An effective S&OP plan is the goal of many, but there is no clear industry definition of an effectiveness. While there are many maturity models, most are not research based.

To better understand the characteristics of an effective S&OP plan, we just completed a study of 73 companies. In the quantitative survey completed this summer, 30 respondents rate their processes as effective and 43 rate the their S&OP processes as less effective on a seven point scale. In this post we share five characteristics of companies that rate their S&OP processes more effective:

1) More Likely to Focus on Delivering a Profitable Plan. While the majority of companies focus on balancing demand and supply ( an analysis based on volume), those rating their S&OP plans as effective have a focus on balancing cost, volume, and mix. This is a maturity factor. Twenty-three percent of the companies in the study are able to determine the most profitable plan.

2) Tie the S&OP Plan to Execution. While 65% of companies with an effective S&OP process tightly couple S&OP planning to execution, only 23% of those rating S&OP as not effective tie S&OP to execution. Planning in isolation, not connected to execution is a major factor in the analysis.

3) More Aligned. Companies rating themselves more effective have tighter cross-functional and alignment. The differences, as shown in Figure 1, are significant at a 90% confidence level. While we are unsure which happens first–whether an organization focused on alignment and improves S&OP, or if better alignment is the outcome of S&OP–we can see the impact of alignment in the open-end responses. Companies with greater alignment find it easier to conduct an effective S&OP process.

Figure 1. Impact of S&OP Effectiveness on Horizontal Functional Alignment

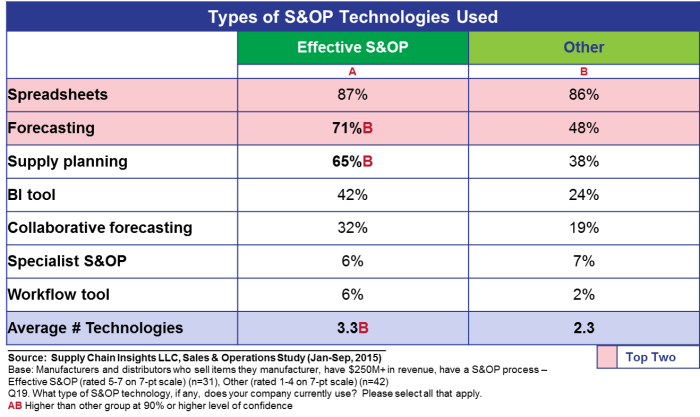

4) More Likely to Use Planning Technologies. Companies that rate their S&OP processes more effective, as shown in Figure 2, are more likely to use supply chain planning technologies in their processes. Those ranking their S&OP processes more effective have a greater dependency on technologies.

Figure 2. Use of Technologies in S&OP

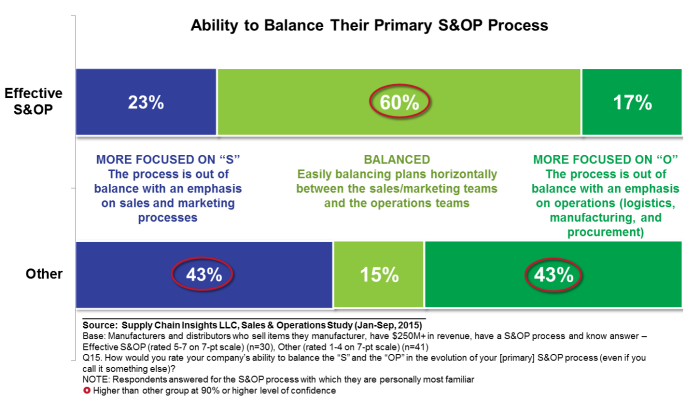

5) More Balanced. In addition, companies rating themselves as more effective in S&OP have greater balance between the “S” and the “OP”. There is balance between the focus on commercial and operational plans. This difference is significant at a 90% confidence level.

Figure 3. Balance in S&OP

For more on these insights sign up for our October newsletter and get our full report.

What do you think? Any surprises?

Want to benchmark your S&OP maturity on these factors? We would love to hear from you! We would love to help you improve your S&OP processes.

If you like this data on S&OP, and want to see more, please help us by completing the inventory management survey. We are three responses short of being able to report the data on the use of inventory optimization. Unlike other research firms, we share research openly with supply chain leaders. The model of open content sharing is very dependent on teams like yours that are willing to help us complete the B2B survey panels. We give thanks to teams like yours that help us, every time we get a response.

This week, I am off to speak at the TraceLink Nexus conference in Washington, DC. The conference focuses on how to drive adoption for Internet of Things and improve pharmaceutical serialization. Next week, I am in Europe speaking first in Athens on Big Data Supply Chain Opportunities at John Gattorna’s conference and then off to Belgium to speak on Why Planning Matters at the OM Partners conference. I hope to see you in my travels. To help organizations, I post all of my presentations on slideshare and in our new community that is launching in October. It is named beetfusion.com: the super food for the supply chain leader. Feel free to join the community and check it out!

About the Author:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora wrote the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. As a frequent contributor of supply chain content to the industry, Lora writes by-line monthly columns for SCM Quarterly, Consumer Goods Technology, Supply Chain Movement and Supply Chain Brain. She also actively blogs on her Supply Chain Insights website, for Linkedin, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research at Temple or knitting and quilting for her new granddaughter. In between writing and training, Lora is actively doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. She thinks that we are never too old to learn or to push an organization harder to improve performance.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora wrote the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. As a frequent contributor of supply chain content to the industry, Lora writes by-line monthly columns for SCM Quarterly, Consumer Goods Technology, Supply Chain Movement and Supply Chain Brain. She also actively blogs on her Supply Chain Insights website, for Linkedin, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research at Temple or knitting and quilting for her new granddaughter. In between writing and training, Lora is actively doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. She thinks that we are never too old to learn or to push an organization harder to improve performance.