On March 2020, somewhere in a field in Gettysburg, PA draped in white Personal Protection Equipment (PPE), I was tested for COVID-19. Scared, I returned home to wait. The positive results came to me in the mail three weeks later. In 2020, the world was unprepared.

Shortly, thereafter, economies around the world started implementing lockdowns and emergency measures to curtail the spread. Normality evaporated for supply chain leaders around the world. (Click the link to download the results of the quantitative report completed at this time five years ago.)

Five years later, I think that it is time for us to get 2020 vision on what we should have learned, but many have forgotten on lessons learned during the Pandemic in 2020.

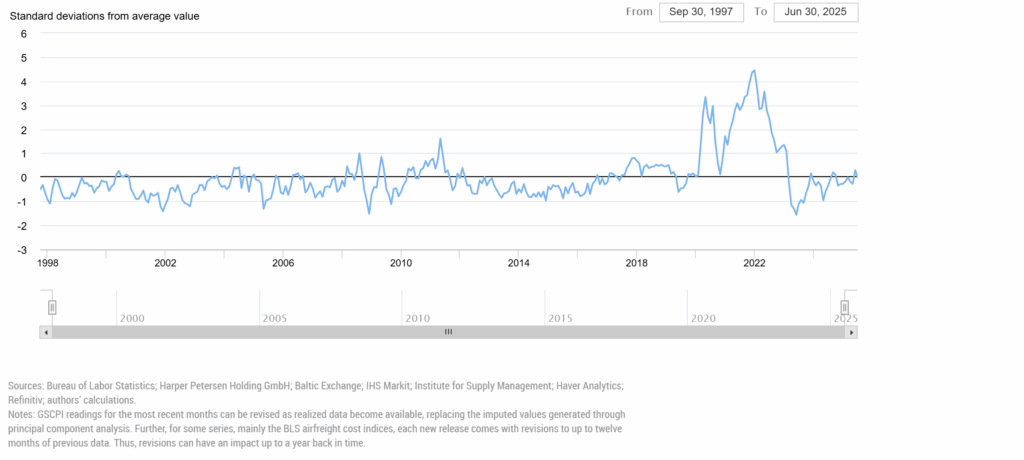

Figure 1. Global Supply Chain Pressure Index September 1997 through June 2025

Why We Need to Look Backward to Look Forward

On Friday, the United States Bureau of Labor Statistics released revised data showing that, over the past three months, the U.S. labor market had its worst quarter since 2010. The data was reminiscent of the first year of the COVID lockdowns in 2020. What had once looked like a massive jobs boom ended up being a historically weak quarter of growth. Tarriff uncertainity abounds, but inflation remains relatively stable, as the New York stock market set new records. Will the pressure index shoot up? Who knows? Market shifts can happen quickly.

Why do we need to look back to look forward? Are we going to ride a roller coaster again? We don’t know.

If turmoil happens, I think that we have forgotten the hard-fought lessons from the pandemic. With all of the hand-waving, and media outlet political maneuvering, supply chain leaders need to be focused on using industry-specific market data. Demand latency from forecasting based on orders/shipments puts companies on the backfoot, making them slow to react. Few companies have moved to the use of market data to sense and respond to market shifts. Here are some key insights from the report/study completed during the pandemic to remind us:

- Six months to Adjust. Midway through the pandemic in September-October 2020, companies rated themselves as more innovative and significantly better on agility and responsiveness at an 80% confidence level than in January 2020. However, it took six-to-eight months for companies to align to a new market signal. There was no improvement in the response when compared to the downturn at the start of the 2007 recession.

- Organizations Rallied to Work Together. During the pandemic, in 75% of manufacturing organizations, collaboration across functions and roles improved in ways that were not possible before the pandemic. This is no longer the case. Organizations have drifted with widening gaps between sales and operations teams.

- Companies That Were Better at Supply Chain Planning Outperformed. If the company had mature capabilities in order-promising processes, production scheduling, supply chain design, and Sales and Operations (S&OP) planning, they rated themselves significantly more agile at an 80% confidence level. The difference? Scenario planning, a focus on network design, and the realization that the planning system of record was essential to drive organizational alignment.

As you think about these points, remember some basic lessons from the pandemic. The larger and more complex the organization, the more important these are:

- The Order is a Poor Proxy for Demand. The order, due to demand latency, does not represent true market demand. The reason? The data is stale. The demand latency –the time to translate channel purchases to an order can be 3-4 weeks for items with velocity in a high velocity channel and 3-6 months for slow moving items in a slower channel–making it difficult to sense and translate demand quickly as markets shift.

- Supply Risk Management is Not Supply Chain Risk Management. While most all supply chain leaders will shake their heads and agree that a risk mitigation strategy is essential, the practices commonly used are focused on procurement and supplier management. Why does this matter? In most companies the greatest risk is the translation of demand and the amplification of the bullwhip.

- Safety Stock is a Small Piece of Total Inventory Management. Most of the focus of traditional supply chain planning applications focuses only on safety stock. For many global multi-nationals safety stock represents 15-20% of total inventory, with the rest being cycle stock, in-transit inventories, and seasonal builds. If uncertainity looms large focus on reducing complexity: a reduction in the number of items sold will reduce cycle inventories, and fewer in-transit nodes, along with shifts in mode, reduces in-transit variability. Inventory is the bigest source of waste and the most important buffer. The greater the variability, the more important it is to reduce complexity.

- Be a Good Trading Partner. As supply tightens, focus on being a good trading partner. Hold yourself accountable to generate a good forecast for suppliers and deploy supplier development teams to understand the steps that you can take to reduce trading friction.

I hope this helps.

Update on Ask Lora

Many of these concepts are covered in the outside-in training classes. Want to know more about outside-in processes? The six training classes on outside-in supply chain planning processes are now updated in the Large Language Model (LLM), Ask Lora, which I released this month. If you are seeking insights on how to redesign planning to better align responsibilities and accountabilities, I think this is a great place to start.

Or, if you want to take it in person, there will be a virtual class starting in October. Direct message me on LinkedIn if interested in joining this session.

As always, I welcome your feedback.