Another call. Same story. As my client explains that they are delaying their project to build network interoperability due to complications with their Enterprise Resource Planning (ERP) upgrade, I tap my foot and sigh. I hear this story a lot.

The ERP upgrade cycle holds many of my clients hostage. While the desire to improve network interoperability is high, the organization’s mindset is focused on transactional efficiency. Most struggle to understand the relative value of investments.

Note that network enablement is not possible from most ERP platforms. (The GT Nexus assets from Infor are an exception.) Point-to-point integration is not the answer.

Unfortunately, I find too few business leaders clear on the value of a network. Here I want to a case to rethink value networks from the outside-in.

What Is A Network?

Moving data from the enterprise to a trading partner in point-to-point communication is not a network. Likewise, simplistic sensing of disruptions, to improve resilience is not a network. My definition of a network is the bi-directional information exchange of manufacturing, procurement, quality, and transportation signals across multiple tiers of trading partners in a many-to-many trading partner information exchange with minimal latency. Electronic Data Interchange (EDI) does not meet this definition. EDI is not bi-directional or across multiple tiers. I think of EDI like old-fashioned mail. It is costly, and must be opened by the receiver. Like mail, and EDI message and takes hours/days to deliver.

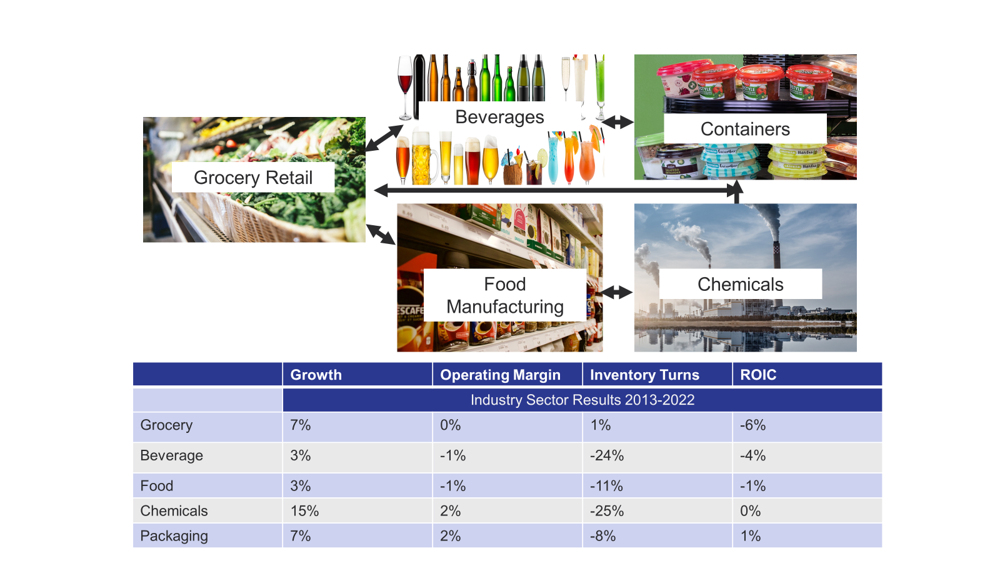

To make the point, let’s examine the food retail network, as shown in Figure 1, over the last decade. With slim margins and ever-increasing inventories, companies invested less in capital assets. Today, this network operates with less capacity and ballooning inventories. As product complexity increased, item forecastability decreased, and companies chased cost reduction. However, the reduction of cost of goods sold (COGS) did not translate to margin due to issues of discipline in managing demand-shaping programs. (Companies cannot see baseline demand and only 50% of trade promotions are ever evaluated.)

To improve asset utilization more products were outsourced to third-party manufacturing (average of 32%). Many of these outsourced products have demand latency of weeks and months (shelf purchase through the replenishment cycle for a manufacturer to receive an order). Despite, the proliferation of channel data, the use of channel data in traditional ERP/APS models is very limited. The issue? The models were not implemented correctly to use channel data.

Less than 1% of companies in this value chain outperform their peer group. The industries in this value chain lack resilience.

