Technology can change or even improve work. Companies today making a fundamental mistake: they are attempting to automate current processes with AI versus challenging and redefining work. What’s missing? A recognition of the reality of the current state. We are not designing work with the human factor in mind.

The goal of human factor process design is to make it easy for employees to do the right thing (and hard to do the wrong thing). Today, in supply chain planning, this could not be further from reality.

Why This Is Important

Employees are scared. Consumer spending, and overall economic pessimism reign. This bearish attitude is well-founded. In May, the total number of job cuts in the US were 696,309 – an increase of 80% from the 385,859 jobs cut in the first five months of 2024. During the first week of June 2025, job cuts continued with 90,000 layoffs with iconic brands like Kimberly-Clark (1500-1900), Microsoft (6,000), P&G (7000), and Wal-Mart (1,500). In May 2025, one in seven home-purchase agreements fell through resulting in the cancellation of 56,000 purchase contracts. The ripple effects are pervasive.

Employees Cannot Get to the Right Data at the Speed of Business

A war is raging between Oracle, Salesforce and SAP to automate supply chains. It is a landgrab of sorts. Each is attempting to slather AI on today’s offering: this fueling a hype cycle for agentic AI. However, a gooey mess on top of traditional tech approaches will not be the tie that binds and helps the downsized organizations. The problem is that the focus is on process automation of the current state versus reinventing work.

Why is a reinvention needed? Supply chain was defined in 1982 as interoperability between source, make and deliver. The concept was that managing trade-offs and optimizing the whole to drive business outcomes would improve value. However, over the last decade, the principles of supply chain as a business model to improve customer outcomes and drive value, slowly became defined a supply-centric functional process. A function within a functional organization. As a result, organizations lost the opportunity to improve organizational alignment. Instead, the alignment between operations and commercial groups grew three-fold. We still plan like it is 1999–when we were bracing for Y2k–versus using new forms of technology to improve planning. Using design theory, the current definitions of planning have regressed despite the advance of promising technologies.

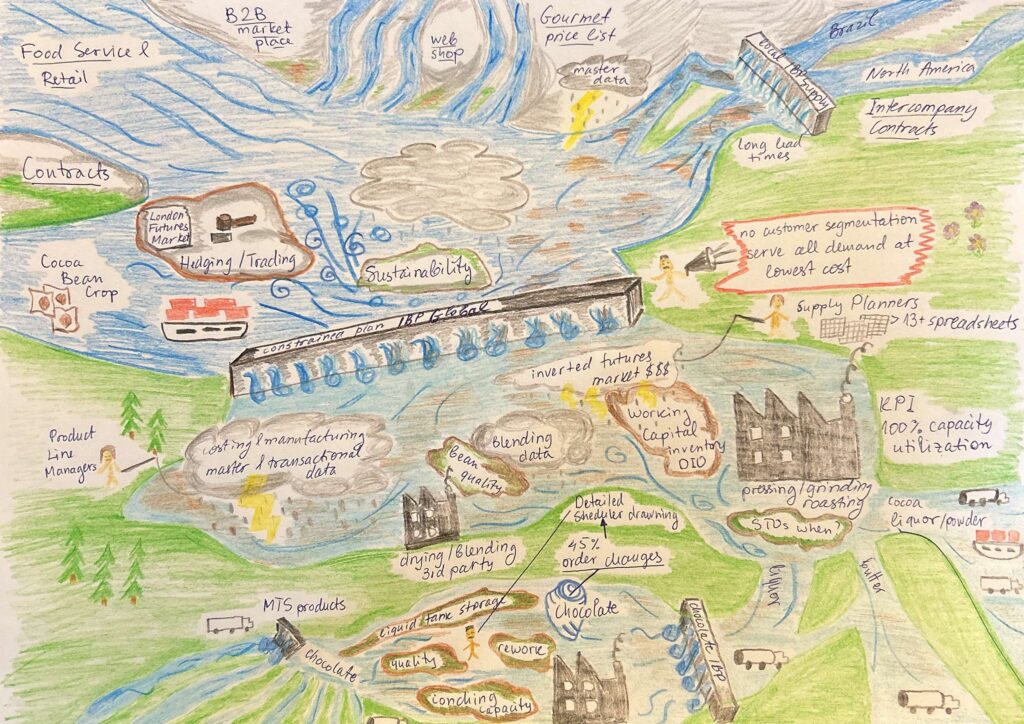

In my classes on outside-in planning, I ask students to draw the river of demand. Over three hundred students have taken the class. As shown in Figure 1, the river of demand activity reveals several things to the student:

- Demand As A River Has Multiple Flows. Each organization has multiple demand streams with different characteristics–forecastability, demand latency, and bias. Most companies forecast a single stream with a focus on error. In this process, the signal becomes muddy –almost unusable. Only 10% of students actively model Forecast Value Added (FVA) defining the best naive forecast for each stream and measure the impact of the current process. Only 1% of the students are improving demand against the naive forecast. But more importantly, few see demand as a process to be managed through lean processes of disciplined analysis of demand shaping/shifting analysis, backcasting, improving models and driving FVA improvements. The signal is clear for commercial teams, but not for supply. The reason? Commercial teams operate in a ship-to environment, but the supply chain teams operate in a transactional world based on a ship from model. Visibility of the translation layer of ship to converted to ship from is not existent. Ask a procurement or transportation professional if they have a good demand signal and expect a laugh. Technology can automate role-based views up and down the river of demand for all roles: marketing, sales, finance, manufacturing, procurement, transportation, and human resources. The goal should not be making today’s planning processes faster and hands-free.

