I remember the first discussion with Mark and Dave. It was a strategy day in 2006. Thirteen years later, it gives me great pleasure to share their story.

I remember the first discussion with Mark and Dave. It was a strategy day in 2006. Thirteen years later, it gives me great pleasure to share their story.

Mark Hersh (shown here) is now a Director of Supply Chain Strategy at Clorox while Dave retired in 2018. Mark and Dave, both career Clorox employees, drove a program to customize the supply chain response using Value Chain Segmentation.

Designing a Fit For Purpose Supply Chain

Value Chain segmentation—designing a fit for purpose supply chain—was the focus of the strategy day workshop. At the time, I was a Research Director at AMR Research (now Gartner). While it seems like yesterday, as I write this, I must remind myself that it was twelve years ago. The story is a focused approach that delivered over a decade of improvement. (Clorox was a Supply Chains to Admire Winner in 2016 and in the top-tier of performance within the peer group for 2017/2018.)

In 2006, Clorox was adding businesses through acquisition, expanding globally in both existing and new markets, moving into new distribution channels, and adding customers who required different route-to-market models. Complexity was increasing rapidly and Clorox needed to find a way to effectively and efficiently manage change. As shown in Figure 1, the company now has sales of 6.1B$, manufacturers 40+ brands in 24 countries while selling products in 100 countries.

Figure 1. Clorox Company Business Overview

Reflections

In the spirit of transparency, I was a Clorox employee in the 1980s. At that time, the Company was 1/6th the size of today. At that time, there were three primary product categories: Bleach/Home Cleaning Products (think home-cleaning brands like Clorox 2, Soft Scrub and Tilex), Hidden Valley Ranch Salad Dressings and Kingsford Charcoal. When I became a warehouse leader at Clorox to manage bleach and salad dressing in the same warehouse facility, I struggled with the marked difference of the rhythms and cycles of the products being managed in and out of the same warehouse facility. We spoke of this during the strategy day.

