This past weekend I decompressed and turned off my cell phone. The concept of being on and available all the time– 24/7– wears on me.

This past weekend I decompressed and turned off my cell phone. The concept of being on and available all the time– 24/7– wears on me.

I spent a beautiful, brisk, Saturday afternoon building monsters with my grandson, Jake, at the local children’s museum. (I find that even building blocks hold more possibilities today than when I was a child 55 years ago.) As I sat on the cold floor holding the pieces together to enable small hands to slowly position the legs of the monster into the imaginary pelvis, Jake would caution me to let him do the work. A fiercely independent child, he rebuked my suggestions. It was clear that he wanted to build it himself.

When Jake clapped his hands in glee upon completion of the monster, my hands were numb. (When my hands grasp objects for a period of time, the fingers tingle and go to sleep. Too much quilting, typing and repetitive motion.) I smiled and sat back enjoying the moment.

During the afternoon, as I quietly held the pieces for Jake’s monster, my mind composed my blog post for the week. I realized that while I have spoken a lot about the need for outside-in processes, I have not helped people identify the building blocks. In this post my goal is to help companies build outside-in processes through a clearer definition.

Reflection

As I sat on the museum’s cold floor, watching him work, my mind drifted to the week ahead. It is a week where I would pack yet another bag to spend the week on the road. On Monday I would speak in Orlando Florida at the Terra Technology event, and on Wednesday present the keynote at the Logistic Summit & Expo in Mexico City. I am halfway through a spring speaking tour that will wrap up in June with speeches in South Africa and Peru.

This work is important to me. I believe that supply chains build economies and save the world. I also believe supply chains need a revolution. It is clear to me an evolution is not sufficient. In my opinion we need a jump-start of sorts.

What drives my passion? I am not quite sure. It evolved over time. I am a manufacturing gal by training. It pains me to see nine out of ten companies are stuck at the critical intersection of cost and inventory turns. Supply chains respond, but they do not sense. Largely driven by batch processes, they are out of step with the markets they serve. As a result costs and waste abound.

Building New Structures Using New Building Blocks

I strongly believe leaders must build their supply chains with new building blocks. While traditional supply chain processes evolved from functional excellence definitions for source, make and deliver from the inside-out, to make the digital pivot and become more market-driven, companies need to define new supply chain processes outside-in. This outside-in orientation needs a definition to make it actionable.

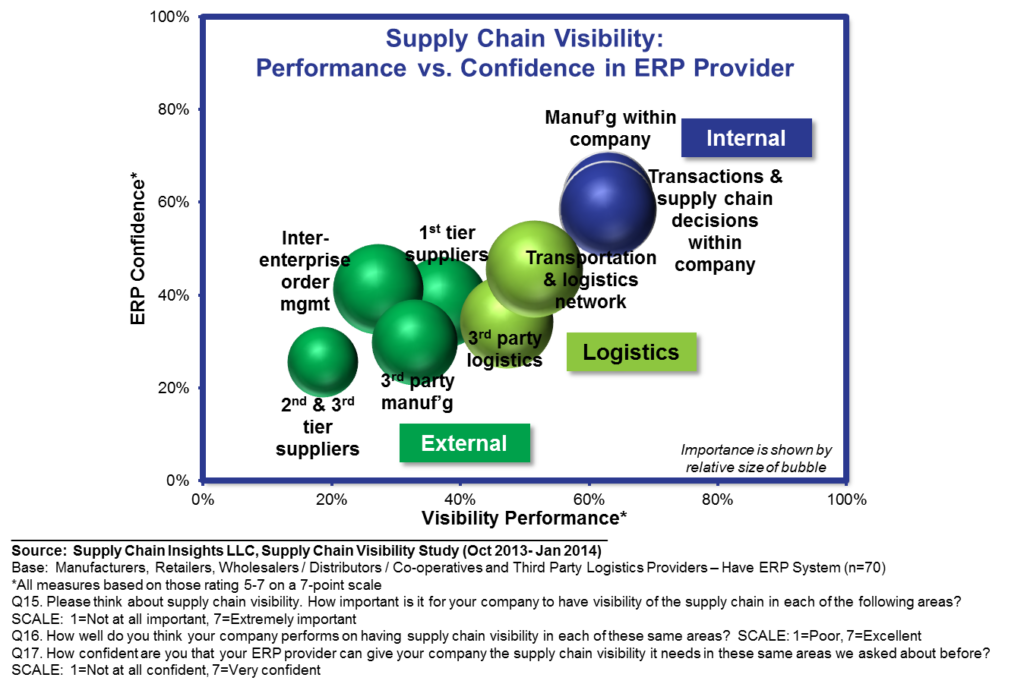

Let’s start with the basics. The design needs to be from the customer’s customer to the supplier’s supplier. While the traditional supply chain process was from the enterprise out to trading partners, in the outside-in supply chain the signals are from the buy- and sell-side markets back to the enterprise. This requires bidirectional communication between trading partners in the value chain. With each link there also needs to be a system of record for agreements and collaborative workflow to drive feasible outcomes. The gaps in supply chain visibility, as shown in Figure 1, are problematic for most companies. We have automated the enterprise, but not the value network.

