As an analyst in the supply chain market for 15 years, I have written many articles on best-of-breed technology companies purchased by a larger company. Today I am writing my take on the acquisition of Terra Technology by E2open. In the market announcement yesterday the terms of the acquisition were not disclosed. I have followed both of these companies for 15 years and writing this post is bittersweet. It is a story of supply chain innovation. Let’s start by taking a look at history.

History of Terra Technology

Terra Technology is 15-years old. Its first customers were Campbell’s Soup and Procter & Gamble. The initial software product release name was Real-Time Forecasting. The product naming convention changed to Demand Sensing (DS) in 2005. DS replaced rules-based forecast consumption with better math (statistics and pattern recognition). Over the last decade the use of Terra Technology’s DS product improved short-term demand forecasts by 37% at 13 consumer products, and food and beverage companies. In 2007-2014 Terra added inventory management, multi-tier demand sensing, transportation forecasting, and long-term forecasting. The adoption of Terra’s products were brisk until 2011, but during 2012-2014 sales softened, resulting in employee layoffs and downsizing. The founders remain, and the company is private, and tightly-held.

The products of Terra Technology are unique, but poorly understood by the mainstream supply chain team. While ToolsGroup and SAP (with the acquisition of SmartOps) are the nearest competitors, Terra prided itself on delivering better decisions through better math. In 2011 Oracle tried to introduce a competitive product and failed. The Terra solution complimented the functionality of the traditional APS vendors, i.e. Adexa, JDA, Logility, Kinaxis, SAP APO and Steelwedge.

History of E2open

Founded in 2000 as a high-tech consortia, E2open is on its fifth leadership team. The Company has a checkered past. E2open sells a cloud-based solution for network collaboration. Used as a one-to-many data model for sourcing and procurement by companies like IBM, Cisco Systems, Dell, Motorola, Seagate, and Vodafone, there is much promise; but in the last five years the Company, plagued by execution issues, encountered problems. In July 2012 E2open went public on the NASDAQ; and in March 2015, after a series of financial earnings disappointments, Insight Venture Partners funded E2open to become private. Currently there is a new leadership team and a new direction, and Insights Venture Partners has big plans to recreate the supply chain market. The Terra Technology investment is one of what we believe will be a series of purchases to build inter-enterprise cloud-based software platforms to redefine supply chain planning.

However, there are no sure bets. In the last decade E2open did not integrate acquisitions well. In July 2013 E2open announced it acquired supply chain vendor icon-scm, and in June 2014 E2open announced its acquisition of SERUS Corporation, a “cloud-based manufacturing and product management provider.” The acquisitions did not live up to market expectations.

The Path Forward

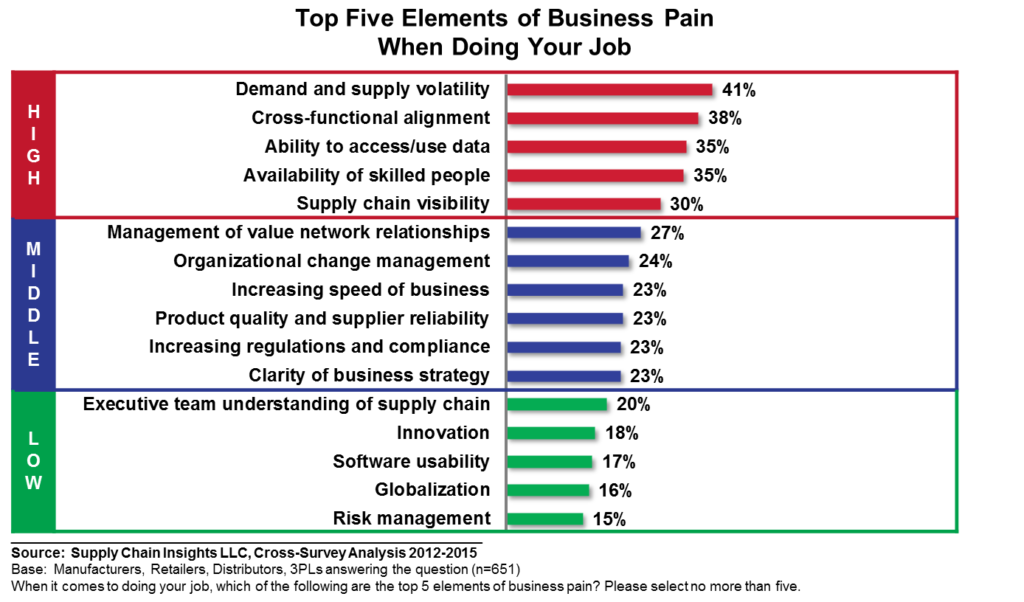

Currently E2open has a new leadership team and strong financial backing. The leadership team is attempting to redefine the market for multi-tier planning solutions based on outside-in processes. They are rolling up assets to make this vision real for the business user. This is a bold move. The question is “Will they be successful?” For me, this is exciting. I have advocated this vision for the last ten years. As shown in Figure 1, demand and supply volatility is the largest issue for the supply chain leader across industries. The Bullwhip Effect, defined in 1992, is known and recognized; but over the last decade there has been little progress to reduce the distortion and amplification of demand error in the Bullwhip Effect. This is the larger opportunity.