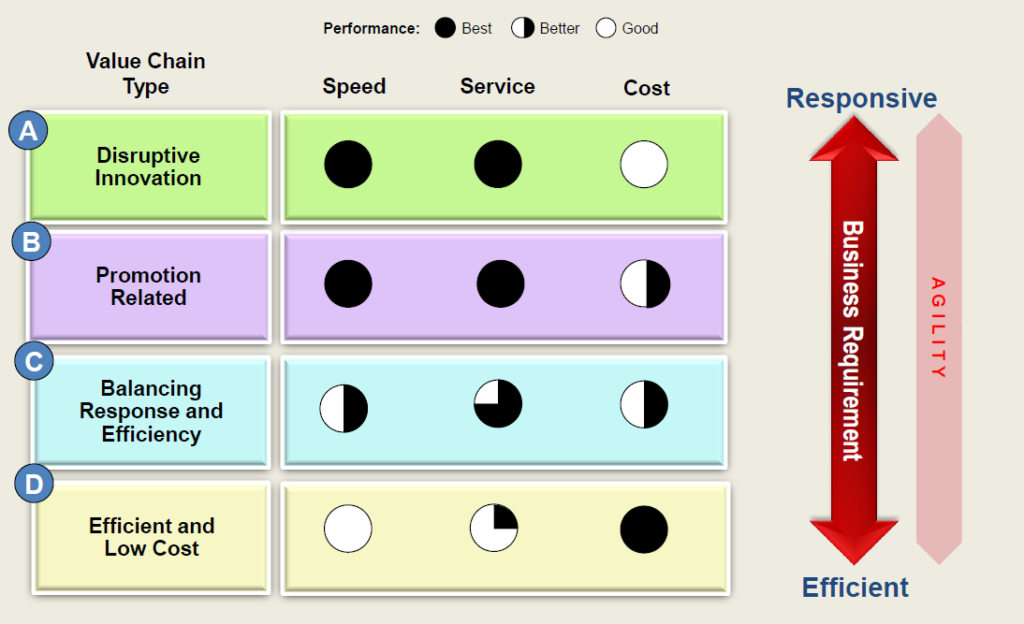

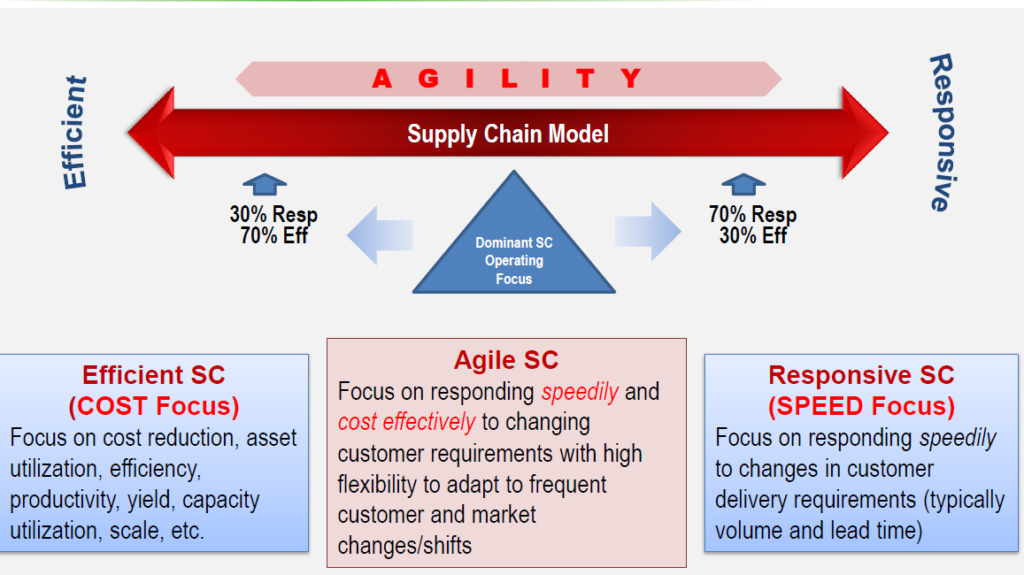

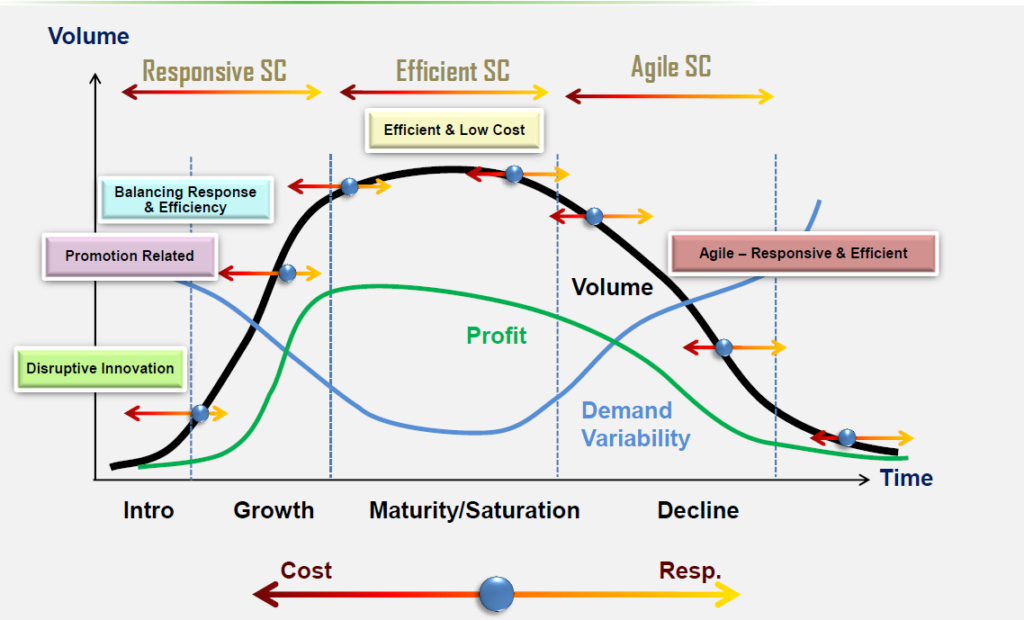

In the strategy session, Dave pushed hard for clarity of terms. He searched for the difference between a responsive supply chain with short cycles and an agile supply chain that could deliver the same cost, quality and customer service given the level of demand supply variability. Unlike most supply chain leaders that I coached in this period, he understood that by definition an agile supply chain or a responsive supply chain would not be able to have the lowest cost per unit. A supply chain with the lowest cost per unit is a different design. The “efficient” supply chain is one with the lowest cost per unit. Defining an effective supply chain hinges on the definition of supply chain strategy based on the business flows.