- Navigating Rocks, Dams, and Whirlpools. Many of the process implementations like Integrated Business Planning(IBP) and Digital Transformation are well intended, but they often result in wasted time. IBP processes in many organizations have elongated planning cycles as order and demand cycles shortened. As a result, the projects place rocks, eddies and dams in the river creating wasted time. Less than 10% of companies are clear on what drives value, and the focus on conventional ERP/APS projects amplifies the bullwhip impact creating waste and delayed response. As a result, the signal becomes muddy (almost non-usable) by the organization.

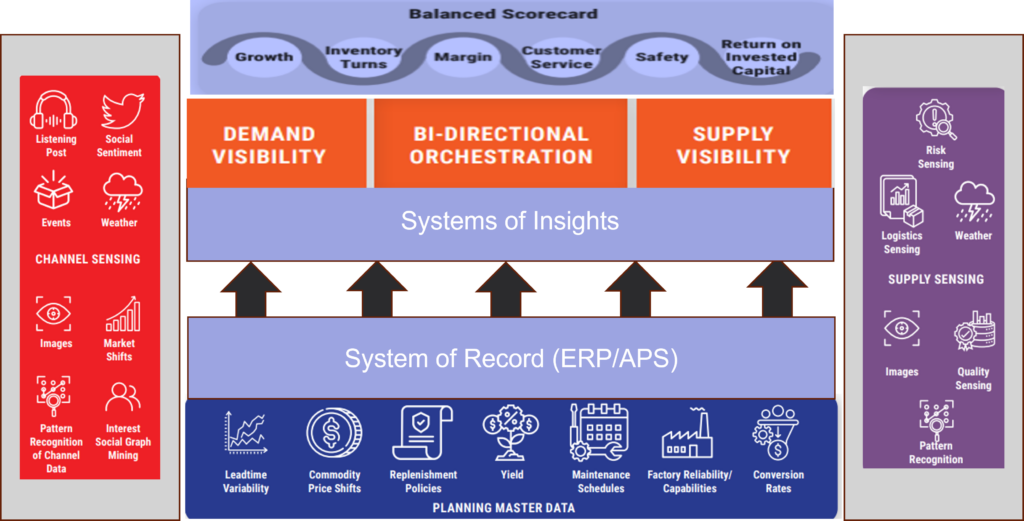

- Need for Bi-Directional Orchestration. Companies need a level of bi-directional orchestration market (channel)-to-market (supply) that is not existent today, Bi-directional orchestration takes many forms. It includes hedging strategies, alternate bill of materials, supplier sourcing strategies, changing routs to market, redesigning push/pull decoupling points, demand shaping policies, and use of outsourced manufacturing and distribution. Thse strategies need to be designed in the strategic and tactical time horizons and then deployed through S&OP planning and execution. This requires the deployment of digital twin and network design technologies running at the same frequency as S&OP.

Companies Pedal Better Uphill Than Downhill

Companies have amnesia. The lessons learned during pandemic and the economic recession of 2007 are quickly forgotten when economies heat-up. As consumers complain of empty shelves, and manufacturers struggle to obtain materials, organizations will struggle to align. They have forgotten the lessons of the 2007 recession and the pandemic. The lesson should be to align to outside-in signals, reduce signal latency and drive systems of insights.

The pandemic and past recession lessons apply now! We are at a economic tipping point. Planning should not be business as usual.

