The shift happened. Haiti crumbled. Chile did far better. The difference was substantial. The contrast offers lessons on how to shelter cities from future devastating earthquakes.

In a similar vein, the Great Recession shook the core of value chains. Some supply chains crumbled and some weathered the storm. What made the difference? It is this story that I want to tell.

The Great Recession

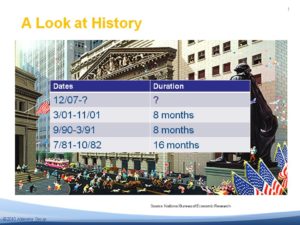

In my lifetime, there has never been one quite like it. October 2008 shook the foundations of business in a way that I had not seen before. It is the longest recession of my lifetime.

As credit tightened, supplier relationships crumbled. Inventory ballooned and factories ceased production. The forecaster was in the hot seat to answer the question of “when will it be over?” All in all, a very scary time .

Not all were Equal to the Challenge

During this period, I interviewed 28 Fortune 500 companies to understand how long it took them to sense the true shift in demand and how long it took to align their supply chain for the recessionary shocks. The differences were striking.

Who did it well?

Cisco did it the best. Burned in the dot.com downturn with inventory write-offs of 2.5 billion, Cisco had taken action to redesign the supply chain to better sense and translate demand. They sensed the downturn in the first month and had aligned the extended supply chain within 6 weeks. Their management team understood the importance and acted. However, for most it was a VERY different story.

Leaders sensed the downturn 5X faster and had more quickly aligned the supply chain response. The interesting fact for me was the capability to sense and translate demand had less to do with technology adoption –the type of system and how it was installed–than attitude and capabilities. Leaders had the right stuff. They did three things differently:

Forecast was True North: Over 80% of companies have implemented supply chain forecasting systems; but, very few have a signal that is true north. True north is a forward-looking compass set on true market demand. Companies with inherent forecast bias were challenged; and companies dependent on sales forecasts were crippled. The companies that did the best were outward-focused using true market indicators and modeling what-if scenarios based on market drivers. Forecast models based on orders and shipments were simply not equal to the task.

Outside-in Focus: Companies that modeled ship-to locations based on selling units out performed. For most this was too HIGH of a bar. Why? Over 80% of forecasting systems are built with tight integration to ERP using ship-from locations (distribution warehouses) as opposed to ship-to (channel locations); and modeling is based on the manufacturing unit, which can be VERY diferent than the selling unit. Likewise, companies that out-performed had replaced rules-based consumption in Distribution Requirements Planning (DRP) with daily statistical modeling using channel demand to calculate required inventories.

Forecast Discipline: The companies that did it well were good at forecasting. They had process discipline: few managerial overrides and when overrides occurred, they held people accountable for bias and accuracy. These companies had experienced forecasters behind the wheel (as opposed to the new kid just hired from a MBA program), their forecasters knew their products and the market, and they excelled in what if analysis and the ability to use modeling programs.

Forecasting Matters

Yes my friends, it is not the system, it is how you use it. It should be a wake-up call for all. Forecasting matters. It will matter even more as we come out of the recession. Case studies are happening right now that will soon be on the front page of the Wall Street Journal.

What do you think makes a difference? Any stories to share?