“This is not a supply chain process. It is a new way of doing business.”

Financial Leader in Discussions on Demand Sensing

In 2013, 80% of supply chain leaders had a material supply chain disruption. It was not just one. The average company had three. Yet, in a study that we just completed, when asked about business pain, supply chain risk rates low. How come?

It is new. It lacks a consistent definition and set of practices. Companies reward the urgent. Risk management requires a focus on the important. It requires leadership and orchestration. Teams don’t know what to do. The companies that are the most mature learned the hard way. They had a disruption.

Defining the Topic

Let’s start with a definition. For the purposes of the study that we just completed, we defined supply chain risk management as the proactive identification and resolution of potential risks to the supply chain. The key word in this sentence is proactive. Unfortunately, too many supply chains are reactive. The systems respond, but they do not sense. Performance is measured by indicators, not by performance predictors. The reward systems focus on the urgent, not the important.

In this series of posts, I will be sharing insights from the research from this recent study. This data will also be featured in an upcoming report in our newsletter.

New Insights

When you talk to supply chain leaders about risk management, their answers tend to be hard-wired for supply. Many will wax eloquently about the work that they are doing on “control tower” or “supply chain visibility.” It is not sufficient. We are only dipping our toes into turbulent waters.

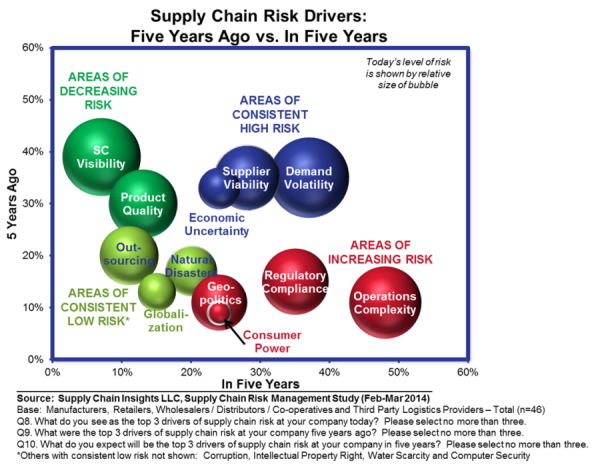

I have been working as an analyst in supply chain management for the last decade. In this role, I have done a study on risk management about every five years. I seldom get surprised on study results; but, the answer to the question on risk drivers in this survey surprised me. As you can see in Figure 1, today it is less about supply and more about demand. The largest gap in risk management expected over the next five years will be the management of global operations. For me, these two trends hop off the page:

- Increasing Complexity of Operations. With a decade of building global supply chains behind us, companies are feeling the impact. Local regulations, fair labor, variability in shipping lanes, new materials, outsourced manufacturing and faster product development cycles are all contributing to the pain. The financial stability of contract manufacturers and third-party logistics firms is a growing risk. It is not just one factor. We are better at managing regional supply chains than tangled/knotty global ones. The organizational dynamics and politics make regional/global governance difficult.

- Demand Variability. The biggest surprise for me in the research is the role of demand uncertainty on risk. The building of demand sensing capabilities requires the automation of market sensing and the use of channel data. The change management issues are high. It is difficult for the supply chain to accomplish this by themselves. Why? The term “supply chain” is politically charged. It has become a function, not an end-to-end process. Marketing and sales are also functions. The functional approach does not allow us to build demand processes. By and large, marketing and sales are not good at forecasting demand. They introduce bias. To combat this issue, and drive success in demand sensing, many companies have to rename the work stream so that it can truly be an end-to-end focus. For sales-driven and marketing-driven companies, this is a major change management issue.

Figure 1.

So, What Should Companies Do?

Recognize the Issue. Simplify Operations. This includes simplification of the product lines and the definition of standard ingredients and/or interchangeable parts. Our research supports that getting this on the product development agenda is a barrier. Mitigating this risk issue requires striking the right balance between global and local governance. There is less variability in the management of regional supply chains. Accountability and priorities are clearer.

Use Channel Data and Build Demand Sensing Capabilities. Reduce demand latency and automate the processes of demand. I work with many companies on the differences between marketing-driven and sales-driven processes and the journey to become market driven. When marketing and sales operate as functions, they are not aligned to more holistic end-to-end processes. This is growing as an enterprise risk.

Focus Where It Matters. Yesterday, I hosted a webinar with David Simchi-Levi of MIT. He has defined a Risk Index which analyzes the Time for Recovery and the Financial Impact (FI) to analyze the risk of the supplier base. It is a great technique to use in supplier development and network design. For those interested, check out David’s recent article on Harvard Business Review. His work with Ford is profiled in Figure 2. After the analysis of Ford’s supplier base, David offers recommendations and actions that are shown in figures. However, to use this methodology requires the organization to be proactive. In the Ford example, the greatest risk was with a tier 2 supplier of O-rings that had low spend. David’s methodology is a stark contrast to the conventional work on supplier development and network design. In the conventional approach, companies would look at the suppliers with the greatest spend and miss the impact on the tier 2 suppliers with low spend. David’s point in the webinar is that you have to be focused and deliberate. Ford has 5,000 suppliers. It is not a simple activity. It requires work. However, based on the results of the study, it is worth it.

Figure 2.

The slides from the risk management webinar are now available on SlideShare. Check them out. We will be doing complimentary webinars twice a month in a countdown to the Supply Chain Insights Global Summit. In this event on September 10th-11th, 230 supply chain leaders will gather to focus on the supply chain of the future. With the coalescence of digital manufacturing, new forms of analytics, The Internet of Things, and the collaborative economy, we think that it is time to re-think supply chain practices and imagine what it could be. Today, 45% of the seats are sold. It is limited to 15% technology and consulting attendees. We would love to see you there.