I am proud of Mark and Dave’s work on value chain segmentation. I share it here. Many times, the work that we did at AMR Research with clients in strategy days met dreadfully boring dead ends. This was not the case for the Clorox. Mark and Dave took the insights from the day and forged a strategy.

A Closer Look at Clorox

In our research we find that over the course of the last decade (2006-2017), we find that each vertical industry has a well-defined pattern of performance. As noted in Figure 2, the margins for retail averaged 7%, while personal products were 10% and consumer products household goods were 16%. In this period, Clorox was acquiring products with significantly higher margins and lower inventory turns. This included products like the Burt’s Bees line.

While many in the industry believe that there was significant improvement in data sharing and collaboration within and across supply chains over the past decade, this was not the case. Instead, each industry operated within its own effective frontier. While retail companies improved inventory, they lost ground on growth and operating margin. And, while household products gained ground on margin, results for inventory turns worsened with the rise of item complexity. (The average company added 48% more items during this period.) To understand this dynamic, reference the patterns of overall performance in Figure 2 for the period of 2006-2017. These results, plotted as an orbit chart, compares the trends in inventory turns and operating margin averages for the respective sectors.

Figure 2. Orbit Chart Comparison of Personal Products, Household Companies and Broadline Retailers (Period of 2006-2017)

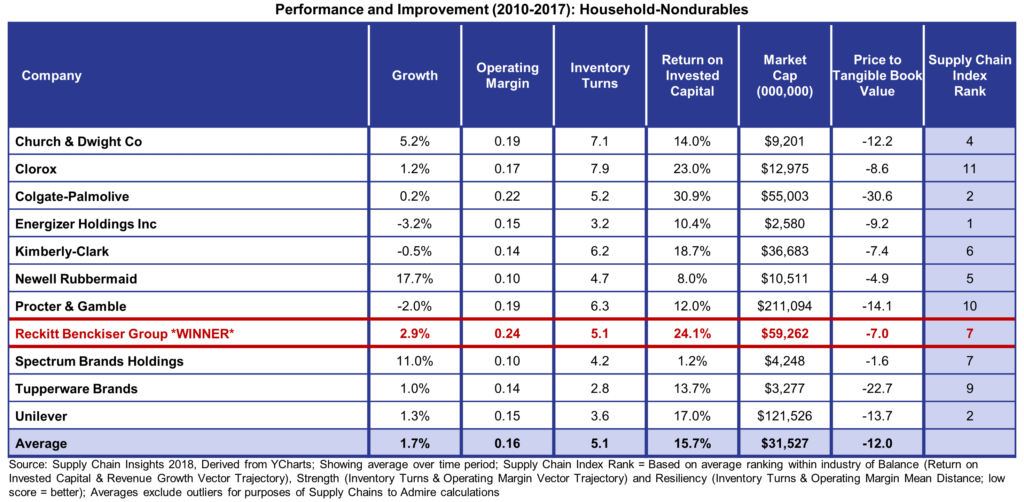

In this period, Clorox outperformed their peer group and was a Supply Chains to Admire Award winner in 2016. The addition of product portfolios with lower inventory turns affected the overall Clorox results, as the company drove a growth strategy. A strong factor in success was the supply chain strategy work led by Dave and Mark. They built a guiding coalition. As a result, as shown in Table 1, the company remained competitive against the relative peer set within household products.

In this period, Clorox outperformed their peer group and was a Supply Chains to Admire Award winner in 2016. The addition of product portfolios with lower inventory turns affected the overall Clorox results, as the company drove a growth strategy. A strong factor in success was the supply chain strategy work led by Dave and Mark. They built a guiding coalition. As a result, as shown in Table 1, the company remained competitive against the relative peer set within household products.

Table 1. Clorox Performance Compared to Competitors (Supply Chain Index is a relative metric of growth.)

Figure 4. Clorox Orbit Charts Versus Household Products Peer Group Along with Procter & Gamble for the Period of 2006-2017

Figure 4. Clorox Orbit Charts Versus Household Products Peer Group Along with Procter & Gamble for the Period of 2006-2017

Clorox is currently 1/10th the size of P&G, but note that the Company outperforms based on scale against both P&G and other competitors.

Clorox is currently 1/10th the size of P&G, but note that the Company outperforms based on scale against both P&G and other competitors.

Looking Back: Q&A with Mark Hersh

Mark and I have discussed this work over the decade. With the increased interest in case studies of companies gaining competitive value through programs to improve agility, I reached out to Mark to write the case study. We agreed to do the case study in a Q&A format. Here I share the dialogue:

What Was the Role of Leadership in Driving the Segmentation Project?

