I shudder when someone uses the term VUCA. The term antifragile racks my brain.

When a speaker wafts eloquently on one of these terms that I hate, I have to manage the inner Lora. As an adult with ADHD, the inner Lora can spark. In a controlled state, my brain questions, “What the ___? Why can’t we put the same energy that we put into inventing new words, tossing around acronyms, and parading on a stage to advocate for maturity models to improve supply chains? Do we have the right narrative? Are we making things better or worse? Are we playing the victim role?” In this type of presentation, I struggle to sit in my chair. I often leave.

I prefer a grounded, data-driven presentation focused on improving value.

When Does The Wisdom of the Crowd Morph to Groupthink?

Supply chain concepts follow hype cycles. I have lived through many. You will as well. Today, it is antifragile. A decade ago, it was resilient. Today it is VUCA. It used to be variability. The industry quickly moves through word salad, slipping from one narrative to another but seldom driving improvement. I question when the wisdom of the crowd morphs into groupthink and serves as a barrier to moving forward. As I walked my dog through the rain yesterday, I reflected deeply on the movement of organizations from the wisdom of the crowd models to groupthink.

I also watch and wonder about the herd mentality. I find that when you gather supply chain leaders in the same room, we tend to steal the oxygen from discussions. Most senior leaders believe they have the answers, often influenced by strategic consultants. I question how we can remain open to outcomes and have data-driven discussions as technology continues to offer new opportunities.

Let’s start with some definitions. “Wisdom of the crowd” endorses that the collective opinion of a diverse and independent group of individuals (rather than that of a single expert) yields better answers. In the supply chain, much of our forward path is fueled by the concepts of the wisdom of the crowd theory. Examples are consensus forecasting, the evolution of the SCORE model, the Annual State of Logistics Report, and the Gartner Top 25.

Social media fuels Groupthink, and now there is ChatGPT (groupthink on steroids).”Groupthink” occurs when there is a need for harmony without critical evaluation. “Herd mentality” happens when behaviors and beliefs conform to the group to which an individual belongs. They both exist in supply chain circles.

I think that the answer to my question lies in the definition of “independent.” When content is hijacked by a marketing agenda, it loses its independence. When consensus discussions are driven by sales models, it is no longer “independent.” When supply chain leaders are part of a “herd”, we lose rational behavior. When social media podcasters give voice on a pay-for-play basis, it is no longer independent and feeds the herd.

Why Can We Not Clear the Fog?

Let’s use the 2024 State of Logistics Report, “Navigating Through the Fog,” as an example.

Before I begin the discussion, let me provide a brief backstory. I used to love the annual report published by the organization, which was then named the Council of Logistics Management (CLM). It was data-driven and well-researched. I anxiously awaited its release and utilized a significant amount of the data.

CLM changed its name twenty years ago to the Council of Supply Chain Management Professionals (CSCMP) to be more inclusive of the source, plan, and make aspects of supply chain management. Sadly, it did not happen. The organization remains heavily focused on logistics, driven by the influence of consultants and technologists in the transportation sector.

The goal of the report series is well-defined and strong in terms of ‘what’, but, in my opinion, the report lacks a clear ‘so what’. Here are some data points:

- The 2002 report states that in 2021, the United States’ business logistics costs increased by 22.4 percent to $1.85 trillion, accounting for 8 percent of the country’s $23 trillion GDP. During the pandemic, logistics was a constraint. But the 2002 report is silent on how we recognize logistics as a constraint.

- This year’s report, “Navigating Through the Fog,” states that in 2024, U.S. business logistics costs totaled $2.3 trillion, representing 8.7% of the national GDP. E-commerce was a key driver of growth, contributing to retail sales of $6.3 trillion. Labor shortages in warehousing persist as a significant issue, with a vacancy rate of 7.4%. The report mentions the freight recession, but is largely silent on the impact on business resiliency.

What is the fog? Here is an excerpt from the report:

“Looking ahead to 2025, the outlook suggests fragile optimism, driven by limp demand, technological integration and a continued focus on resilience and sustainability, while uncertainties–especially those driven by new tariff trade tensions–will remain front and center.”

In short, the report does not address the nature of the fog. Which prompts me to ask, are our current practices the ‘fog’?