Figure 1. Current Levels of Visibility

The Building Blocks

In building networks and outside processes, start with demand, product, and supplier networks. Map the data and the processes outside-in. Start with the channel. Segment customers and suppliers against the business strategy and digitize–electronic definition of the relationships and record exchange–based on the segmentation activity. As you do this mapping focus on building value networks that have bidirectional flows, collaborative process management, and a network system of record. (A network system of record is required to manage bifurcated trade, scorecards and deductions.

Without an inter-enterprise system of record, in a volatile world it is near impossible to reconcile matching issues. Realize early, as shown in Figure 2, that ERP is not the right building block for outside-in business processes management. Instead, recognize it as the important building block: the enterprise system of record. Stabilize ERP investments and maintain ERP as the anchor to connect outside-in processes.

Figure 2. Business Leader Confidence in ERP to Deliver on Supply Chain Visibility Requirements

As you map your outside-in processes think about demand, product, information flows, and cash flows simultaneously. And, outside-in from the customer’s customer to the supplier’s supplier. In the process ask yourself a series of questions. Tease out the future of your supply chain by examining how the electrons and molecules are shifting. Answer these as a warm-up activity:

- Credit. Credit cards are being disintermediated through the use of mobile payments. What will this do to your supply chain? How can you use electronic payment methods to get better terms?

- Time. With the use of new technologies and forms of analytics, the cadence of business increases. The rhythms of the supply chain become closer to the cycles of the market. How does this affect your internal processes?

- Voice of the Customer. When you think about social interaction how can you use information from both the social and interest graphs?

- New Business Models. What is the potential impact of new business models? Brainstorm the impact of the collaborative economy, e-commerce, and shared-service models.

- Forms of Channel Data. To become more adaptive how can you mine customer/shopper and channel data to reduce latency?

- Shifts in Molecules. As you think about the products/services sold embrace new business models. What is the role of 3D printing in your future supply chain? Bio-engineering? Customization?

- Complexity and Life Cycles. When you think about the product life cycle from cradle-to-cradle through the moments of truth of purchase, usage, and disposal, what are the opportunities to improve corporate social responsibility? What are the constraints? Where will there be potential commodity shortages in the future?

- Risk. Draw a map of your first and second tier suppliers. Ask yourself where the suppliers will be in the future. Then list all of the potential risks in the supply chain and outline potential risk mitigation strategies. How do you sense supplier behavior today to mitigate risk? How should you sense supplier performance in the future?

Then think about how the channel flows can shift outside-in using these building blocks:

1) Customer Sentiment Analysis. The voice of the customer gets clearer and clearer each day. Customer sentiment abounds in the Internet age. Today supply chains do not use sentiment data–blogs, ratings and reviews, social data on Twitter and Facebook, and call-center logs in supply chain processes. Customer sentiment technologies mine the patterns of unstructured text and use new forms of analytics to guide discovery on what matters to the customer. Explore how you can capture, harmonize and analyze this data to inform upstream processes. For example: should customer sentiment data feed into quality systems? Into warranty systems? Trade promotion decisions? Product life cycle and complexity processes? In the ideal situation customer sentiment is used to test and learn cross-channel, cross-region, and across market. Cross-functional teams meet regularly to learn from the voice of the customer. As a group, spend time brainstorming how sentiment can be used cross-functionally.

2) Market-Driven Forecasting. Inside-out, traditional forecasting processes use statistical methods to predict the future based on order and shipment patterns. As companies have proliferated items, the long tail of the supply chain has grown making the order less and less a good predictor of demand. Demand latency has grown. So what are the market signals to model to forecast demand at the cadence of the market? How can you build market-driven forecasting processes? This is critical in a volatile economic environment.

For example: in the recession of 2007, DuPont missed the downturn in the market. Sitting three and four levels back in the supply chain, DuPont’s orders were six to eight months out of sync with market trends. The DuPont supply chain supplied products and services into the housing and automotive supply chains. When they started to slow, DuPont could not sense the slowdown. If DuPont implemented market-driven forecasting, the inputs to their forecasting would have been housing starts, new home purchases, and refinancing for their housing-centric supply chain. In a similar vein, their forecasts for the automotive market would have been on new automotive sales and dealer inventory. Since the automotive supply chain is a push-based supply chain it would not have been the number of cars produced.