We could not have accomplished the goal of the program without consistent and strong executive level leadership. The acquired businesses—natural personal care products, health care products, professional products, Burt’s Bees, and Digestive Health—were very different flows than the traditional bleach business. The degree of change for the supply chain was profound requiring a rethinking of the end-to-end network (from the customer’s customer to the suppliers’ suppliers) to deliver the right supply chain capabilities to meet the evolving needs of customers and consumers. James Foster (former CSCO) was the driving force behind the project. He is now retired but realized in 2010 that the past supply chain model of “one size fits all” would no longer work in a changing market requiring new and different capabilities.

Sidebar:

Based on Mark’s accolades we reached out to James Foster to learn more about leadership in driving the Value Segmentation program. In the interview, James commented, “Value Segmentation was part of a larger program to become more demand driven. I am very proud of the work. To me, it was a strategic choice to place the consumer at the center of the universe. The goal was to create the most value for the consumer through supply chain design. Historically, within the Clorox company, the supply chain evolved as a cost function. My goal was to change this and be a business partner to deliver economic value.

Our challenge was to manage multiple business units—small in stature and different in characteristics —to drive scale. I termed it “a basket of miracles. My goal was to apply capability in a leverageable way.

I wanted to change the conversation with the business partners. In the beginning, the business leaders would state that the supply chain was not flexible enough and the costs were too high. Let me give you an example. One time a GM came uncorked and demanded that I go to the contract manufacturer and get a lower cost on a product in our wipes business. It was a hugely successful product. I knew that something was not right, but we needed to do the value chain segmentation to understand the drivers. They protested, but I talked them into it. The product started as a single canister business and evolved. At the time, 80% of the volume was a multi-pack. The business went through chaotic customization. The problem was not contract manufacturing costs/efficiency. Instead, we were forcing multi-packs through a network designed for single-packs. At the time, 40% of inventory of the Clorox company were these wipes. The entire supply chain needed a redesign. We needed to get better at forecasting and using postponement logic for late-stage packaging. The impact of the value chain segmentation was significant.

At the end of the day, the supply chain metrics do not change, however, the goals vary by value chain segment for cost, inventory, and growth.

My barometer for success was ‘What conversation am I having?’ At the start it was about process and assets. We evolved to having the conversation on the business and translating it into one of the four models. Simple for the GMs and simple for us.

I would ask, ‘What flexibility do you need?’ Seldom could they define it. In business, flexibility is a vague notion. Changing the conversation with business management and being business led on strategy design helped. ‘Does the supply chain design fit the strategy of the business.’ I would ask. The four models made it easier to talk about it.

Flexibility reduced working capital (which is not in the GM’s bonus). I firmly believe that value chain design starts at the shelf.

Teaching people is very important. One of the enablers of success was talent development. I strove to teach the supply chain leaders what we were trying to do. At the time, we were spending 1M$ in training and development. So, I took everyone’s budget and gave 250K to Georgia Tech to build us a program using their materials. It enabled growth at scale.

I drove adoption through employee word-of-mouth. I asked my boss, the COO to come and speak at the program and when he returned, he asked, ‘Why are you guys the only ones there?’ So, we invited eight of the forty employees on the GM track to attend the course. We paid the tuition for the people on the GM track to attend. As we progressed, marketing and sales people would come back and talk about the value, and they made the classes better because they were there. It took years. We are now in the seventh year of the class. This was one of many modules. It took us a long time to get to where we were. If I could have something back, I would build learning programs earlier.

In addition, if I did it again, I would force a mandate for program adoption earlier. Initially, we tried influence. The problem is that we left money on the table because we were nibbling away at the problem and did not force adoption. My struggle was that I reported to two COOs competing for the CEO’s job. As a result, we lost two years. If we could have been more overt in our actions and more top down, the pace would be faster. However, as a supply chain leader, you have to pick your battles very carefully. Initially, I was unsure how far to stick my neck out. However, looking back I would be more aggressive. As we did more and more work, the value of segmentation strategy work became clearer.

In summary, the method does not matter as much, the core is the idea. In the end, the core concept of strategy lead and thoughtful about the design drives value. My advice is to pick a method and go for it.”

How Did You Start the Design Processes?