Figure 1. Food Manufacturing Process Network

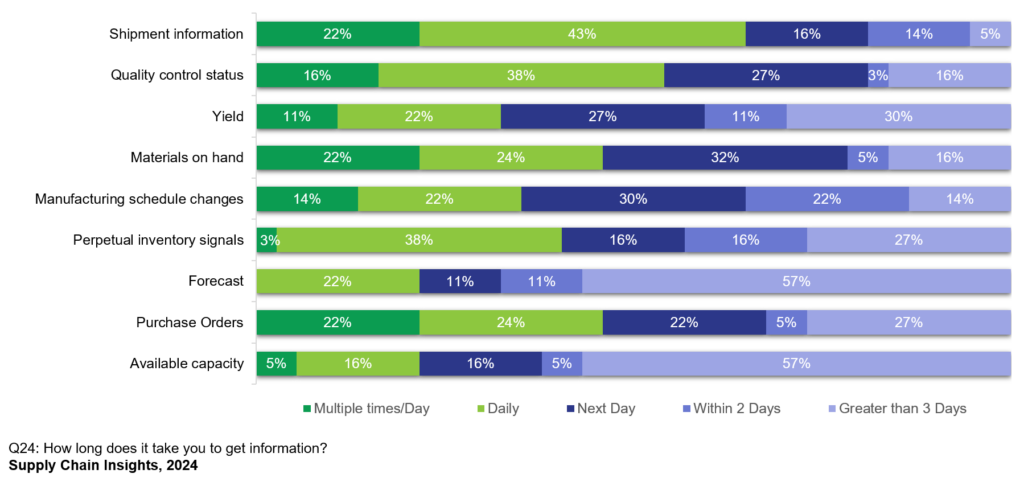

Outsourcing without automation increases network black holes. In Figure 2, we share the time to get data in networks. Companies with network automation get bi-directional status updates 85% faster than companies that connect through spreadsheets and email. Yet only 8% of companies communicate with their contract manufacturing providers using third-party networks.

Figure 2. Time to Get Information

Solving the problem is complex. Not all networks are equal. In the market, there are networks that focus on transportation, sourcing, or manufacturing, but few are equal to the bi-directional management of the range of signals shown in Figures 2 and 3 to manage a trading partner relationship.

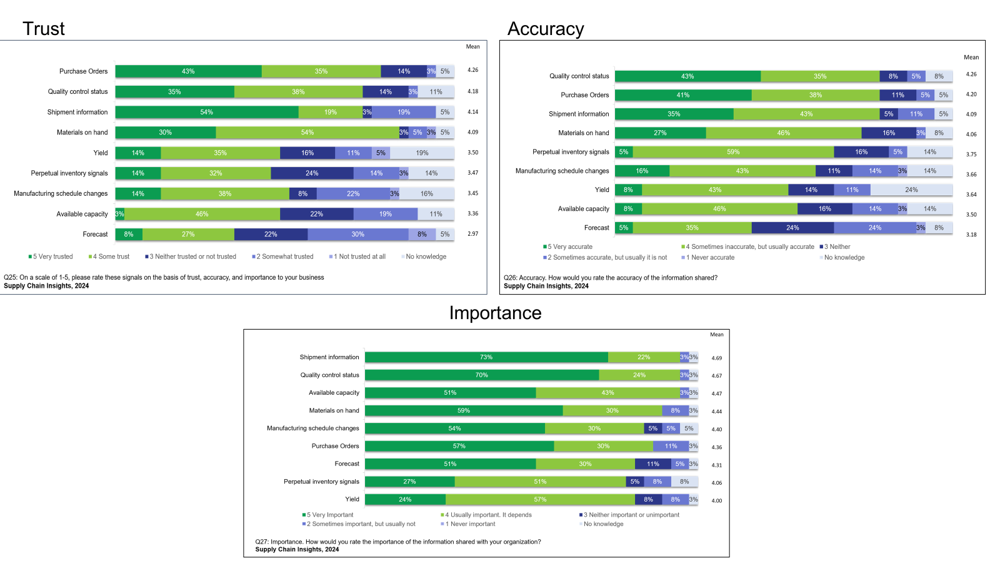

A mistake that I see many companies make is trying to automate single streams of information–shipment information or purchase order status– without a holistic focus on flow. In Figure 3, we share the level of trust, accuracy, and importance of the signals. Note that while quality information is viewed as accurate, data latency is a day. (Imagine handling a recall?) Similarly, available capacity information is important, low in accuracy, and has a latency of 2.5 days. (Need to schedule that second production run of a new product? Good luck!) The accuracy and timeliness of perpetual inventory information is an issue adding to the issues of multi-tier inventory management.

Figure 3. Trust, Accuracy and Importance of Network Information

So What? Who Cares?

Network enablement is an opportunity requiring less effort, capital or project management than large enterprise IT projects, but I find few understand the opportunity. The enablement of networks needs to be about building fundamental capabilities. The efforts should not be held hostage by traditional thinking. So, when your boss asks you, “What is the value of a network approach? Why can we not get there through an ERP investment.” Engage him/her in a different discussion. Here I offer three starting points:

- ESG Initiatives Need to Focus on Inventory. Inventory management is critical to the success of ESG initiatives. The rising inventories, and associated waste, should drive a call to action. In our research, we find that 95% of companies are not clear on what makes a good inventory plan. The automation of safety stock primarily focuses on demand variability and intended service levels. Less than 1% of companies consider supply variability in the calculation of buffers despite the rise in supply variability and the increase in the number of black holes in the value network with days of latency.

- Consumers Want More. The Network Enablement is Not Equal to the Opportunity. As we shift from the use of the barcode to using the QR code at the shelf, consumers want more information on nutrition, quality, and sourcing. Companies without network automation will be unequal to this opportunity. Network enablement should be a key element of brand building.

- Customer Service. Network inventories are trapped in the black hole of data and process latency. Ask yourself the question, “How effective is Available to Promise (ATP) on two-day old information?” As we think about multi-channel enablement, this is an opportunity for all.

I would love your thoughts. All the best!