3) Distributor Sales. To sense market shifts use pattern recognition to understand relative velocities in the multiple tiers of the channel. Track shifts in velocity by product attribute (patterns are often lost in item-based sensing). For example, if you are an apparel retailer, track the number of sales by cut, size, color, occasion, and material. Challenge the team to think differently about substitution logic and assortment planning using cognitive learning and rules-based ontologies.

Study these pattern shifts daily and weekly. Track the trends. Sense shifts in velocity and align the supply chain planning systems through attribute-based modeling.

4) Demand Network Visibility. Build systems to enable channel sensing. Roll-up insights and actions on channel movement, sentiment analysis, and market-driven forecasting for cross-functional teams. Reduce latency. Drive insights from the channel into the supply chain on a daily and weekly level. Use the insights to sense and shape demand to drive higher sales and reduce outages. Help drive a cross-functional understanding of demand latency as waste through Lean programs.

5) Deductions and Management of Bifurcated Trade. How can you capture customer requirements and reduce deductions and improve matching? How quickly can you resolve a deduction? Do you need to screen-scrape customer portals and build a system of record for reconciliation?

Then think about your supply base. How good of a buyer are you? How easy is it to buy from your company? What is the time to onboard new suppliers? Generate a PO? Share scorecards? How good is your demand signal to a supplier? Answer these questions and then think about the automation of the supplier networks outside-in.

1) Supplier Networks. Build systems to translate channel demand sensing to suppliers. The traditional forecast is not a very useful signal for the supplier base. Think about how you can help the suppliers synchronize with your markets and production plans. What are the most important signals? How can you translate these signals with minimal latency?

2) Supply Visibility. Build systems to track inbound logistics and use telematics to better predict and sense estimated time for arrival. Use GPS, maps and weather signals to better predict arrival and route transportation assets.

3) Supplier Sensing. What is the financial health of your supplier base? Where is the risk? How do your supplier development teams design processes to ensure the viability of your supplier base? How can you develop sensing to support their processes?

4) Supplier Risk Management. Build a virtual map of first and second tier supplier locations. Include the supplier’s warehouse and manufacturing locations. When you do risk mitigation drills—simulation of potential natural disasters—build processes to sense supplier risk and plans to act. While you can outsource your supply chain, you cannot outsource the risk. The brand owner always owns the risk and needs to build systems to sense and respond.

5) Corporate Social Responsibility Monitoring. Actively measure the consumption of non-renewable resources (carbon, water, energy, etc) in the network. Manage out of control situations and include corporate social responsibility goals in network design activities.

What do you think? I would love to hear your thoughts.

Where Can You Find Out More?

We are currently putting the finishing touches on the Supply Chain Insights Global Summit. (Registration is open for the first 150 participants. We limit the number of technology providers to 25% of the audience.) The conference will be live streamed. The program focuses on five themes:

- Financial Results. A critical look at supply chain processes impacting supply chain financial results through the Supply Chains to Admire research.

- Economic Vision of Supply Chain 2030. It is hard to know where we are going if we are not clear on the end state. Join us for a critical view of supply chain 2030 through the insights of leading economists.

- New Business Models. Making the Digital Pivot. Sit back and listen as companies share insights on the adoption of robotics, the Internet of Things, 3D printing, manless vehicles, new forms of analytics, and the emergence of new business models like Alibaba, Amazon, and Uber.

- Building Supply Chain Talent and Leadership. Insights on leadership, continuous improvement and talent development for emerging markets.

- Outside-In Processes. Experience the difference between traditional inside-out and outside-in processes.

In addition, you can gain some short-term insights by attending our Network of Networks & Shaman’s Circle in Amelia Island on April 17, 2016 (invitation only), or by participating in our new research studies. With the completion of each study we share the research results. We always keep our survey respondents and their responses confidential, but share the results with business leaders in private roundtables to maximize networking.

Our philosophy is, “You give to us, we give to you.” We do this through Open Content research for supply chain leaders. Our current studies in the field are:

If you are a discrete manufacturer in supply chain, we would love your insights on this research study on direct material sourcing. The goal is to understand how companies manage sourcing in innovation, compare suppliers and collaborate on design. At the conclusion of the research share the results and network with leaders around the world.

Agility and flexibility in supply chain operations is strongly dependent on the building of strong cross-functional and horizontal processes of Sales and Operations Planning, revenue management, new product launch and supplier development. In this study, we analyze the maturity of revenue management and Sales and Operations Planning and the value of cloud-based solutions to drive improvements. This study will close in May and the results will be shared with business leaders in a cross-industry round table.

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for supply chain excellence.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for supply chain excellence.