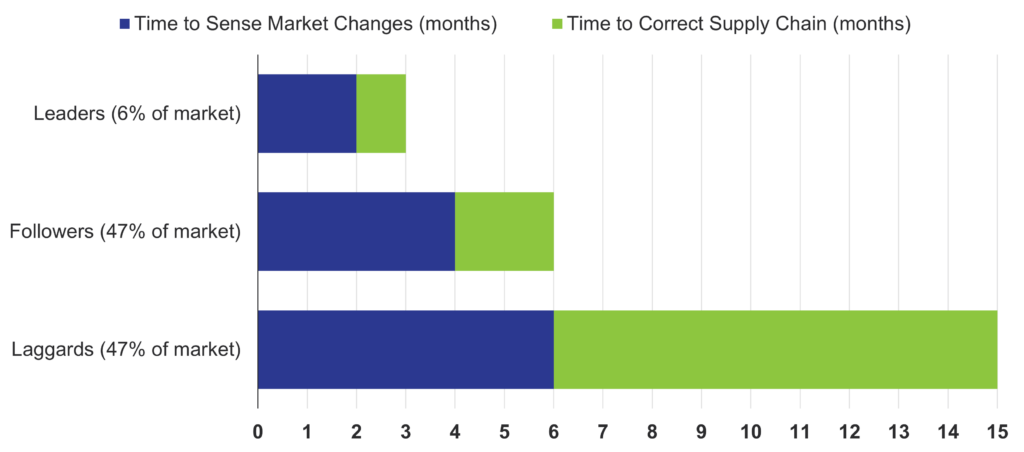

As shown in Figure 2, if these lessons are not applied, it the average company will take 6-8 months to align to market potential. The key is to use channel data and decrease demand latency. The problem is that the data does not fit into conventional ERP/APS models very well because they are supply centric. (Ship from models modeling orders shipped from a distribution center or a manufacturing plant versus shipments to a customer based on pull-through data.)

Figure 2. Time to Align the Supply Chain to Market Potential in the 2007 Financial Crisis

The reason? Information flows through commercial teams from the channel back into the organization it meets supply-centric ship-from models. Companies cannot translate the channel insights when the data gets to supply because the systems were not designed with the use of channel data in mind. There is a push/pull decoupling point on enterprise data between CRM/commercial technologies and the supply-centric technologies of ERP/APS/TMS.

We are planning like it is 1999 even though the markets are poised to move downwards with serious supply constrants and demand shifts.

Irony

Over the last decade, the number of planners at global manufacturing companies exploded. Channel complexity increased and the number of products sold proliferated. As a result, demand variability grew. In parallel, technology capabilities increased. The irony? Companies did not use the advancements of data science innovation and work with hyperscalers to redefine work and improve the process.

Let’s take a case study from the current class on outside-in processes that I am teaching. In the class, I ask for each student to do homework. (I know, audible “groan.”) One company in the class with demand latency of 3 months, and a 40% negative Forecast Value Added never evaluated the forecastability (simple COV analysis) or the need to backcast to develop a model to use outside-in data appropriately. The team was surprised to see the results on forecastability on a small data set profiled in Table 1.

Table 1. Forecastability for Large Food Company

The Company is in the middle of a digital transformation (code for an ERP upgrade), but they have not taken the steps to analyze the current state much less redefine demand planning to improve value.

A negative FVA increases cost, inventory, and risk. The impact is exponential. Until we redefine architectures, use new forms of data science to drive demand insights from outside-in data and write the insights to an APS/ERP system of record. Build three-in-a-box teams (data scientist, an interpreter, and a business leader), to redefine your planning processes. (The interpreter–someone that understand data science concepts and business flows–is important.)

Steps Leaders Can Take

If this blog post speaks to you, here I share advice:

- Recognize the Current State. The current definition of technology needs to change to be outside-in and enable bidirectional data flow from the channel to supply to enable orchestration. (Bi-directional orchestration is the continuous redesign of supply options across make, source and deliver to reduce costs and improve customer service.) Until this happens, use a data science team to model and drive insights from channel data. Write these insights to the APS/ERP technologies as a planning system of record.

- Don’t AI Stupid. Push to use Artificial Intelligence (AI) to redefine work versus making current processes hands free and faster. Design Agentic AI to define self-service planning by role while minimizing the organization’s dependency on planners.

- The Plan. Many organizations artificially manipulate the plan. Unrealistic goals are set at the beginning of the year, and the process is manipulated through a hockey-stick process to bring the plan back to reality by year-end. This creates waste and destroys human potential. The Supply Chains to Admire report is designed to help you align your organizational goals to industry potential. This is important, because the potential of 72% of supply chains within industry sectors at the intersection of operating margin and inventory turns declined post-recession.

- Remove Boulders, Eddies and Dams. Analyze your demand and supply streams with a new lens. How are your current processes reducing the impact of human potential? What can be done to improve work? Improve outcomes?

Summary

Don’t fall prey to today’s hype cycle and the attempt to AI stupid. Instead use the opportunity to redefine work. Walk down your hallway and look at the number of people in meeting rooms having the wrong discussions with latent data and then drive a strategy to act. Don’t plan like it is 1999. We can do better. With current processes, companies are introducing error and waste, but more importantly wasting human potential.

Next week, I will be launching the Large Language Model–Ask Lora. This subscription enables easy access to a decade of content–blogs, podcasts, videos, webinars, eBooks, case studies, and the benchmarking in the Supply Chains to Admire report. The Large Language Model is interactive in different languages and allows leaders to ask me questions directly in a confidential environment. Watch for the launch. I don’t believe supply chain research is ever effective behind a paywall. Use the insights gained through open research models (research based on insights from my 340K followers on LinkedIn) to improve your team’s understanding of how to drive value in a value chain.

Reference: Human Factors, Human factors and Homer Simpson – Human Factors 101