This morning, I threw away three loaves of moldy bread. In my attempt to step away from processed food, I don’t buy bread that does not mold. The mold is a kind reminder of the bread’s age. As I threw out my trash, I thought about my strategy session last week.

Stale Answers from Stale Data?

Last week, I facilitated a strategy session on the value of “fresh data” (data with minimal latency) in supply chain planning. I loved ideating on the use cases and highlighting the fallacy of using old, or stale, data in planning. As I look at the Supply Chain Planning industry, I question why companies are buying software and implementing processes that use stale data.

Most companies do not realize that the data is stale. Data in today’s system do not carry a mark of freshness. There is no “good by date” or “mold on the decisions.“

As you think about the topic reflect on the fact that the order, due to demand latency, is stale. Orders/shipments are a poor representation of market demand. Likewise, leadtimes are not based on actual market behaviors. As a result, supply planning fails to reflect what is realistic and drive insights on market variability.

The market is full of math gurus and AI hype. Most of the discussions focus on better math and optimization on stale data.

However, I think that the redesign of the next generation of supply chain planning needs to start with a discussion of goals. Teams need to agree on what drives a good plan. Hopefully, the recent announcement by Kraft Heinz on the market loss of $57 billion since the 2015 merger is a clear message to the market that a focus on functional excellence with a focus on cost degrades value. The 3G plan of a laser focus on cost-cutting in the back office to fuel a marketing-driven commercial strategy for existing brands in a market that is walking away from pre-packaged food should be a lesson for all in the market.

The next discussion should be focused on data–availability, relevance, and currency–followed by a discussion on database technologies (the benefits of schema on read versus schema on write) and the use of unstructured data insights. In my opinion, then and only then, should teams be talking about techniques to use artificial intelligence.

I find it ironic that technology today can enable the ingestion of data at the speed of markets (channel and supply networks) to drive decisions at the speed of business, yet the market does not adapt. Using the analogy of stale bread, business leaders are not recognizing the issues of using stale data.

Stale Data: The Answer is Not Real-time Insights

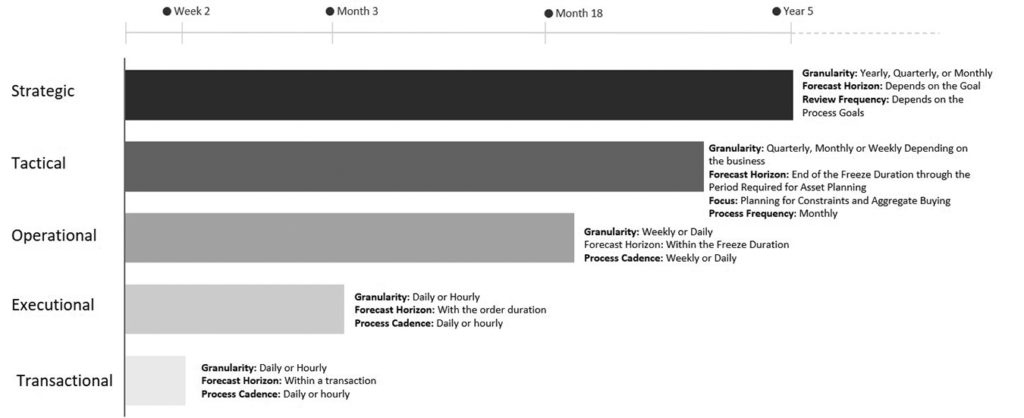

But before we continue let’s differentiate between real-time decisions and decisions made at the speed of business. Real-time decisions introduce nervousness into supply chains whereas data made on market data improves insights at the speed of the market. To understand the nuance, reference Figure 1.

Figure 1. Decision Framework

In Figure 1, we outline the decision cadence of strategic, tactical, operational, and executional decision making. While executional processes need to be made in near real time, the use of data with minimal latency also helps to improve the decisions made in the other time horizons.

The problem is that most business leaders do not understand that the average demand latency of turn volume business in process industries is weeks, and the long tail volume is months. (Based on my analysis of product flows in my training classes, 20-30% of sales in process industries today are turn volume. Demand latency is the time from the purchase in the channel to the translation of the demand signal to an order.)