The goal was to design from the customer/consumer back. New businesses, product lines and acquisitions required different route-to-market models – some using current Regional Distribution Network (RDC), some direct to customer, some using distributors and some using a different model. In this time period, the bleach business has not changed. It is still supplied through a low-cost and highly efficient supply chain. Other businesses were very different. James knew that we needed a fit-for-purpose supply chain that matched the needs of the customer.

James sold the concept to the COO, the Business Operations Leadership Team (BOLT) and senior leaders of the Company. His goal was to match supply chain capabilities with the needs of the market and product portfolio. General Managers needed quicker and more responsive product supply processes. James heeded the call. If we were an efficient, a low-cost supply chain overall like we had for our bleach business, he knew that the company could not support the requirements for businesses requiring responsiveness and speed to win in the marketplace.

By piloting this approach with several businesses, General Managers began to understand the trade-offs such as “If you focus on speed, cost will be good, but likely not industry best.” A powerful part of the process is the trade-offs conversation to establish the predominant capability needed. We used the diagram in Figure 5 to illustrate the trade-offs with the leadership teams.

Figure 5. Map of Segmentation

The goal is to define capabilities. A very responsive supply chain is focused on outstanding customer service with a focus on new products, promotional events and ensuring continual on-shelf availability. There is more reserve capacity and the focus is on flexibility. In this segmentation it is also more important to collaborate and communicate with trading partners continually for timely information flow in all directions. Whereas, in an efficient supply chain, the focus is on the lowest cost and regular trading partner communication is important but every day is not critical since demand is generally more predictable.

The goal is to define capabilities. A very responsive supply chain is focused on outstanding customer service with a focus on new products, promotional events and ensuring continual on-shelf availability. There is more reserve capacity and the focus is on flexibility. In this segmentation it is also more important to collaborate and communicate with trading partners continually for timely information flow in all directions. Whereas, in an efficient supply chain, the focus is on the lowest cost and regular trading partner communication is important but every day is not critical since demand is generally more predictable.

Figure 6. Designing Supply Chain Segmentation

How do you train and maintain the segmentation program?

How do you train and maintain the segmentation program?

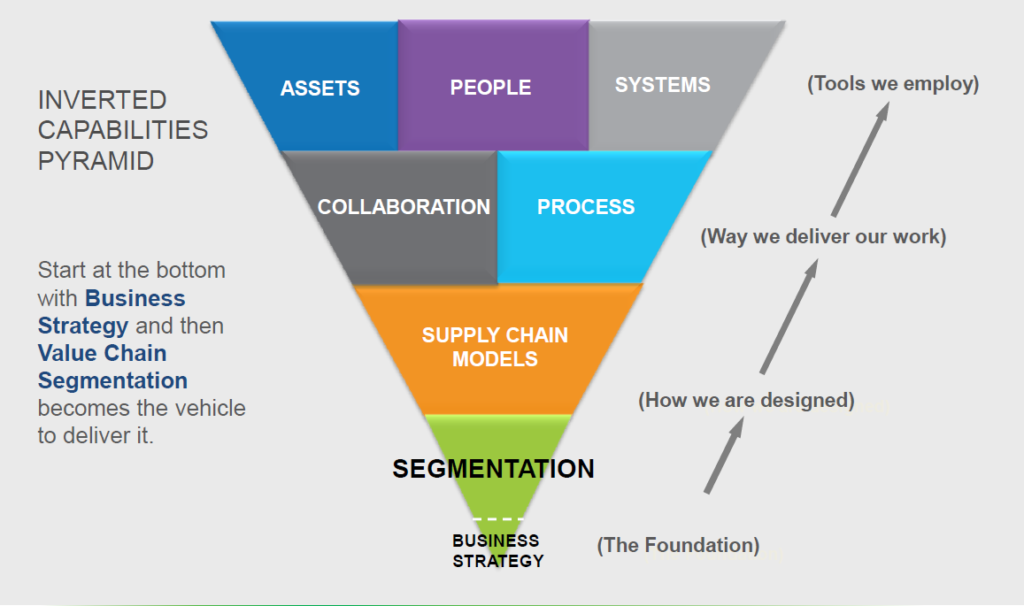

We start with business strategy. Every year, we have an annual company strategy planning process. In this process, business units and GMS share their plans. We focus on very clear objectives: goals and aspirations, where to play, how to win, and how to configure. Within our supply chain strategy organization we translate the strategies to the right supply chain designs and requirements, identify gaps with the current designs, and then deploy the value chain segmentation methodology to achieve the desired capabilities. We do this review each year. The review work, led by members of the Supply Chain Strategy group, starts with strategy. Deployment of the methodology involves members of the business unit leadership team – sales, marketing, finance, IT, HR. We don’t utilize special technologies, but utilize our proven and repeatable process using standard tools and templates.

