Aluminum. Corrugated. Freight. Ocean cargo. Labor in China. The surprise and dismay continues. Supply is tightening, international currency is changing, prices are more volatile, and the future is less certain. Supply chain leaders need to steer the course. As a result, S&OP has risen in importance. If 2009 was about demand, 2010 will be all about supply. Are you ready?

It Matters.

Over the past six years, I have spoken to over 150 companies on Sales and Operations Planning (S&OP). When I started this research, less than 10% of companies had a well-defined S&OP organization and a focus on S&OP excellence. This has changed. Today, three out of five projects for Supply Chain Planning (SCP) software are driven by a person with a S&OP-specific title; and in the next three months, I will attend three industry conferences dedicated to S&OP. S&OP has risen in stature.

This important horizontal process makes a major difference in a company’s performance. Companies with strong S&OP processes sensed the recessionary downturn and corrected supply chains five times faster than those with less mature processes. As we wobble through the swings of the recovery, companies are realizing that cross-functional alignment matters more than ever. The greatest opportunity for profit and risk will happen in the economic rebound. The risks and the rewards will be greater. They want to be ready. As a result, S&OP has become main stream.

Letter Perfect

Last week, I counted 52. Tomorrow, it could be over 60. In the back of a well-worn notebook, I keep track of the different names I hear for S&OP. Company after company feels that they need a UNIQUE name for S&OP.

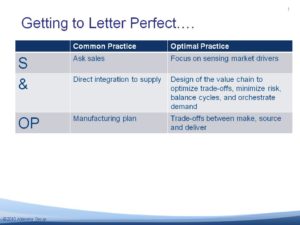

Letter perfect means correct to the last detail. I believe that the term S&OP is letter perfect. The practices are imperfect. The embellishment of the standard S&OP acronym is a current fad. The list of names–SIOP, DDS&OP, DDBS, IDDSP, IBM, and IBP –goes on and on. The danger is that as we rename and embellish S&OP initiatives, we lose the essence and the meaning of this important process. The real issue is that due to bad practices, and the lack of understanding, the term S&OP has become tainted. The letters, when understood stand strong on their own:

-S: The S in S&OP is about selling strategies and market drivers. Effective processes focus on go-to-market strategies. It is often confused to be about sales. What is the difference? Let’s contrast the difference it through a case study:

In 2006, Del Monte transitioned from asking sales what they were going to sell to focus on market drivers. They stopped their process of collecting sales data at the item level through laborious spreadsheets to focus on sensing demand, understanding market drivers and using the information to shape how they go to market. The new process focuses on shopper insights: who is buying what, where they are buying and why they are buying. It focuses on how to best shape demand in these sectors (the right combination of assortment, price, promotion, trade deals, and sales incentives) to drive profitable demand. Del Monte found that the right data to collect from sales is clarity on the market drivers: the number of new accounts taking new products, competitive activity in the market, success on past promotions, and retail channel insights.

Contrast this type of approach—a focus on market drivers—by a company like Del Monte to a focus on sales—what does sales forecast that they are going to sell—by Campbell’s Soup. In figure 1, the stock price of the two companies is contrasted through the recent recession. While I cannot attribute all of the difference to S&OP, it was a contributing factor.

Figure 1: Stock performance of Del Monte (red) and Campbell Soup (blue) against the Dow (brown)

-&: And, what? The and in the S&OP process represents the cross-functional coordination/alignment required to meet the strategic goal of the process. For example, if the goal is to be demand-driven, the focus is on outside-in market sensing. The demand plan is an input into the financial plan and the organization is tasked with determining:

- The best working capital plan: determining the right form and function of inventory versus constraining inventory or focusing on just inventory levels

- Trade-offs: The alignment of the value chain to balance growth initiatives with the trade-offs between sustainability, corporate social responsibility, tax efficiency, speed to market, and costs.

- Network design: Based on demand and supply variability, and market conditions, what is the best network design to minimize risks and maximize the market opportunities?

At Cisco, the supply chain organization is called the Customer Value Chain Management organization (CVCM) for a reason. The company runs a risk management engine of 4300 inputs with over 1000 simulations by 10 planners a months. Intel calculates the effective frontier between service and costs. Del Monte runs weekly Monte Carlo simulation models to translate demand volatility to orchestrate demand horizontally (promotions and pricing moves are based on the simulation of market demand with commodity market fluctuations.)

To do this, companies need to start with the goal in mind, and work backwards. A starting point is determining how many supply chains you have, the goal of each supply chain against the corporate strategy, the trade-offs for each to make these goals, and how to mitigate the supply chain risks.

-OP: OP is about operations. It is not just about the factory or the enterprise. It is about the network: making the right trade-offs in the network across the processes of deliver, make, and source. When done right, S&OP planning is also tied to execution. For example, at a recent WAM Systems conference, Celanese spoke on the translation of trade-offs in S&OP to optimize the manufacturing rhythm wheel (product sequencing) for each of their plants.

A common mistake made in S&OP is to focus only on operations. Companies that have fallen in this trap feel the greatest need to embellish.

Yes, here we have it. S&OP: Letter perfect. Practice imperfect.

As we see at Cisco and Del Monte, what a difference a few changes can make in improving performance.

This week, I am in New York at the Consumer Goods Technology (CGT) conference and then off to UConnect to moderate a panel on why standards matter.

I look forward to networking with you in my travels.