The supply network–shipments and production of trading partners–represents over 70% of the environmental impact of supply chain decisions. Despite the importance, the investment in networks to automate the information flow between trading partners remains low.

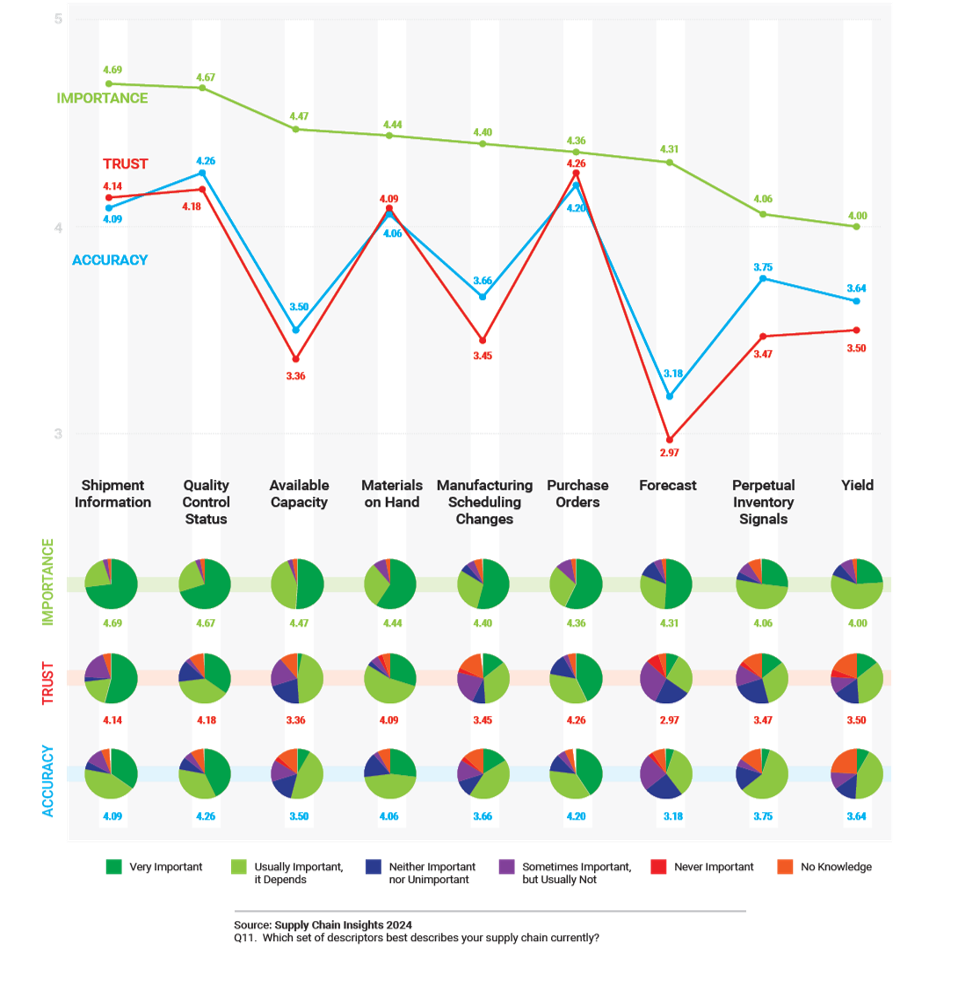

Networks take three forms–demand, design, and supply. Here I share insights on the sharing of supply data. In Figure 1, I share the importance, trust and perceived accuracy of different forms of supply data. In this research, 81% of brand owners and contract manufacturers primarily depend on communication through email and spreadsheets. Approximately 32% of manufacturing, across industries, is outsourced.

These flows are one-to-one– focused on sharing a singular flow of information– lacking a system of record. In addition, a purchase order changes three-to-four times and there is a black hole (data is caught between email systems of trading partners for one-to-two days).

Shipment data is the most important, but we have not figured out how to best move logistics network data across trading partners. Most is silo’d. Many systems without interoperability.

Purchase order data, while not as important, has the smallest gap. Most of the network investment is in passing procurement transactional data.

The Return on Investment

Network investments reduce supply cycles and improve decision capabilities. The global economy and multi-national supply chain flows were based on rational government policy. As the number of drones and missiles fly into new war zones, and climate issues worsen, companies should be more serious about networks. Unfortunately, this is not the case. My research is focused on driving change in thinking.

So What? Why?

The enlightened supply chain leader reading this might say, “Lora, why has not much changed? This looks like the same pattern from two decades ago despite the evolution of technology capabilities.” I agree. So, why have we not invested in networks despite the criticality of the data to supply chain decision making and the importance to ESG initiatives?

- Lack of a Buyer. Look at any company’s strategy, and you quickly see that the focus is on improving enterprise applications. Few supply chain leaders understand the flows and black holes associated with the lack of enterprise investments. Seldom do you see this addressed in enterprise strategies. As a result, there is no clear buyer or clarity on Return on Investment.

- Opportunity Cost of Endless ERP Upgrades. Unfortunately, most of the industry is stuck in an endless cycle of Enterprise Resource Planning (ERP) upgrades which do little to improve network flows. Most companies do not realize that the basis of effective networks is the mapping and automation of outside-in flow. In contrast, ERP systems are focused inside-out to provide transactional efficiency. As a result, ERP is not the connector for effective networks strategies.

- Self-Serving Business Models. There is no interoperability between networks. Buiding a network is hard. Each network has a self-serving strategy. As a result, the interoperability layer between networks like Ariba, Informs/Nexus, E2Open, Elemica, Nulogy, and One Network has to be built as a part of the enterprise infrastructure using NoSQL. There are no industry standard connectors.

- PE Firm Buy-out and Consolidation. Many of the existing networks — GXS, E2Open, Elemica, and Exostar–suffered from PE investment that stalled innovation. The churn of dollars primarily reduced SG&A and R&D spend to improve profitability. In contrast, Infor bought GT Nexus, Kinaxis purchased MPO, SAP purchased Ariba, and Trimble purchased Transporeon. In most of the consolidation plays, the focus is using the network to sell more enterprise applications not on improving the network capabilities. To date, no investment has improved network capabilities.

The research conducted with Nulogy was an attempt to clarify the value proposition for contract manufacturing. Take a look and let me know what you think.

Summary

In a world, where consumers want to scan the shelf to know provenance (where did goods come from) and businesses want to better understand risk (currently companies only understand the flows of the first tier of supply). We need to get more serious about network strategies and realize the futility of current approaches. Unfortunately, this type of thinking cuts across the grain of convention. Business leaders need to summon the courage to challenge status quo.