The GM is active throughout the process. Their hardest job is providing clarity on both product and market needs for the next three to five years. A longer term view helps to enable a better design and results. This is hard, but critical to achieving the optimal supply chain design and capabilities. This happens at the beginning.

Value Chain Segmentation training is part of our current GM Development Program. It is also the program we have for our future GMs. During this training, they apply the learning and process to actual product lines in the business units they own. This exercise allows them to see how this process can help them deliver their financial objectives – revenue, profitability, margin and cost.

Figure 7. The Process Starts with Strategy

Now segmentation is part of the culture. It is a routine and part of the planning process. If the product moves in the lifecycle, it is a signal to rethink the supply chain. We show in the model in Figure 8.

Now segmentation is part of the culture. It is a routine and part of the planning process. If the product moves in the lifecycle, it is a signal to rethink the supply chain. We show in the model in Figure 8.

Figure 8. Shifts in Strategy Through the Product Lifecycle

The process helped us to manage very different businesses that were different than the core.

What would you say are the critical success factors?

There are five in my opinion:

- Ease of Understanding. The first is having the GMs and business unit leaders clearly see and understand how value chain segmentation enables their strategic and financial objectives. Keep the process and framework simple.

- Holistic Thinking. The second is you have to take an end-to-end approach. Just segmenting within your supplier, manufacturing and customer base without connecting it into a full value chain view will only provide limited success.

- Iterate. The next ties to what James said, “Create a method that’s good enough and then act, learn, improve and scale” Don’t let perfection be the enemy of good. Recognize that value chain segmentation is an iterative, continuous process.

- Build Support Through Training. The fourth is educate, educate, educate…across functions and at multiple levels.

- Embed. And finally, embed the process within the company’s strategy refresh process. Check supply chains annually with updated strategy plans.

What Measurable Value has the Value Chain Segmentation Process Delivered?

What’s exciting about using value chain segmentation is that it delivers value in multiple areas, not just improved cost. Over the past six years we’ve delivered over $40 million dollars in cumulative value to the business. Value included:

- A $20M profit improvement by bringing manufacturing of a major product line in-house for self-manufacturing.

- An incremental $4M in revenue through improved responsiveness and service.

- A $10M profit improvement by moving a specific product into an Efficient & Low-Cost value chain.

- A 50% lead time reduction on a business where responsiveness is critical for success.

- Deferment of $10M in capital investment.

Why Is Clorox Outperforming the Industry on Margin?

Simple answer. It is the focus of our CEO, members of the Executive Committee, and leaders at all levels across the company. Employees understand why margin improvement matters. It is everyone’s job to improve margin – proactively identify and eliminate waste in our work, products and supply chain; identify cost savings, etc. Margin is clearly outlined in the strategic priorities. His strategy? Companies that are growing margin are creating dollars which become the fuel to drive good growth. All functions are held accountable for margin.

Inventory turns went down due to the businesses that were less predictable. Businesses that we added are not as stable or predictable and in some cases required a learning curve.

What Do you Reward and Manage the Measurement System?

When it comes to differential measurement across the four value chain types, we have not evolved yet to different metrics. We recognize that this is a need. We measure customer service the same way across all segments, but we have not differentiated metrics to match what is important. We measure things the same way: service, cost, quality, safety, and product availability. In the service area, the focus is on-time delivery and on-time and in full..

The focus is always on the customer and consumer.

Our Take

Clorox is one of few companies to initiate and maintain a value chain segmentation process as a systemic program. The initiative started by a visionary leader and reinforced by GM training with yearly review, Through this process, Clorox has been able to successfully manage the rhythms and cycles of multiple businesses while maximizing scale. The results speak for themselves. Congrats to the team.

Additional Reading

Like case studies? Here we share some written over the last couple of years on driving agility. Notice the very different tactics driving agility improvements. (We define agility as the ability to deliver the same cost, quality and customer service given the level of demand and supply volatility.)

Campbell’s Soup Focuses on Simplification of Product Supply

Sandisk Builds Agility

L’Oreal Delivers on the Promise of the Agile Supply Chain