The reasons are many. As companies elongated product lines, demand latency grew. As companies outsourced, supply, supply latency grew. The latency of data in today’s processes is much higher than the 1990’s yet, we use the same techniques. This increases the bullwhip and introduces variability. The effect is worse for the global multinational than the smaller, more regional supply chains.

Isn’t it ironic that we are more dependent on networks, but we have not automated the flows. Data flowing through emails and spreadsheets adds to the latency.

Conversely, data flows in other parts of the business flow at the speed of business but are not used in main stream supply chain processes. This includes e-commerce data (latency is hours and days) and transportation data (data latency is within the day).

Planning Like We are Living in 1999

Remember the old song “Like it is 1999“?

As I read the words–

I wish that Y2K had happened, we would stay forever classic

You and I would both be trapped in, in 1999

I thought, yes, it did happen. Today, we have the same taxonomy definition in supply chain planning

Why is this important? The processes are still batch, and the data is stale (the demand and supply latency of channel and supplier data is weeks and months). Yet, teams are investing in agentic AI to process stale data and drive insights from batch processes. Unfortunately, companies are not stepping back to answer the question of, “How, do I drive better decisions based on market data? And what is a good decision?”

Is Planning As We Know It Becoming Irrelevant?

Let me cast a critical eye on the market. As the O9 sales team flocks to SAP, Kinaxis is scooping up Blue Yonder talent, prior Llamasoft employees are starting the new ventures of Lyric and Optilogic, and the prior owners of Servigistics have launched planning on the Salesforce platform in an offering named KettieQ: the industry is circling. The market is ripe for innovation, but the recycling of resources is detrimental to the overall health of the supply chain planning category.

There are more similarities of existing solutions –Blue Yonder, Gains, Kinaxis, Logility, Oracle, OMP, SAP, and Relex– than there are differences. The new innovators are not challenging existing paradigms. Innovation is stalled. The industry is attempting to drive better decisions using advanced engines on stale data through batch processes. Buyers scratch your heads. Stop the craziness. Don’t rely solely on enterprise data: use market data from both demand and supply networks. Question existing paradigms.

A Lesson from the Industry. What Happens When Companies Don’t Adapt.

Kellogg’s–a marketing-driven company– and once a formidable player in the food industry is now history. Poof! The firm shed its assets and is no more. The issue is that the company failed to adapt to a changing market. (Ferrero International announced the acquisition of WK Kellogg Co. for $3.1 billion at a premium of 31%. In parallel, Mars, a private food manufacturer purchased Kellanova (NYSE: K) for $35.9 billion, including assumed net leverage at a premium of 44% to transfer the ownership of the snack brands –Pringles®, Cheez-It®, Pop-Tarts®, Rice Krispies Treats®, NutriGrain® and RXBAR®, and breakfast foods –Eggo® and MorningStar Farms®.)

I fear that this is the path of the supply chain planning market. The market is failing to adapt to a changing market. Memory is cheap, data is readily available, and machine learning helps us to improve interoperability. So, why are we not adapting? I think that we are caught in a fly wheel of faster horses.

How so, you might say? Remember the old quote attributed to Henry Ford, “If I asked my customers what they wanted, the response would be faster horses.” Today, I see a flywheel of technologists selling outdated visions to manufacturers/retailers of faster horses. Unfortunately, there are few innovators (7% of the market are innovators) and there is a vacuum of good product marketing to help business leaders envision what planning could look like using market data at the speed of business. So, on faster horses we will ride to drive a decline in enterprise vale.

I, for one, vote that we throw away the stale bread and focus on data-driven discussions to drive value.

Update on Ask Lora

Want to know more about outside-in processes and the use of market data consider investing in my new Large Language Learning model? The six training classes on outside-in processes are now updated in the Large Language Model (LLM), Ask Lora, which I released this month.

And, if you want to learn the principles with other business leaders, we will teach the class again in October. If you are interested in joining, drop me a direct message.

I hope to see you then, and meanwhile, I welcome your feedback.

______________________