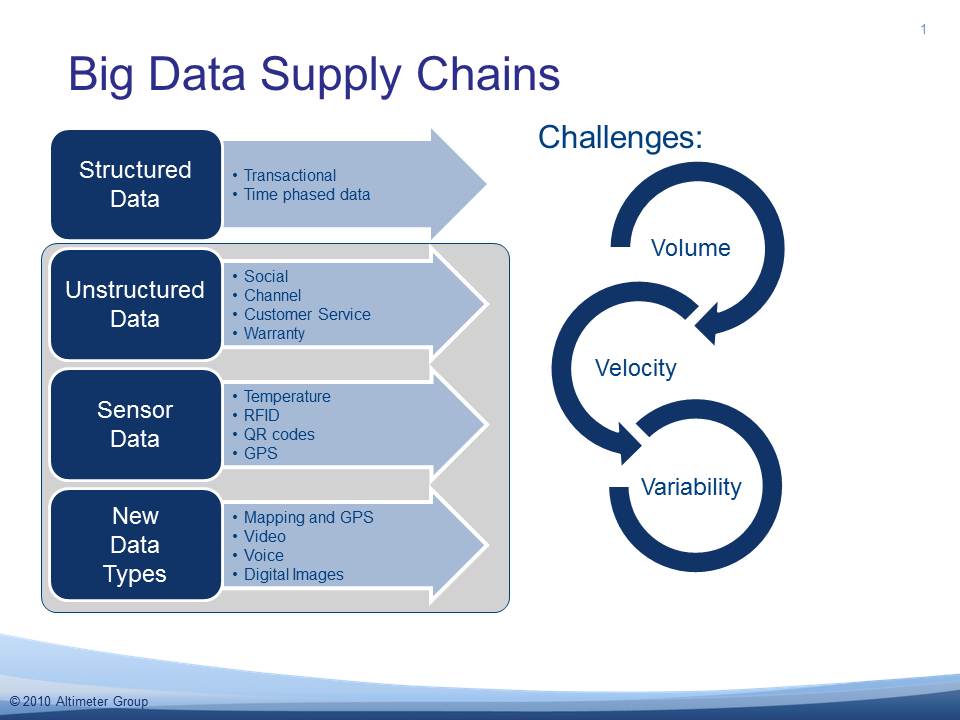

Today’s supply chain needs to be able to sense and respond across ALL of these data types. For supply chain management it is the “it” in IT (information technology). Yes, we have entered the era of BIG DATA supply chains. It is a world where the volume, type and the velocity of data has exploded. While companies have successfully scaled to handle transactional volumes, the other data types mentioned above combined with enrichment data –content, weather, location, maps, voice, video, digital images–can enable new capabilities to sense and respond more intelligently. Let me give you three examples:

Today’s supply chain needs to be able to sense and respond across ALL of these data types. For supply chain management it is the “it” in IT (information technology). Yes, we have entered the era of BIG DATA supply chains. It is a world where the volume, type and the velocity of data has exploded. While companies have successfully scaled to handle transactional volumes, the other data types mentioned above combined with enrichment data –content, weather, location, maps, voice, video, digital images–can enable new capabilities to sense and respond more intelligently. Let me give you three examples:

- Why is my Customer not Buying my Product? Or Buying a lot of my Product? Point of Sale (POS) data can be successfully harmonized and integrated into Demand Signal Repositories (DSR) to answer the question of what sold when. However, it cannot answer the question of “why”. Only through the integration of structured data with unstructured text –ratings and reviews, blogs, social sharing and and listening posts– can a company answer the “why”. The new work by IBM on the Netezza appliance and the work by Teradata on Asterdata signals a technology shift for the DSR market.

- What did my Customer really Want? In extended supply chains, product flows through distributor relationships. Frequently what is sold is not what the customer REALLY wanted. This is especially true in automotive supply chains where the color of the car is determined in the first step of production. Again, semi-structured data is the answer. The combination of click through data on the web (how many times did a buyer request a quote of a certain car color) combined with social news feeds and distributor data can give insight on what the customer really wanted. Today, we only know what was bought.

- When is the Supply Chain at Risk? To improve buying power, companies have aggregated procurement into commodity buying groups. This consolidation in large, global companies (greater than 1 billion) is a maze of supplier relationships. The use of unstructured text mining on suppliers can signal early warning of potential risks. The use of risk sensing alerts when the supply chain is at risk, but must be combined with transactional data (e.g purchase orders, quality data, shipments, receipts) to answer the magnitude of the risk. Supplier risk sensing was pioneered by Open Ratings, now a Dun & Bradstreet company.

The case studies abound. It is exciting. We can answer old questions in new ways. And, yes, I think that we can teach old dogs –like me– new tricks.

What are your favorite use cases for Big Data Supply Chains? I welcome your thoughts.