Definition: Brass tacks are a type of pin or nail. The phrase to come (or get) down to brass tacks is sometimes used idiomatically to consider the basic facts of a situation. Source Wikipedia

In the 1990s suppliers had channel power. The formula for success seemed foolproof. A new product was launched, the ads ran on national TV and “poof” a new brand was created. This all changed with the disintermediation of national media.

During the next decade, the power shifted to the retailer. Consumers became more loyal to retail brands, and retailers increased the number of products manufactured and marketed as house brands. This trend spawned chains like Trader Joe’s, Walmart, Whole Foods Market, etc.

Today, with the acceptance of the mobile phone and digital media, the power has shifted to the shopper. Consumers want to shop anywhere, and buy in the way that they want to buy. The digital consumer often wants to shop online, pick up at the store, and conveniently manage returns. The e-commerce customer wants convenient delivery to the home.

With the shifts in power, the relationships in the value chain are morphing. Each year I go to the Consumer Goods and Technology (CGT) conference where speaker after speaker talks about retail/supplier collaboration. I usually sit in the back of the room and watch the event with a wry smile on my face. Why? I am a disbeliever. Collaboration is evasive. Today it is more talk than action. In this post I want to share what I think really needs to happen to spawn true collaboration.

What Is Collaboration?

I define collaboration as a lasting win/win value proposition for both parties. Today we have collaborative data sharing, and collaborate processes, but we seldom have what I term true collaboration. Instead, we have had situations where one party wins at the expense of the other. In the 1990s the supplier won at the expense of the retailer. In the last decade the retailer won at the expense of the supplier. It is for this reason that I sit on the back row at most conferences watching, listening, and smiling.

Why Is It More Important Now?

As the bricks and mortar retailer is attacked by e-commerce pure plays—Amazon in North America, Alibaba in China, and Flipkart in India—assortment and excitement in the store become paramount to lure customers. They need the supplier more to drive excitement in the store. While many retailers are changing the role of the store to include services: pet grooming in PetSmart, clinics in CVS, cooking classes in Williams-Sonoma, etc.—this is not enough. The retailer needs the help of the supplier more than ever. It is for this reason that I have written a letter to the retail Chief Operating Officer below.

My Letter to the Retailer

Dear Retail Chief Operating Officer,

I have watched the evolution of consumer value chains for many years. I have studied the building of collaborative processes, and written about the shifts, and highlighted where we are gaining value. I know we have talked about collaboration for many years, but all I see is pilots: good intentions defined by fits and starts. In my research, I do not see that any retailer has really redefined value chains through collaboration. Based on what is happening in the industry and the need to drive excitement in assortment in the store, I would like to share three things I would do if I were you to build a collaborative framework to enable true collaboration between you and your suppliers.

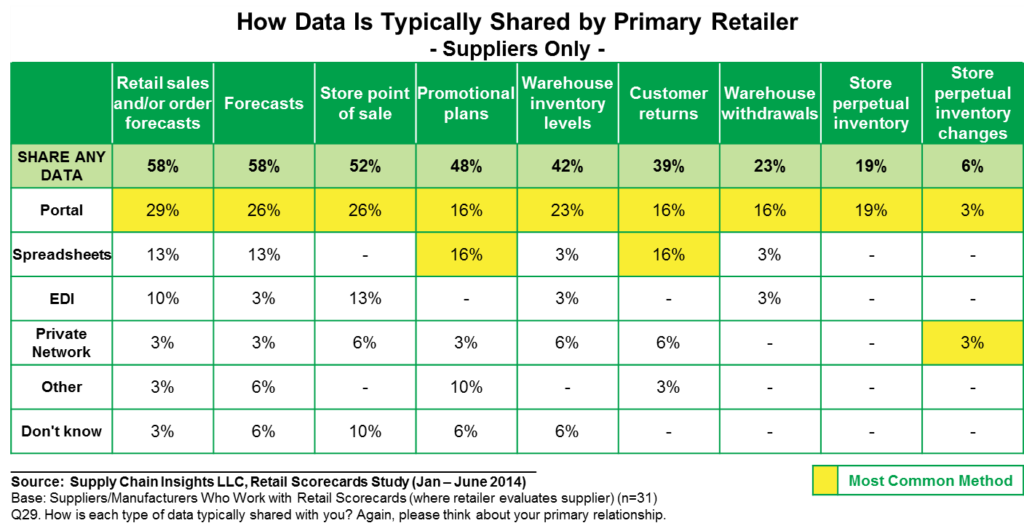

Figure 1. Data Sharing Mechanisms

1. Share Data Freely and Openly through a Private Network. Today, as shown in Figure 1, most retail data is shared through a portal. The most effective way to share data is through a private network. Portals do not enable effective data sharing and support of collaborative practices. When data is shared through a portal it lacks a persistence layer. As things change there is no system of record. Today only 3% of retailers are using private networks for data sharing. I know that this takes investment, but it is worth it in the long run. Consider the impact of Walmart’s Retail Link on Walmart.

Figure 2. Current State of Perpetual Inventory

2. Get Good at Data Sharing. Replenishment is fueled by an effective perpetual inventory signal. It anchors optimization engines for replenishment. The supply chain needs it. Without a perpetual inventory signal you will never be able to manage out-of-stocks and promotions. Today, as shown in Figure 2, 57% of retailers have a perpetual inventory signal in the warehouse, and 47% have a perpetual inventory signal in the store. Collaborative relationships need a good signal for inventory. It needs to be an accurate signal reflecting real-time changes as orders are shipped throughout the day. So, to be a collaborative trading partner, build a good perpetual inventory signal … there is no substitute for an accurate PI signal in supply chain excellence.

Additionally, get good at forecasting. Measure the Mean Absolute Percentage Error (MAPE) of your forecast and focus on driving improvement. Today there are only two retailers that have forecast accuracy that is good enough to drive value downstream for trading partners. Drive a difference. Own your data.

3. Take Your Hand Out of the Supplier’s Pocket. For many, deductions and penalties for performance have become a budget line item (often a profit center). And 84% of retailers charge for deductions with 1/3 of retailers having a budget for deductions with many taking them into income. As a result, it has become a systemic way of making money for the retailer which is a lose/lose. In this relationship no one wins. Suppliers cannot get to the root cause to solve problems, and revenue recognition is delayed. Instead, it becomes waste, or Muda, in the supply chain to track and manually audit. Instead, focus on clean transactions. Carrots drive better performance than sticks.

My advice. Own your own network. Focus on creating value and winning together. Isn’t that is what collaboration was supposed to be all about? If you get serious, I want to write your story in the new book that I am writing.

What do you think? I would love to hear from you. This month, in our newsletter on October 21st, we’ll be sharing the results of a study that we’ve been working on focused on Downstream Data Sharing. We would love your input as we close the survey.