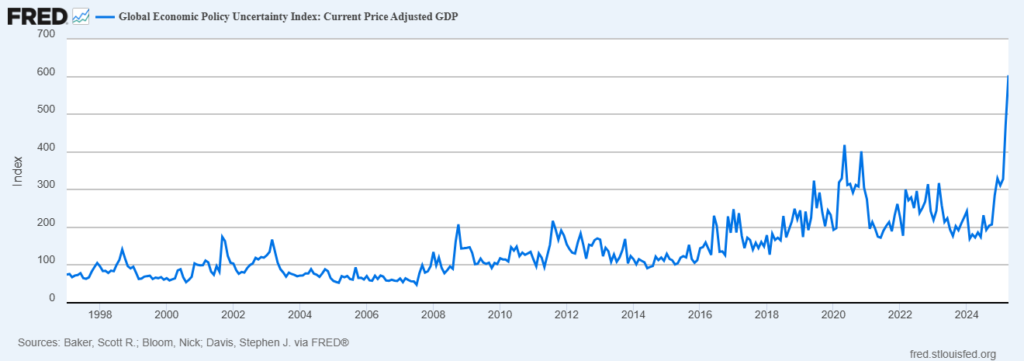

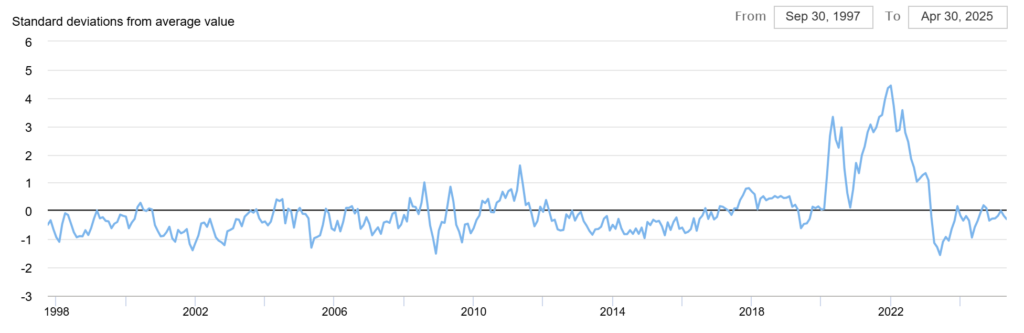

The report published by Kearney and Penske for CSCMP is a marketing piece with the narrative that we face unprecedented variability and are persevering despite the challenges. I question why the report uses the FRED Economic Policy Uncertainty Index versus the Global Pressure Index to tell the story. The Fred Index is a collective of the frequency of country newspaper articles that contain a trio of terms pertaining to the economy (E), policy (P) and uncertainty (U) for twenty-one countries In contrast, the Global Pressure Index produced by the New York Fed is based on data: transportation cost data and manufacturing indicators Note the very different patterns and perspectives in Figures 1 and 2. The FRED index supports the narrative that uncertainty is at an all-time high, while the Global Pressure Index supports the concept of low volatility.

Figure 1. The FRED Index

Figure 2. The Global Pressure Index

Which is it? I think both perspectives matter. Leaders believe there is unprecedented volatility, but the data tells a different story. Is it possible that we are unnecessarily stuck in a doom and gloom story?

In either case, why aren’t we using transportation data to change and define processes from the outside in? Here are some possibilities to lift the fog:

- Improving Availability. Why are we not connecting ATP and Allocation through ontological frameworks to transportation frameworks, such as FourKites, Project 44, and Transporeon, to enhance visibility and product availability for the customer? And, for inbound shipments to factories? Even if the data is not complete, the use of machine learning and pattern recognition to project arrivals on partial data would be better than what we have today.

- Planning Master Data. We speak of higher variability, but few companies utilize logistics data in their planning engines to accurately reflect actual lead times, costs, or logistics availability. As a result, most companies struggle with the feasibility of their plans.

- End-to-End Planning. While we have end-to-end transactional processes (order to cash and procure-to-pay), there is no end-to-end planning solution. Why are we not redefining planning outside-in? Logistics is a great place to start. (TMS and DRP have nothing in common and direct materials planning is a hodgepodge.) Would there be less fog if we could move planning data seamlessly across make, source, and deliver bi-directionally through orchestration engines?

- Demand Signals. For supply chains three to five layers back in the value chain, transportation signals are a good source of demand data. (Think chemical, paper, and plastics.) Why are we not mapping our demand flows and measuring the rate of movement of the outbound flows to understand the patterns of downstream customers? The use of logistics as demand data enables visibility of shifts 30-40% faster than waiting for an order signal.

- Value Networks. Why are we not pushing for interoperability between networks? Each network operates in a silo essentially feeding transactional data into enterprise systems. No system enables network transparency across source, make, and deliver.

- Trading Partner Improvement. Many shippers are not good trading partners. What if we had a shipper rating system based on forecast, dock scheduling, warehouse logistics, and payables?

So What? What Now?

My goal is for leaders to own a go-forward positive narrative focused on value. I believe we have a unique opportunity to drive a positive narrative based on new forms of data and analytics. I am frustrated that we are wasting cycles creating word salad. I want to help lift us from a doom-and-gloom model.

As I listen to most presentations, I ask myself the question of how we got here. Why is the industry focused on supply risk management without embracing the totality of supply chain risk management? (I think that our current processes of demand are our most significant risk.) Why are we not proactively removing the waste in the supply chain through the use of outside-in data? With the decline in freight rates and pressures on carriers, why are shippers not striving to be better trading partners? Why aren’t we measuring and utilizing bullwhip insights?

I could go on and on, and then I visit one of my clients, and reality hits. Logistics teams are typically stationed in a trailer at a factory and seldom interface with demand, manufacturing, or procurement planners. The teams operate in silos. Many teams that I work with do not understand how the planning models map data.

An opportunity exists for the planning teams to map opportunities for using logistics more holistically to improve outcomes. Few have mapped the Distribution Requirement Planning (DRP) System flows to support tender loading. Only 7% actively design their supply chains to embrace visibility. Most are living in the altered reality that companies can buy end-to-end planning.

I for one vote that we turn off the fog machine and focus on data-driven discussions to drive action.

Update on Ask Lora

Want to know more about outside-in processes? The six training classes on outside-in processes are now updated in the Large Language Model (LLM), Ask Lora, which I released this month. I welcome your feedback.

________________________________________________________________________________

Sources: State of Logistics Report, CSCMP 2021-2024

Definitions:

Antifragility is defined as a convex response to a stressor or source of harm (for some range of variation), leading to a positive sensitivity to increase in volatility (or variability, stress, dispersion of outcomes, or uncertainty, what is grouped under the designation “disorder cluster”). Wikipedia

VUCA is an acronym based on the leadership theories of Warren Bennis and Burt Nanus, to describe or to reflect on the volatility, uncertainty, complexity and ambiguity of general conditions and situations.[1][2] The U.S. Army War College introduced the concept of VUCA in 1987. VUCA – Wikipedia