Figure 1. Supply Chain Business Pain

E2open is now listening and acting on the market opportunity. While I want to be optimistic, the outcome is unknown. I feel that there are two likely scenarios with very little in between.

- Best Scenario: The best scenario embeds the Terra Technology product into demand networks and provides new capabilities for demand sensing and demand translation for the value network. The high-tech value chain needs a demand network solution to enable building demand capabilities for distributor networks. This will require development to manage both product forecasting and margin management within the network. The closest solution in the market is ModelN. However, ModelN is an enterprise, not a network-based, solution. For E2open this will require product development and market positioning. The change will be major. It is a new buyer. Traditionally E2open sold to the procurement organization. With the acquisition of Terra Technology, the buyer is different and the joint solution will require development. The goal is to redefine supply chain planning on a multi-dimensional data model. The question is, “Can the two organizations work together to build a very different solution?” If so, there is huge market potential.

- Worst Scenario: The worst scenario is that the Terra Technology acquisition goes badly like the icon-scm acquisition. In this case the current Terra Technology assets will decline in value and the installed assets will become legacy applications for the business user. This is a real possibility, but I think that this is a lower probability.

The Goal of the Acquisition

Traditional supply chain planning focused on optimizing the planning signals within the enterprise. However, the supply chain over the last decade is becoming a network. There is greater dependency on third parties for manufacturing and sourcing. High-tech companies are the most advanced in technologies to automate supply, and consumer products companies are the most mature in the automation of demand. Does this acquisition merge the leadership insights of these two important industries into solving the issues with traditional enterprise approaches? This is the promise.

The global supply chain trade lanes are more complex. The need to reduce the Bullwhip Effect and accelerate demand-driven capabilities within the enterprise is real. The Bullwhip Effect increases–with demand signals greatly distorted–through traditional enterprise approaches to supply chain management. These traditional definitions of demand, as enterprise forecasting with statistics applied to forecast the future based on order patterns, also distorts the true demand signal. This becomes an even greater need as companies expand into emerging markets.

For the past three decades supply chain planning focused on the optimization of the enterprise, not the value network. The vision of this acquisition is to reduce the Bullwhip Effect’s impact and improve demand signals across the multiple parties in the value network. In Figure 2 we define the Bullwhip Effect.

Figure 2. The Bullwhip Effect

Next Steps?

My Advice to E2open and Terra Technology Business Users: If you own either of these solutions: get involved and push for success. Don’t assume that success will happen. This is an opportunity to define true demand-driven network capabilities. To maximize value, put a person on point to engage and guide the evolution. The E2open team will need to understand the Terra Technology solution and re-tool to sell to a new buyer. This transition won’t be easy and will take time. The E2open team will need to retain the Terra Technology team’s talent and train the E2open team on demand. Likewise, the Terra Technology team will need to learn sourcing. As a user, be firm in direction, clear on expectations through the transition, and engage with the joint company through the transition.

My Advice to SAP: Now would be the time to finish the development of the SmartOps product for demand sensing and build it into the Ariba network. This acquisition is a sign that the market is shifting. The race is on. The market is moving to multi-tier planning. It is time to build multi-tier demand networks. You are the only other company in the market with similar assets to compete. Be clear and concise on the execution of the SAP SCM rewrite on HANA and then aggressively build value network capabilities. Today the business vision for the next evolution of SAP APO is confusing and the lack of progress on this vision is frustrating for the business user. It is time to step up to the challenge to being a supply chain application leader.

My Advice to Kinaxis. Today the market is very confused. Many business users give you the benefit of the doubt of supporting many-to-many data flows. However, as this acquisition evolves, it will become clearer that the Kinaxis platform is an enterprise data model with limited messaging to extended supply chain partners. The lack of strong demand capabilities will be an Achilles’ heel. If E2open is successful in this acquisition strategy, your role in the extended supply chain will diminish unless you create a many-to-many data model and invest in demand management. Now is time to rewrite your future.

I hope that this helps. I would love to hear from you.

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for supply chain excellence.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for supply chain excellence.